Form 8611, Recapture of Low-Income Housing Credit, is a crucial document for taxpayers who have previously claimed the low-income housing credit and are now facing a situation where they must recapture part of that credit. This form is typically required when there’s a decrease in the qualified basis of a low-income housing project or when a building (or an interest in it) is disposed of without meeting certain conditions that would prevent recapture. The low-income housing credit, established under Section 42 of the Internal Revenue Code, provides a tax incentive for the acquisition, rehabilitation, or construction of rental housing targeted to lower-income households. However, this credit comes with strings attached – namely, the requirement to maintain the property’s status as low-income housing for a specified period. If the property fails to meet these requirements during the 15-year compliance period, the taxpayer may be required to recapture a portion of the previously claimed credits, which is where Form 8611 comes into play.

Purpose of Form 8611

Form 8611 serves several key purposes:

- To calculate the amount of low-income housing credit that must be recaptured

- To report the recapture amount to the IRS

- To determine any interest due on the recaptured amount

- To adjust the carryforward of unused credits

When to File Form 8611?

- The qualified basis of a low-income housing building decreased from one year to the next

- You disposed of a building or an ownership interest in it, and you didn’t follow procedures that would have prevented recapture

- The building is no longer in compliance with the requirements of Section 42

How to Complete Form 8611?

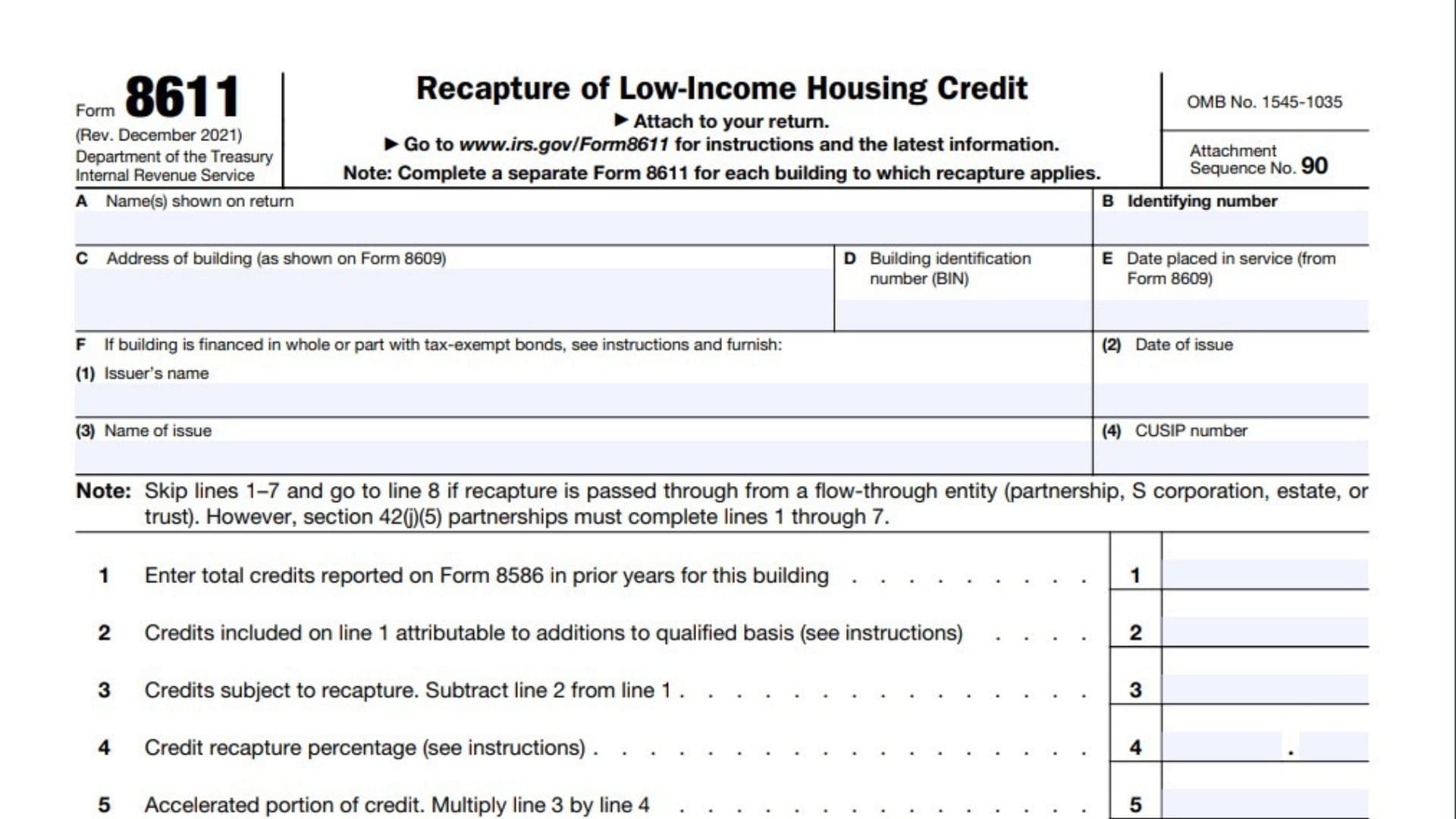

Part I: Identifying Information

A. Name(s) shown on return: Enter the name(s) as shown on your tax return.

B. Identifying number: Enter your Social Security Number (SSN) or Employer Identification Number (EIN).

C. Address of building: Enter the address of the building for which you’re recapturing the credit.

D. Building identification number (BIN): Enter the building identification number from Form 8609.

E. Date placed in service: Enter the date the building was placed in service (from Form 8609).

F. If building is financed with tax-exempt bonds:

(1) Issuer’s name: Enter the name of the entity that issued the bond.

(2) Date of issue: Enter the date the bond was issued.

(3) Name of issue: Enter the name or other identification of the bond issue.

(4) CUSIP number: Enter the CUSIP number of the bond with the latest maturity date.

Part II: Recapture Information

Line 1: Enter the total credits reported on Form 8586 in prior years for this building.

Line 2: Enter credits included on line 1 attributable to additions to qualified basis.

Line 3: Subtract line 2 from line 1 to get credits subject to recapture.

Line 4: Enter the credit recapture percentage (see instructions for specific percentages).

Line 5: Multiply line 3 by line 4 to get the accelerated portion of credit.

Line 6: Enter the percentage decrease in qualified basis as a decimal.

Line 7: Multiply line 5 by line 6 to get the amount of accelerated portion recaptured.

Line 8: Enter recapture amount from flow-through entity (if applicable).

Line 9: Enter the unused portion of the accelerated amount from line 7.

Line 10: Subtract line 9 from line 7 or line 8 to get the net recapture.

Line 11: Enter interest on the line 10 recapture amount.

Line 12: Add lines 10 and 11 for the total amount subject to recapture.

Line 13: Enter unused credits attributable to this building.

Line 14: Recapture tax. Enter the smaller of line 12 or line 13 here and on the appropriate line of your tax return.

Line 15: Carryforward of the low-income housing credit.Part III: Only for Section 42(j)(5) PartnershipsLine 16: Enter interest on the line 7 recapture amount.

Line 17: Add lines 7 and 16 for total recapture.

When completing Form 8611, it’s crucial to have accurate records of all previously filed Forms 8586, 8609, and 8609-A. The recapture amount can significantly impact your tax liability, so careful calculation and timely filing are essential. Remember that recapture doesn’t apply in certain situations, such as when the decrease in qualified basis doesn’t exceed additions to qualified basis after the first credit year, or when the property was disposed of but continues to be operated as a qualified low-income building.