Form 5405, the Repayment of the First-Time Homebuyer Credit, is a crucial document for those who received the First-Time Homebuyer Credit and are now required to repay it. Properly completing this form ensures compliance with IRS regulations and avoids potential penalties. The primary purpose of Form 5405 is to facilitate the repayment of the First-Time Homebuyer Credit that was claimed under the Housing and Economic Recovery Act of 2008. This credit provided financial assistance to first-time homebuyers, allowing them to claim a tax credit of up to $7,500 (or $8,000 for homes purchased in 2009 and early 2010). However, for homes purchased in 2008, this credit was essentially an interest-free loan that must be repaid over 15 years. Form 5405 is used to report the annual repayment amount or to accelerate repayment if the home is sold or no longer used as the taxpayer’s primary residence. This ensures that the IRS can track and collect the repayment amounts as required by law.

Who Must File Form 5405?

Form 5405 must be filed by individuals who are required to repay the First-Time Homebuyer Credit. This includes those who purchased a home in 2008 and claimed the credit, as they must make annual repayments over 15 years. Additionally, if you purchased a home in 2008, 2009, or early 2010 and you sold the home, ceased to use it as your primary residence, or the home was destroyed, condemned, or disposed of under threat of condemnation, you must file Form 5405 to report the repayment. The form is also necessary if you transferred the home to a spouse or former spouse due to a divorce. It’s important to note that the form should be filed only in the year a repayment event occurs or as part of the annual repayment schedule for homes purchased in 2008.

How to File Form 5405?

Filing Form 5405 involves specific steps and must be done in conjunction with your annual tax return. First, determine if you are required to file the form based on the criteria mentioned above. If you are, download Form 5405 from the IRS website. Gather all necessary documentation, including records of your home purchase, any previous repayments made, and details of any sale or change in the use of the home. Complete the form by entering the relevant information about your home purchase and the required repayment amount. If you are making an annual repayment for a 2008 home purchase, calculate the repayment amount, which is typically $500 per year. Once completed, attach Form 5405 to your federal tax return (Form 1040 or Form 1040-NR). If filing electronically, tax software will guide you through the process. Ensure you meet all filing deadlines to avoid penalties and interest on unpaid amounts.

How to Fill out Form 5405?

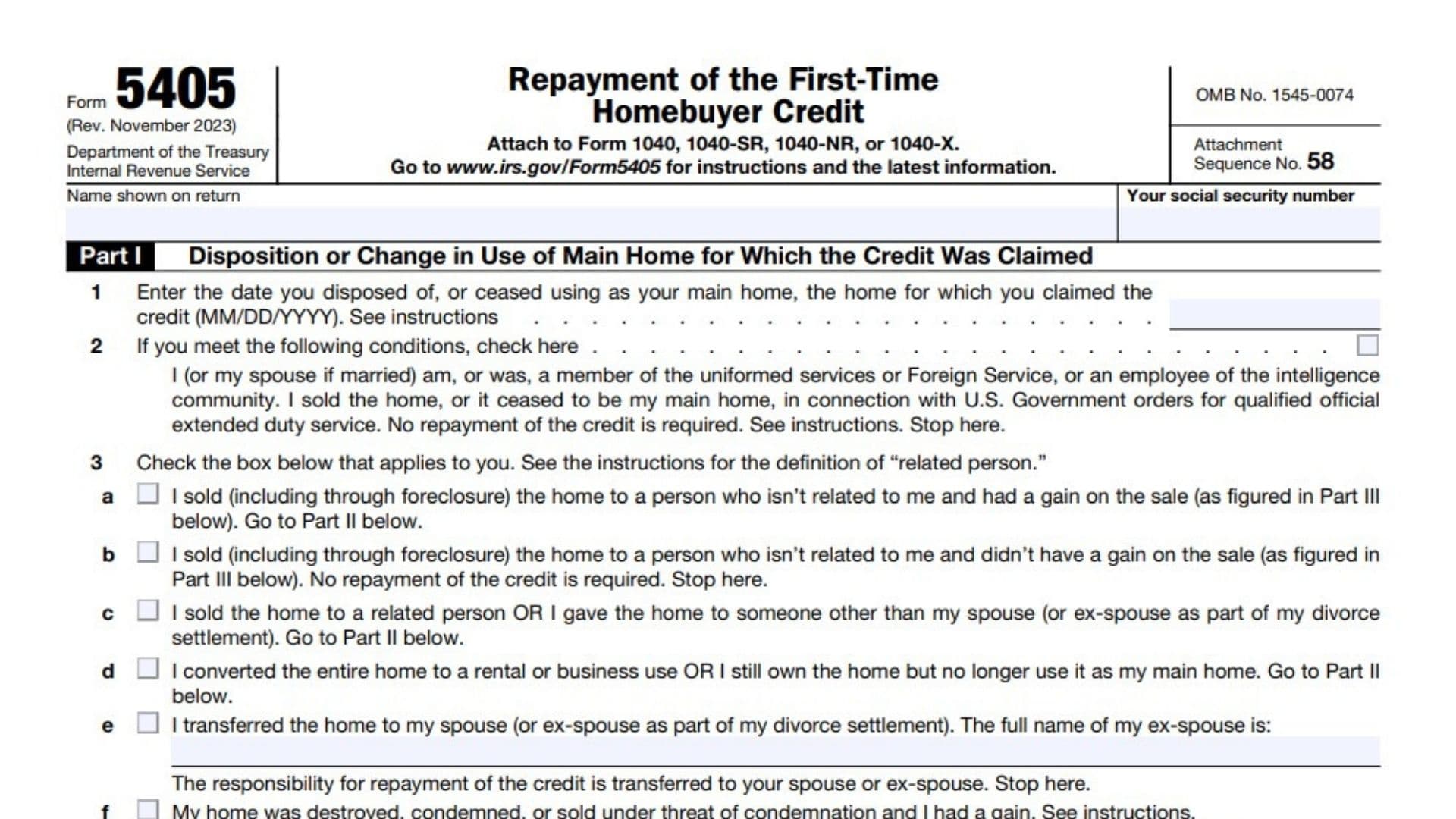

Filling out Form 5405 requires careful attention to detail to ensure all necessary information is accurately provided. The form is divided into several sections, each addressing different aspects of the repayment process. Below are line-by-line instructions based on the form provided:

- Part I – Disposition or Change in Use of Main Home for Which the Credit Was Claimed: This section is completed if you sold the home or it ceased to be your primary residence. You will need to provide information about the disposition date, selling price, and other relevant details.

- Part II – Repayment of the Credit: Enter the amount of the credit that needs to be repaid. This includes the annual repayment amount if you purchased your home in 2008 and the entire remaining credit balance if you disposed of the home or it ceased to be your main home.

- Part III – General Information: Provide details about the home for which the credit was claimed, including the address, purchase date, and amount of the original credit.

Part I: Disposition or Change in Use of Main Home for Which the Credit Was Claimed

Line 1:

- Enter the date you disposed of or stopped using your home as your main residence. Format: MM/DD/YYYY. For example, if you sold or converted the property to a rental on March 15, 2023, enter 03/15/2023.

- Refer to the instructions for what qualifies as a change of use.

Line 2:

- Check the box if applicable. This box is for individuals who were members of the uniformed services, Foreign Service, or intelligence community and had to sell or change the use of their home due to qualified official extended duty orders. If checked, no repayment of the credit is required, and you can stop completing the form.

Line 3: Check the Box that Applies to You

Choose one of the following options:

- 3a: If you sold your home to an unrelated person and had a gain (calculated in Part III), check this box and proceed to Part II.

- 3b: If you sold your home to an unrelated person and did not have a gain, check this box. No repayment is required. Stop here.

- 3c: If you sold or transferred the home to a related person or gave it to someone other than your spouse (or ex-spouse in a divorce settlement), check this box and go to Part II.

- 3d: If you converted the home to rental or business use or you no longer use it as your main home but still own it, check this box and go to Part II.

- 3e: If you transferred the home to your spouse (or ex-spouse as part of a divorce), enter your ex-spouse’s name. The repayment responsibility transfers to your spouse. Stop here.

- 3f: If your home was destroyed, condemned, or sold under threat of condemnation, and you had a gain, check this box and follow the instructions for Part II.

- 3g: If your home was destroyed, condemned, or sold under threat of condemnation and you did not have a gain, check this box. No repayment is required. Stop here.

- 3h: If the taxpayer who claimed the credit died in 2023, no repayment is required. If filing a joint return with a deceased taxpayer, follow the instructions. Otherwise, stop here.

Part II: Repayment of the Credit

Line 4:

- Enter the amount of the credit you originally claimed on Form 5405 for 2008. If you filed jointly or checked boxes 3f or 3g, refer to the instructions for additional details.

Line 5:

- Enter the total amount of the credit you’ve already repaid from tax years 2010 through 2022. This includes repayments made with your previous tax returns.

Line 6:

- Subtract Line 5 from Line 4. This gives you the remaining credit that may need to be repaid.

- If you checked box 3f or 3g, refer to the instructions. If you checked 3a, proceed to Line 7. Otherwise, skip to Line 8.

Line 7:

- If you checked box 3a in Part I, enter the gain from the sale of your home (calculated in Line 15, Part III).

Line 8:

- Enter the amount of the credit that must be repaid. Refer to the instructions for this line to see how much of the remaining credit (from Line 6 or Line 7) must be repaid. You will need to report this amount on Schedule 2 (Form 1040), Line 10.

Part III: Form 5405 Gain or (Loss) Worksheet

Complete this section only if you sold your home to someone who isn’t related to you, or your home was destroyed, condemned, or sold under threat of condemnation.

Line 9:

- Enter the selling price of your home, the insurance proceeds, or the gross condemnation award if applicable. If your home was sold, this will be the total sales price.

Line 10:

- Enter your selling expenses, which may include commissions, legal fees, advertising costs, or other seller-paid expenses related to the sale.

Line 11:

- Subtract Line 10 from Line 9. This gives you the amount realized from the sale of your home.

Line 12:

- Enter the adjusted basis of your home. This is generally the amount you originally paid for the home plus any improvements or additions made over the years. Refer to Publication 523 for more details.

Line 13:

- Enter the first-time homebuyer credit claimed on Form 5405, minus the amount you’ve already repaid (from Line 5).

Line 14:

- Subtract Line 13 from Line 12. This is the adjusted basis for the purpose of repaying the credit.

Line 15:

- Subtract Line 14 from Line 11. This figure will tell you if you had a gain or loss from the sale of your home:

- If Line 15 is greater than zero, you had a gain. Check Box 3a and complete Part II.

- If Line 15 is zero or less, check Box 3b. No repayment is required, and you can stop here. If the home was destroyed, condemned, or sold under threat of condemnation, check Box 3g.

Final Steps

- Once you’ve completed Form 5405, attach it to Form 1040, 1040-SR, 1040-NR, or 1040-X. Ensure the amount on Line 8 of Form 5405 is entered on Schedule 2 (Form 1040), Line 10.