Filing Form 4684, also known as the Casualties and Thefts form, is crucial for taxpayers who have suffered property losses due to events such as natural disasters, accidents, or theft. By accurately reporting these losses, taxpayers may be eligible for deductions that can reduce their overall tax liability. Properly completing this form ensures compliance with IRS regulations and helps individuals recover some of their financial losses. Taxpayers must file Form 4684 if they have experienced property losses due to casualties or thefts. This includes losses from natural disasters such as hurricanes, floods, earthquakes, and other unforeseen events, as well as losses due to theft or vandalism. The form is applicable to both personal-use property and income-producing property.

How to File Form 4684?

To file Form 4684, follow these general steps:

- Obtain the Form: Download Form 4684 from the IRS website or use tax preparation software.

- Attach to Tax Return: Attach the completed Form 4684 to your U.S. federal income tax return (Form 1040 or Form 1040-SR).

- Submit: File your tax return, including Form 4684, with the IRS by the standard tax filing deadline, which is usually April 15. Ensure that you retain copies of the form and all supporting documentation for your records.

How to Fill Out Form 4684?

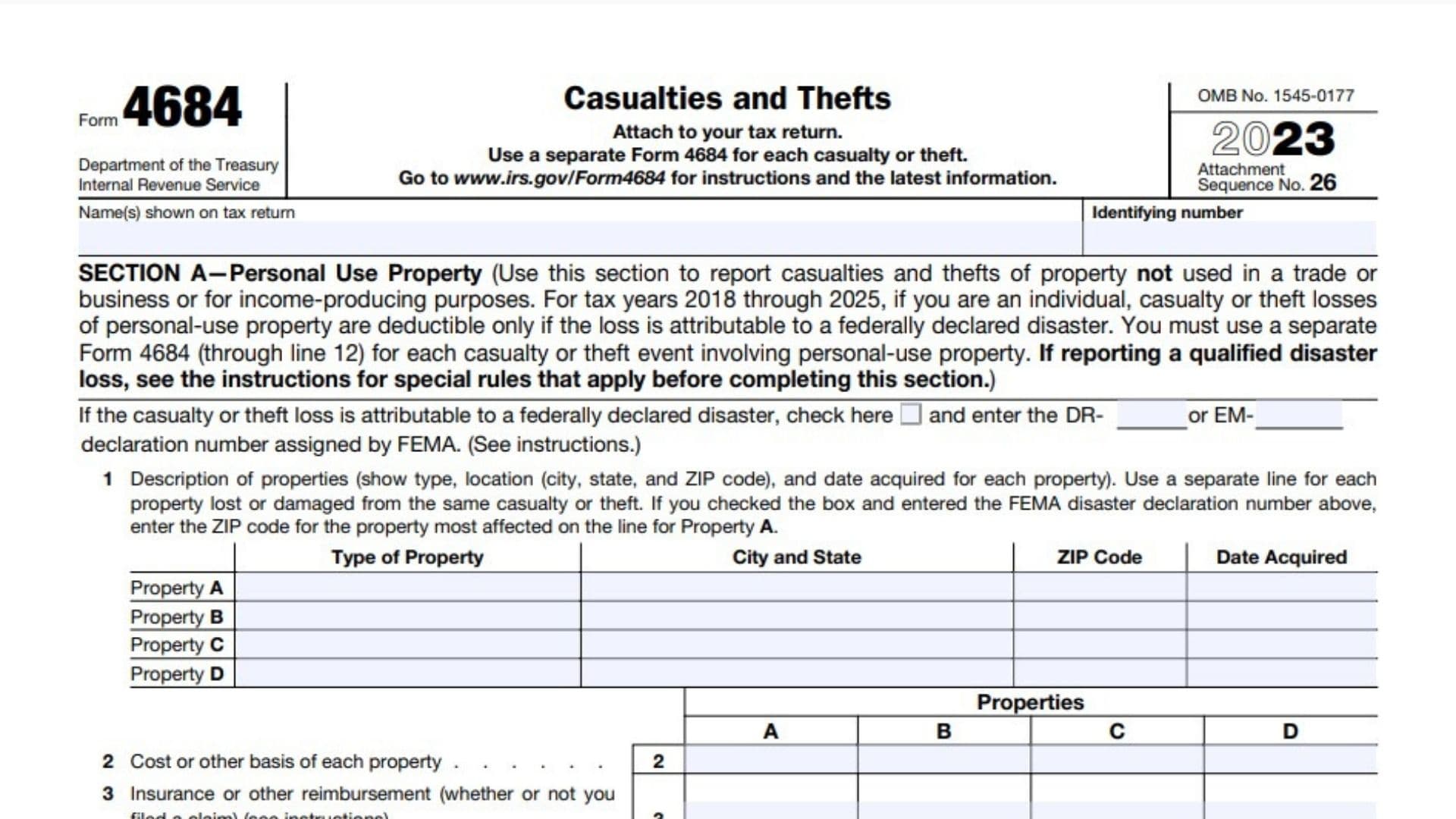

Filling out Form 4684 requires detailed information about the casualty or theft loss. Follow these steps to ensure accuracy:

- Enter Basic Information: At the top of the form, provide your name and Social Security Number (SSN).

- Section A – Personal Use Property:

- Line 1: Describe the property affected and the type of casualty or theft.

- Line 2: Enter the date the casualty or theft occurred.

- Line 3: Provide the property’s location.

- Line 4: Calculate the cost or adjusted basis of the property.

- Line 5: Determine the fair market value (FMV) of the property before and after the event.

- Line 6: Compute the decrease in FMV due to the casualty or theft.

- Line 7: Enter any insurance or other reimbursements received.

- Line 8: Calculate the loss after reimbursements.

- Line 9: Subtract $100 for each casualty or theft event.

- Line 10: If the loss occurred in a federally declared disaster area, you may be eligible for special tax relief.

- Section B – Business and Income-Producing Property:

- Lines 11-22: Provide similar information as required in Section A but for business or income-producing property. Include details about the property’s adjusted basis, FMV before and after the event, and any reimbursements.

- Total Loss Calculation:

- Line 23: Sum the losses from both sections to determine your total deductible loss.

- Sign and Date: Sign and date the form to certify that the information provided is accurate and complete.

Key Things To Know About Form 4684

- Eligibility: To claim a deduction for casualty or theft losses, the losses must exceed $100 per event and the total loss must exceed 10% of your adjusted gross income (AGI) for the year.

- Due Date: The form must be filed by the standard tax filing deadline, which is usually April 15.

- Exemptions: Losses due to negligence or willful actions are not deductible. Only losses from events that are sudden, unexpected, and unusual qualify.

- Penalties: Failure to accurately report casualty or theft losses can result in penalties and interest. It’s essential to provide accurate and complete information and keep detailed records of the losses and any reimbursements received.

Form 4684 provides a way for taxpayers to report and potentially deduct losses due to casualties and thefts, helping to mitigate the financial impact of such events. Understanding the eligibility requirements, accurately completing the form, and filing it with your tax return are crucial steps to take advantage of these deductions. By doing so, taxpayers can ensure compliance with IRS regulations while recovering some of their losses. Always keep detailed records and consult a tax professional if you have any questions about your specific situation or the completion of Form 4684.