Form 3468, Investment Credit, is used by taxpayers to claim various investment credits that can reduce their federal tax liability. These credits include the rehabilitation credit, energy credit, and qualifying advanced coal project credit, among others. Properly managing this form ensures compliance with IRS regulations and maximizes the tax benefits associated with eligible investments. By understanding and correctly managing Form 3468, taxpayers can take advantage of significant tax incentives designed to encourage investment in specific types of property and projects.

The primary purpose of Form 3468 is to allow taxpayers to claim various investment credits against their federal tax liability. These credits are designed to incentivize investment in certain types of property and projects, such as rehabilitating historic buildings, investing in renewable energy, and developing advanced coal projects. By using Form 3468, taxpayers can calculate and claim credits for eligible investments, which can significantly reduce their overall tax burden.

Who Must File Form 3468?

Form 3468 must be filed by individuals, corporations, estates, and trusts that are eligible to claim investment credits. This includes:

- Individuals and Corporations: Taxpayers who have made qualifying investments in property or projects eligible for the credits.

- Estates and Trusts: Entities that have made qualifying investments and are seeking to claim the investment credits.

The form must be filed with the taxpayer’s annual income tax return.

How To File Form 3468?

Filing Form 3468 involves several steps and requires detailed information to ensure all necessary information is provided. The form must be filed along with the taxpayer’s annual income tax return.

- Obtain Form 3468: The form can be downloaded from the IRS website. Ensure you have the correct version for the tax year in which you are filing.

- Complete the form: Fill out Form 3468 with the required information, including details about the qualifying investments and the calculation of the credits.

- Attach supporting documentation: Gather all required documents, such as receipts, contracts, and certification statements, that substantiate the qualifying investments.

- Submit the form: File Form 3468 with your annual income tax return (Form 1040, Form 1120, etc.). Ensure that the form and all supporting documentation are included in the tax return package.

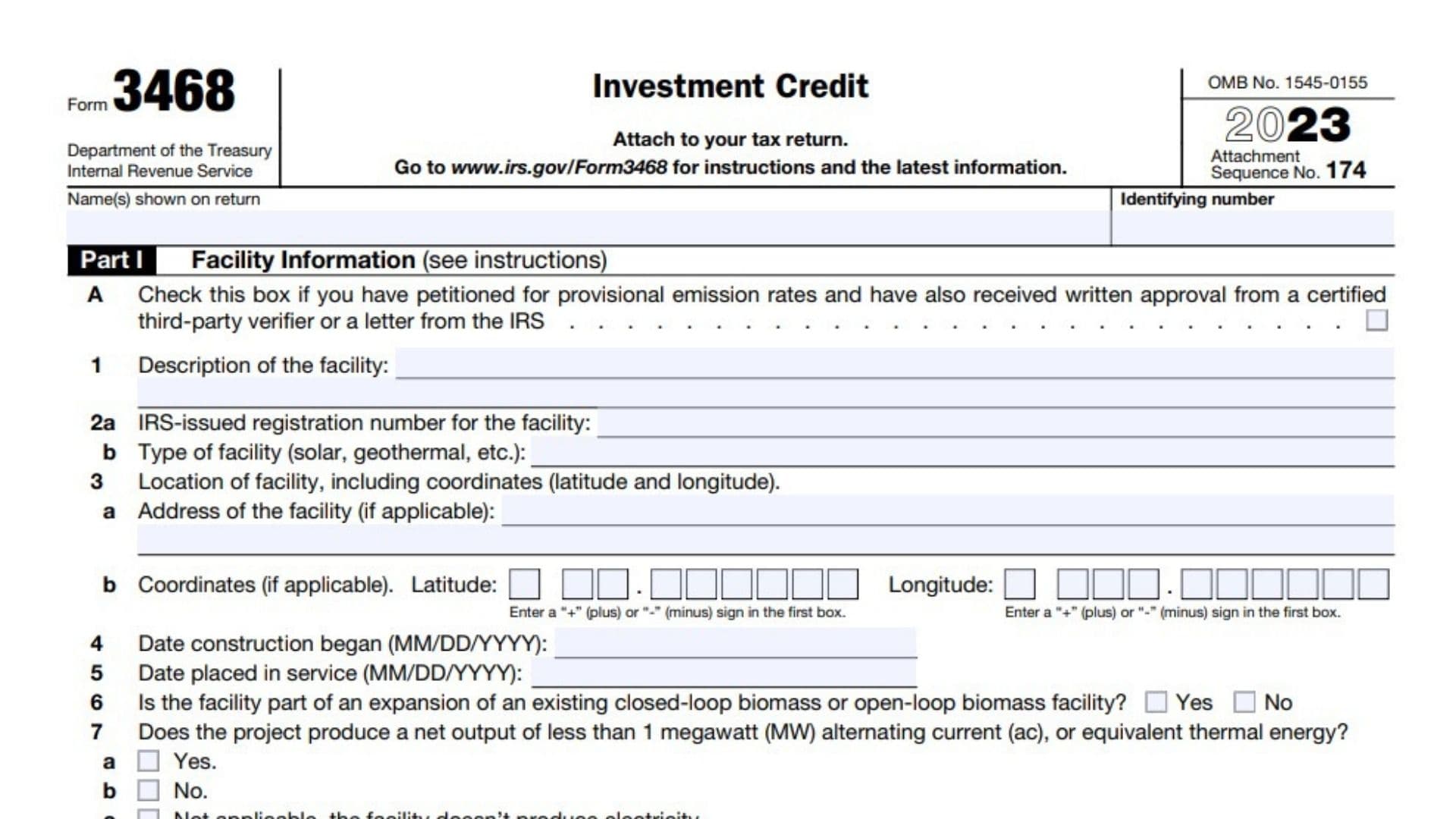

How To Fill Out Form 3468?

Filling out Form 3468 requires accurate and comprehensive information about the qualifying investments. The form is divided into several parts, each addressing different aspects of the investment credit calculation.

- Part I – Rehabilitation Credit and Energy Credit:

- Line 1: Enter the amount of qualified rehabilitation expenditures.

- Line 2: Enter the amount of qualified expenditures for energy property.

- Line 3: Calculate the total of the above amounts.

- Part II – Other Investment Credits:

- Lines 4-8: Provide detailed information about other qualifying investments, such as advanced coal projects, advanced energy projects, and qualifying gasification projects.

- Line 9: Calculate the total of the above amounts.

- Part III – Credit Recapture:

- Lines 10-12: Provide information about any recapture of previously claimed credits due to the disposal of property or other disqualifying events.

- Part IV – Summary:

- Lines 13-16: Summarize the total investment credits claimed, including any carryforwards and carrybacks from other tax years.

- Signature:

- Ensure the form is signed and dated by the taxpayer or an authorized representative. The signature confirms the accuracy of the information provided and the filer’s agreement to the return.

Ensure all information is accurate and complete. Double-check the calculations and supporting documentation. If needed, seek assistance from a tax professional to ensure the form is filled out correctly and submitted on time.

Things to Consider When Filing Form 3468

Understanding the specific rules and implications of filing Form 3468 is essential for taxpayers seeking to claim investment credits.

Accurate Reporting: Ensure that all information reported on Form 3468 is accurate. Incorrect or incomplete information can lead to penalties and delays in processing by the IRS.

Supporting Documentation: Provide thorough and detailed supporting documentation to substantiate the qualifying investments. This includes receipts, contracts, and certification statements.

Credit Recapture: Be aware of the rules for recapturing previously claimed credits if the qualifying property is disposed of or if other disqualifying events occur. Properly managing recapture can prevent unexpected tax liabilities.

Coordination with Other Tax Forms: Ensure that Form 3468 is accurately completed and filed with your annual income tax return. This form works in conjunction with other tax forms to report and calculate your total tax liability.

Record Keeping: Maintain accurate records of all qualifying investments and the calculation of the credits. Proper record-keeping helps ensure compliance and can be crucial in case of an IRS audit.

Professional Assistance: Due to the complexity of the investment credits and the specific reporting requirements, consider seeking assistance from a tax professional. A qualified advisor can help ensure that Form 3468 is completed accurately and submitted on time and can provide guidance on the implications of the investment credits for your overall tax strategy.

Legal and Financial Implications: Understand the legal and financial implications of claiming investment credits. This includes the impact on your financial planning, investment strategies, and potential financial gains or losses.