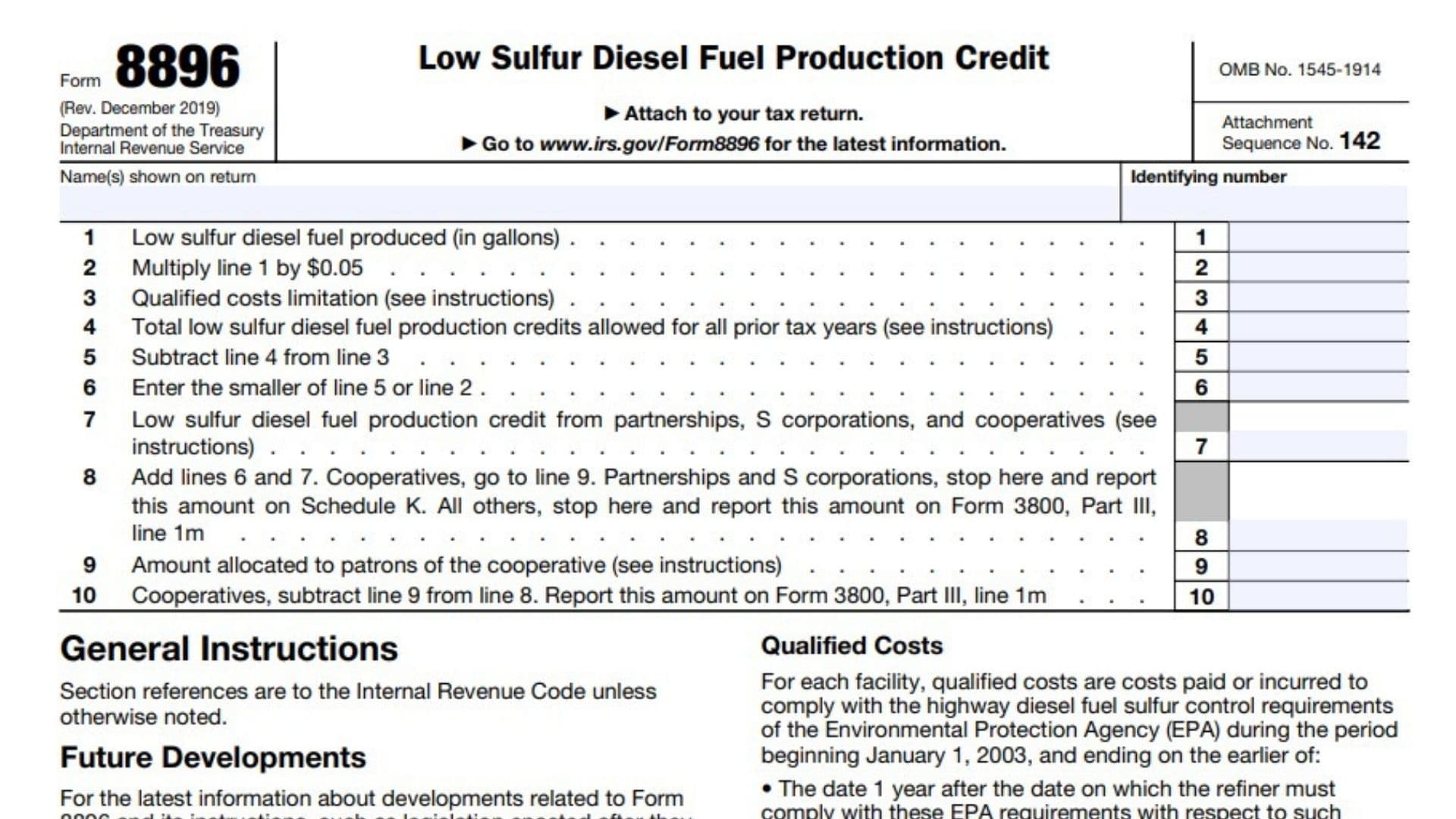

Form 8896 Low Sulfur Diesel Fuel Production Credit is available to qualified small refiners. The credit is calculated at five cents per gallon of diesel fuel produced. The credit can be multiplied by 75%. The credit is also available for qualified small employers. Form 8896 is a small form to fill out. It just consists of only one page and ten lines in total. Once you’ve done with the fillout process, you must attach your Form 8896 to your tax return. For those troubled with the fill out process, the following section, which includes the line-by-line instructions for Form 8896, will help you overcome this.

How to Complete Form 8896?

Line 1: Low sulfur diesel fuel produced (in gallons).

Line 2: Multiply line 1 by $0.05.

Line 3: Qualified costs limitation

Line 4: Total low-sulfur diesel fuel production credits allowed for all prior tax years.

Line 5: Subtract line 4 from line 3

Line 6: Enter the smaller of line 5 or line 2

- Line 7: Low sulfur diesel fuel production credit from partnerships, S corporations, and cooperatives. You must enter some amounts from other forms in this line. Enter total low sulfur diesel fuel production credits from:

- Schedule K-1 (Form 1065), Partner’s Share of Income, Deductions, Credits, etc., box 15 (code P);

- Schedule K-1 (Form 1120-S), Shareholder’s Share of Income, Deductions, Credits, etc., box 13 (code P)

- Form 1099-PATR, Taxable Distributions Received From Cooperatives, box 12 (box 11 for 2019; box 10 before 2019), or other notice of credit allocation.

Line 8: Add lines 6 and 7. Cooperatives, go to line 9. Partnerships and S corporations, stop here and report this amount on Schedule K. All others, stop here and report this amount on Form 3800, Part III, line 1m

Line 9: Amount allocated to patrons of the cooperative

Line 10: Cooperatives, subtract line 9 from line 8. Report this amount on Form 3800, Part III, line 1m.