You must complete Form 6478 if you have invested in the section 40 biofuel producer credit for the tax year that the sale or use of the biofuel occurs. This credit consists of the second-generation biofuel producer credit and the cellulosic biofuel producer credit. This form is required for individuals, partnerships, S corporations, cooperatives, estates, and trusts.

In order to qualify for the credit, you must be a qualified biofuel producer, which means that you have produced enough qualifying fuel in one year to offset all of the taxes you paid on that fuel. This can be done by applying to the IRS, along with supporting documentation of your production. The IRS will then review the application and determine if you are eligible to claim the credit.

The application for this credit can be found on the IRS website. The form asks for a lot of detailed information, including your name, address, and social security number. You must also provide details of the production facility that you have, as well as the types of fuels that have been produced there. The application must be signed by an authorized representative of the biofuel producer.

Depending on the type of business, there are other credits that you may be eligible to claim. These include Form 6765, Credit for Increasing Research Activities; Form 3800, General Business Credits; and Form 5884, Work Opportunity Credit (targeted group employees include long-term family assistance recipients, SSI recipients, qualified veterans, and former convicted felons).

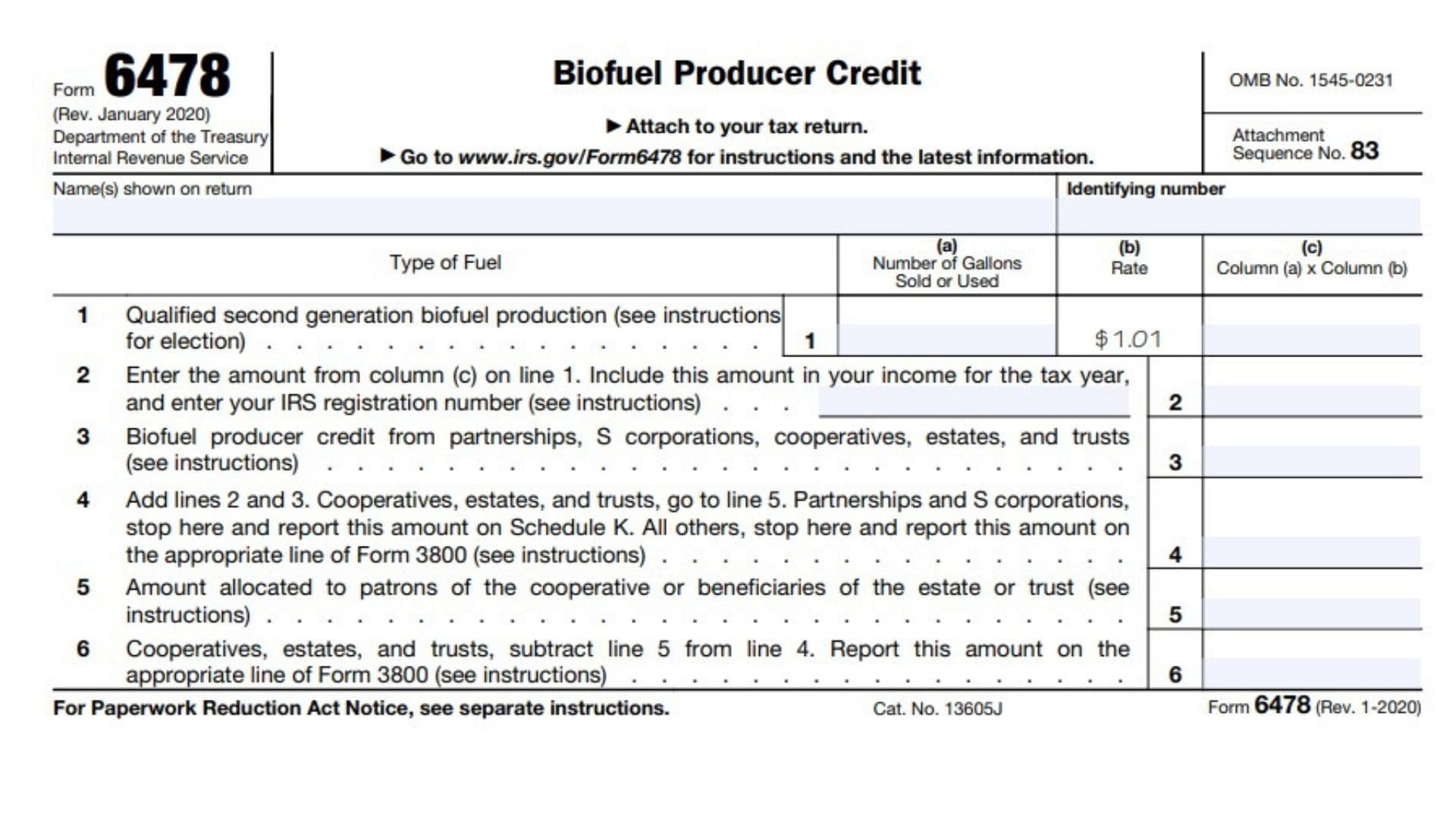

How to Complete Form 6478?

- Enter the name shown on your return.

- Enter the Identifying number.

There are three columns for each Line:

- (a) Number of Gallons Sold or Used

- (b) Rate

- (c) Column (a) x Column (b)

Line 1: Enter qualified second generation biofuel production amount

Line 2: Enter the amount from column (c) on line 1. Include this amount in your income for the tax year. Also, enter your IRS registration number.

Line 3: Enter Biofuel producer credit amount from partnerships, S corporations, cooperatives, estates, and trusts

Line 4: Add lines 2 and 3. Cooperatives, estates, and trusts must proceed to Line 5. Partnerships and S corporations, stop here and report this amount on Schedule K. All others, stop here and enter this amount on Form 3800.

Line 5: Enter the amount allocated to patrons of the cooperative or beneficiaries of the estate or trust.

Line 6: Cooperatives, estates, and trusts; subtract line 5 from line 4 and enter this amount on Form 3800.