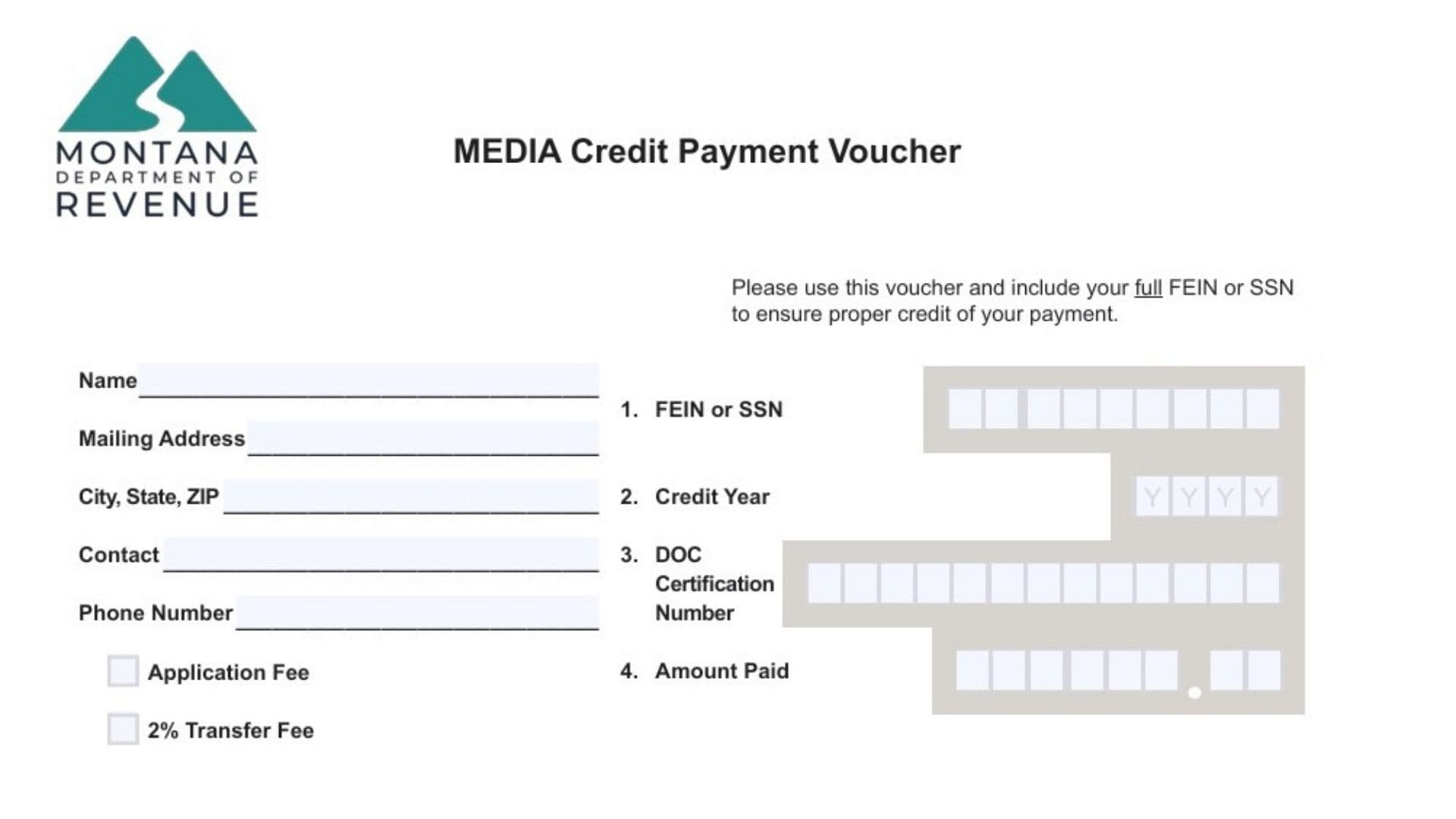

The MEDIA Credit Payment Voucher is a specialized remittance slip used to ensure your payment is correctly credited to your account when you pay by check for Montana media tax credit fees. It specifically handles two types of payments: the initial MEDIA Credit Application Fee (which varies based on your investment level) and the MEDIA Credit Transfer Fee (which is required if you are transferring the credit to another taxpayer). The voucher ensures that the Department of Revenue can match your check to your specific production and tax identification number, preventing processing delays.

The form includes a “cut line” separating the instructions/record-keeping portion from the actual voucher that you must mail in. It also outlines the specific fee amounts: $500 for productions with a base investment under $350,000, and $1,000 for those investing $350,000 or more (or for postproduction companies applying for the postproduction credit). For transfers, the fee is calculated as 2% of the credit value being transferred.

How To File Montana MEDIA Credit Payment Voucher Form

Fill out the voucher completely, ensuring your Federal Employer Identification Number (FEIN) or Social Security Number (SSN) is accurate to ensure proper credit. Once completed, detach the voucher along the “Cut line” indicated on the page. Mail the detached voucher along with your check to the Montana Department of Revenue at PO Box 5835, Helena, MT 59604-5835. The instructions explicitly state that you should not staple or tape the voucher to your check or return; keep them loose in the envelope.

How to Complete Montana MEDIA Credit Payment Voucher Form

Applicant Contact Information (Upper Section)

- Name: Enter the full legal name of the production company or individual making the payment.

- Mailing Address: Write the complete street address or PO Box where mail is received.

- City, State, ZIP: Fill in the city, state abbreviation, and ZIP code for the mailing address.

- Contact: Provide the name of the person responsible for this payment who can answer questions if they arise.

- Phone Number: Enter a direct telephone number for the contact person listed above.

Payment Voucher Details (Lower Section – Below Cut Line)

- Fee Type Checkboxes: Locate the two boxes on the left side and check the one that applies to this payment:

- Application Fee: Check this box if you are paying the initial fee to apply for the credit ($500 or $1,000).

- 2% Transfer Fee: Check this box if you are paying the fee required to transfer an existing credit to another party.

- Box 1 (FEIN or SSN): Enter your full Federal Employer Identification Number or Social Security Number in this box—this is the most critical field for ensuring the money is applied to the correct account.

- Box 2 (Credit Year): Write the specific tax year (YYYY format) for which the media credit applies or is being claimed.

- Box 3 (DOC Certification Number): Enter the unique certification number assigned to your production by the Department of Commerce (often found on your certification letter).

- Box 4 (Amount Paid): Write the exact dollar amount of the check you are enclosing.

Form Management

- Clear Form: Use this button if you are filling the form out digitally and need to erase all fields to start over.

- Cut line: Physically cut or tear the paper along this dashed line to separate the voucher from the top portion before mailing.