The Montana Form RCYL (Recycle Credit/Deduction) is a valuable tax document that rewards businesses and individuals for investing in recycling. If you have purchased machinery to collect, process, or manufacture products from reclaimed materials—or if you simply buy recycled material for business use—this form allows you to claim a credit or an additional deduction. The form is versatile: it covers everything from heavy machinery used to treat contaminated soil to the purchase of everyday recycled goods. By filing this form, you can reduce your Montana tax liability significantly, with credits tiered based on the equipment’s cost and additional deductions for using eco-friendly materials. Whether you are a partner in a firm, a mobile equipment operator, or a business owner buying recycled stock, this guide will walk you through each line to ensure you claim every dollar available to you.

How to Complete Montana Form RCYL

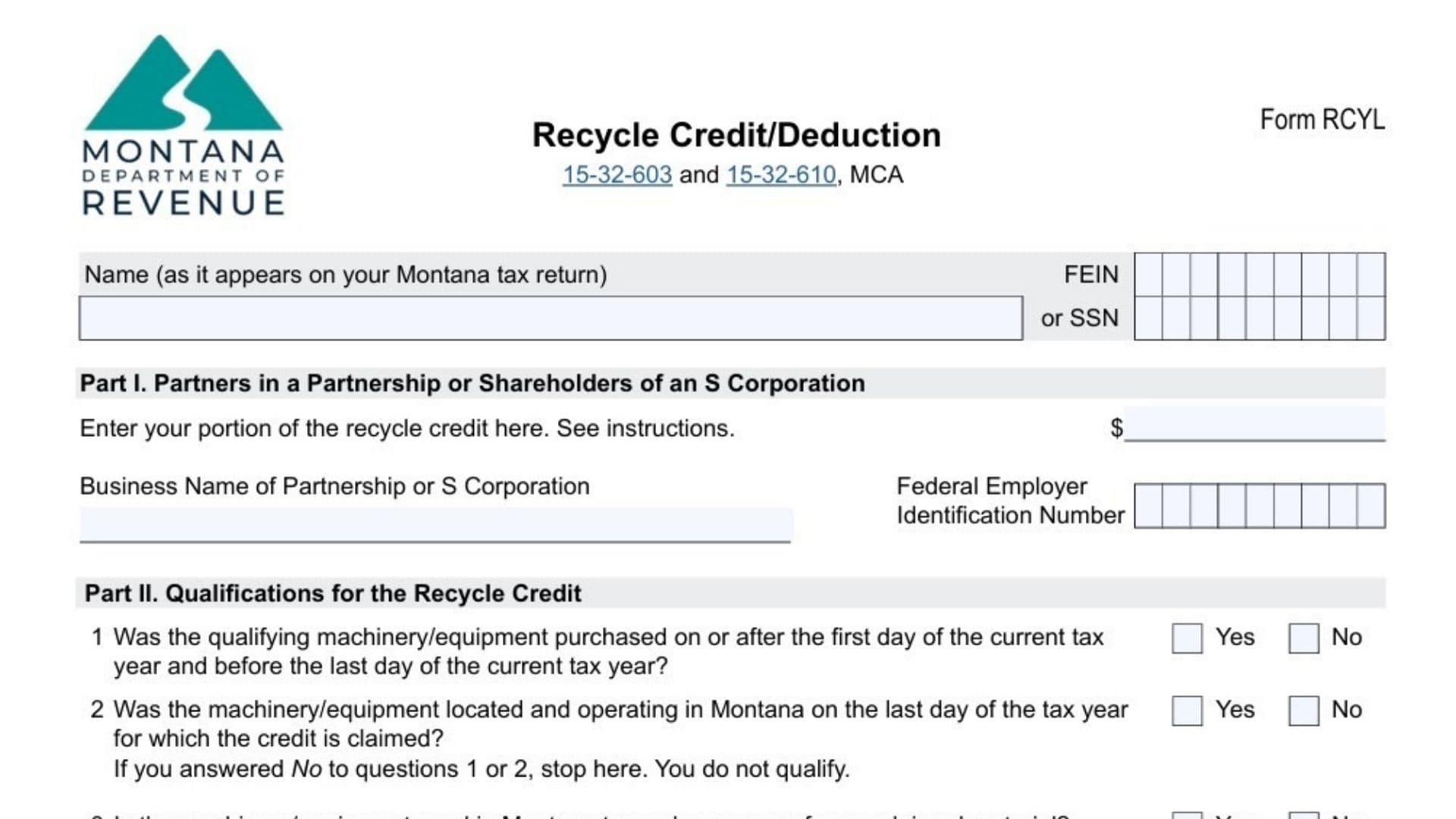

This section is strictly for individuals receiving a credit through a pass-through entity. If you are filing on behalf of the business itself to calculate the credit, skip this and move to Part II.

Enter your portion of the recycle credit here: Input the specific dollar amount of the credit allocated to you. This figure should be provided to you by the partnership or S corporation (typically on a Schedule K-1).

Business Name: Write the full legal name of the Partnership or S Corporation that generated the credit.

Federal Employer Identification Number: Enter the FEIN of the business entity listed above.

Part II: Qualifications For The Recycle Credit

Before calculating any numbers, you must pass this eligibility test. Answer these questions honestly to determine if your equipment qualifies.

Line 1: Was the machinery purchased during the current tax year? Check Yes or No. It must be bought between the first and last day of the tax year.

Line 2: Was the machinery located and operating in Montana on the last day of the tax year? Check Yes or No.

- Stop Rule: If you answered No to either question 1 or 2, you do not qualify for the credit. Stop here.

Line 3: Is the equipment used to produce energy from reclaimed material? Check Yes or No. - Stop Rule: If you answered Yes, you do not qualify for this specific credit (energy production often falls under different incentives).

Line 4: You must answer Yes to at least one of the following (a, b, or c) to qualify: - 4a: Is it used primarily for collecting or processing reclaimed material?

- 4b: Is it used primarily for manufacturing finished products from reclaimed materials?

- 4c: Is it used to treat soils contaminated by hazardous waste?

If you answered No to all three, you do not qualify for the credit.

Part III: For Equipment Used In Montana

Complete this section if your qualifying equipment is primarily stationary and used within Montana.

Line 1: Provide a detailed explanation of the equipment and its specific use. You must attach copies of pamphlets, brochures, or other supporting documents that describe the machinery.

Line 2: Enter the exact Date of purchase (MM/DD/YYYY).

Line 3: Enter the Cost of equipment. Important: Do not enter an amount greater than $1,000,000.

Line 4: Calculate your credit using the tiered percentage system:

- 4a: Multiply the first $250,000 of the cost by 25% (0.25). Enter result.

- 4b: Multiply the next $250,000 of the cost by 15% (0.15). Enter result.

- 4c: Multiply the next $500,000 of the cost by 5% (0.05). Enter result.

Total Credit: Add 4a, 4b, and 4c together and enter the total here.

Part IV: For Qualifying Specialized Mobile Equipment

Complete this section instead of Part III if your equipment is mobile and used both inside and outside of Montana.

Line 1: Explain the equipment and its use in detail. Attach supporting pamphlets or documents.

Line 2: Enter the Date of purchase.

Line 3: Enter the Cost of equipment (Limit: $1,000,000).

Line 4: Enter the number of days used in Montana during the year.

Line 5: Enter the total days used everywhere during the year.

Line 6: Divide Line 4 by Line 5. Enter the resulting ratio (percentage of Montana use).

Line 7: Calculate the credit by applying the Montana ratio to the tiered rates:

- 7a: Multiply ratio (Line 6) by 25%, then multiply by the first $250,000 of cost.

- 7b: Multiply ratio (Line 6) by 15%, then multiply by the next $250,000 of cost.

- 7c: Multiply ratio (Line 6) by 5%, then multiply by the next $500,000 of cost.

Total Credit: Add 7a, 7b, and 7c. Enter the total here.

Part V: Deduction For Purchase Of Recycled Material

Use this section if you purchased recycled goods for business use. This is a deduction, not a credit.

Line 1: Describe the Type of recycled material purchased.

Line 2: Enter the total Cost of recycled material.

Line 3: Multiply Line 2 by 10% (0.10). This is your additional deduction amount. Enter this figure on your main tax return.