The Montana Form QEC (Qualified Endowment Credit) is a designated tax form used by individuals, corporations, estates, and trusts to claim a credit for charitable contributions made to a qualified endowment. This credit encourages philanthropy by offering significant tax relief—40% of the present value for planned gifts (like charitable trusts or annuities) and 20% for outright gifts made by corporations. A “qualified endowment” is a permanent, irrevocable fund held by a Montana-based 501(c)(3) organization or a bank/trust company on behalf of one, specifically for religious, educational, or charitable purposes. This form is essential for documenting your donation, verifying its eligibility, and calculating the exact credit you can subtract from your Montana tax liability. Whether you are an individual donor setting up a charitable remainder trust or a business owner making a direct contribution, this guide will walk you through every line to ensure your claim is accurate and compliant.

How to Complete Montana Form QEC

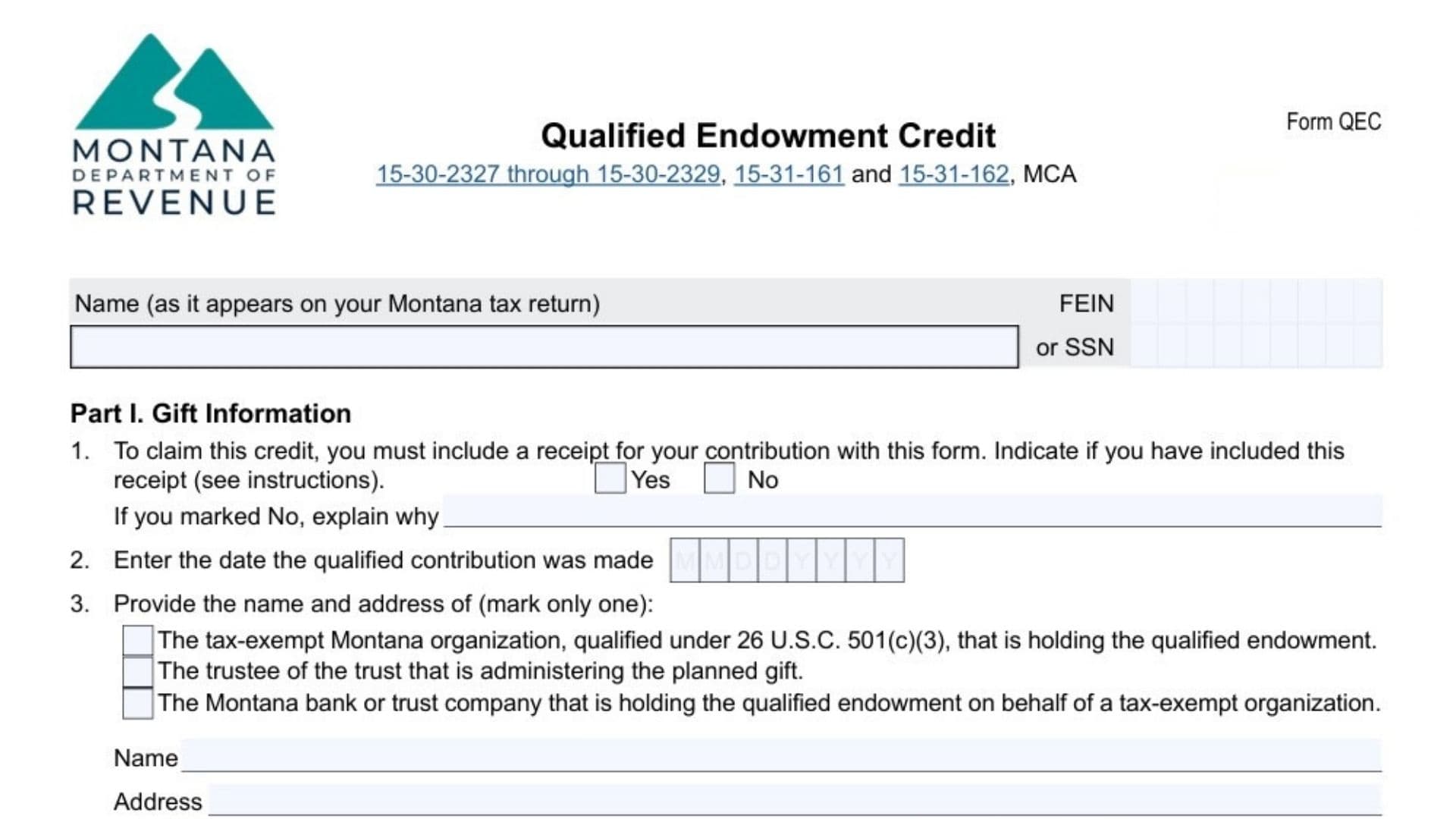

Part I: Gift Information

This section validates the legitimacy of your donation. You must complete this part to prove that your contribution meets the legal standards for the credit.

Line 1: You must attach a formal receipt for your contribution to this form. Check the box “Yes” to indicate you have included it. If you check “No,” you must provide a written explanation in the space provided detailing why the receipt is missing.

Line 2: Enter the exact date (MM/DD/YYYY) that your qualified contribution was made. This date determines the tax year for which you can claim the credit.

Line 3: Identify the recipient of your gift. You must check one of the three boxes to indicate who is holding the endowment:

- A tax-exempt Montana organization (501(c)(3)).

- A trustee of the trust administering the planned gift.

- A Montana bank or trust company holding the fund for a tax-exempt organization.

Below the checkboxes, clearly print the Name and full Address (City, State, ZIP) of the entity you selected.

Line 4: If your contribution was a planned gift, you must identify the specific financial vehicle used. Check the appropriate box from the list provided: - Charitable remainder unitrust

- Charitable remainder annuity trust

- Pooled income fund trust

- Charitable lead unitrust

- Charitable lead annuity trust

- Charitable life estate agreement

- Paid-up life insurance policy

- Charitable gift annuity

- Deferred charitable gift annuity

If your gift was an outright contribution (typical for corporations), you can skip this line.

Part II: Credit Calculation

This section is where the math happens. You will calculate the actual dollar amount of your tax credit. Important: Complete only one column. Use Column A if you made a planned gift. Use Column B if you made an outright gift.

Line 5: Enter the financial value of your contribution.

- Column A (Planned Gift): Enter the present value of the charitable gift portion of your planned gift.

- Column B (Outright Gift): Enter the full amount of your outright charitable contribution (the charitable deduction amount).

Pass-Through Entities: If you are claiming a credit based on a contribution made by a partnership or S corporation, enter your share of that contribution here. In the space provided below the line, you must also enter the Business Name and Federal Employer Identification Number (FEIN) of that entity.

Line 6: This line displays the statutory percentage rate for your credit. - Column A: The rate is pre-filled as 40% (0.40).

- Column B: The rate is pre-filled as 20% (0.20).

Line 7: Multiply the amount on Line 5 by the percentage on Line 6. Enter the result here. - Maximum Limit: Do not enter an amount larger than $15,000.

This final figure is your Qualified Endowment Credit. You will transfer this amount to the appropriate line on your Montana income tax return (Form 2, Form CIT, or Form FID-3).

Important Limitations & Rules

- Double Dipping: You cannot claim this credit and a charitable deduction for the same contribution. You must add back any amount used for this credit to your taxable income.

- Married Filing Jointly: If both spouses make separate qualifying gifts, the limit increases to $30,000 ($15,000 per spouse). You must file a separate Form QEC for each gift.

- Carryovers: The form does not explicitly detail carryover years in this section, but always check your main tax return instructions for how to handle unused credits.

- Estates & Trusts: Can claim up to $15,000. Unused credits can be passed through to beneficiaries.