IRS Form 8804-C, titled “Certificate of Partner-Level Items to Reduce Section 1446 Withholding,” is a critical document designed specifically for foreign partners in U.S. partnerships engaged in trade or business activities that generate effectively connected taxable income (ECTI). Under section 1446 of the Internal Revenue Code, partnerships are required to withhold 21% (or 37% for certain cases) on foreign partners’ allocable shares of ECTI to ensure compliance with U.S. tax obligations, but this form allows eligible foreign partners to certify specific partner-level deductions, losses, and credits—such as net operating loss carryovers, capital losses, suspended passive activity losses, at-risk limitations, and section 704(d) basis limitations—that can reasonably reduce their U.S. federal income tax liability on that income. By submitting Form 8804-C to the partnership before the applicable installment due date or the end of the partnership’s tax year, partners enable the partnership to lower or eliminate the withholding amount, avoiding over-withholding that would otherwise require the partner to seek a refund through their individual tax return (Form 1040-NR).

This certificate is particularly valuable for foreign individuals, corporations, or other entities with complex tax situations involving carryovers from prior years or limitations under sections like 469 (passive activities) or 465 (at-risk rules), ensuring accurate withholding without the need for immediate tax payments. Importantly, the form incorporates strict representations about the partner’s compliance history, including timely filing of prior U.S. returns and payment of taxes, to maintain the certificate’s validity; failure to meet these can trigger updates or revocation. As outlined in Treasury Regulations section 1.1446-6, the certificate must be based on reasonable expectations and cannot be used for estimated tax payments under sections 6654 or 6655 on non-partnership income, nor can the same items be certified to multiple partnerships for the same tax year. Overall, Form 8804-C streamlines tax withholding for international investors, promotes efficient cash flow by reducing upfront taxes, and aligns with IRS efforts to simplify compliance for nonresident aliens while safeguarding revenue collection—making it an essential tool for any foreign partner anticipating ECTI from U.S. partnerships, whether publicly traded or not (though it’s ineligible for the latter).

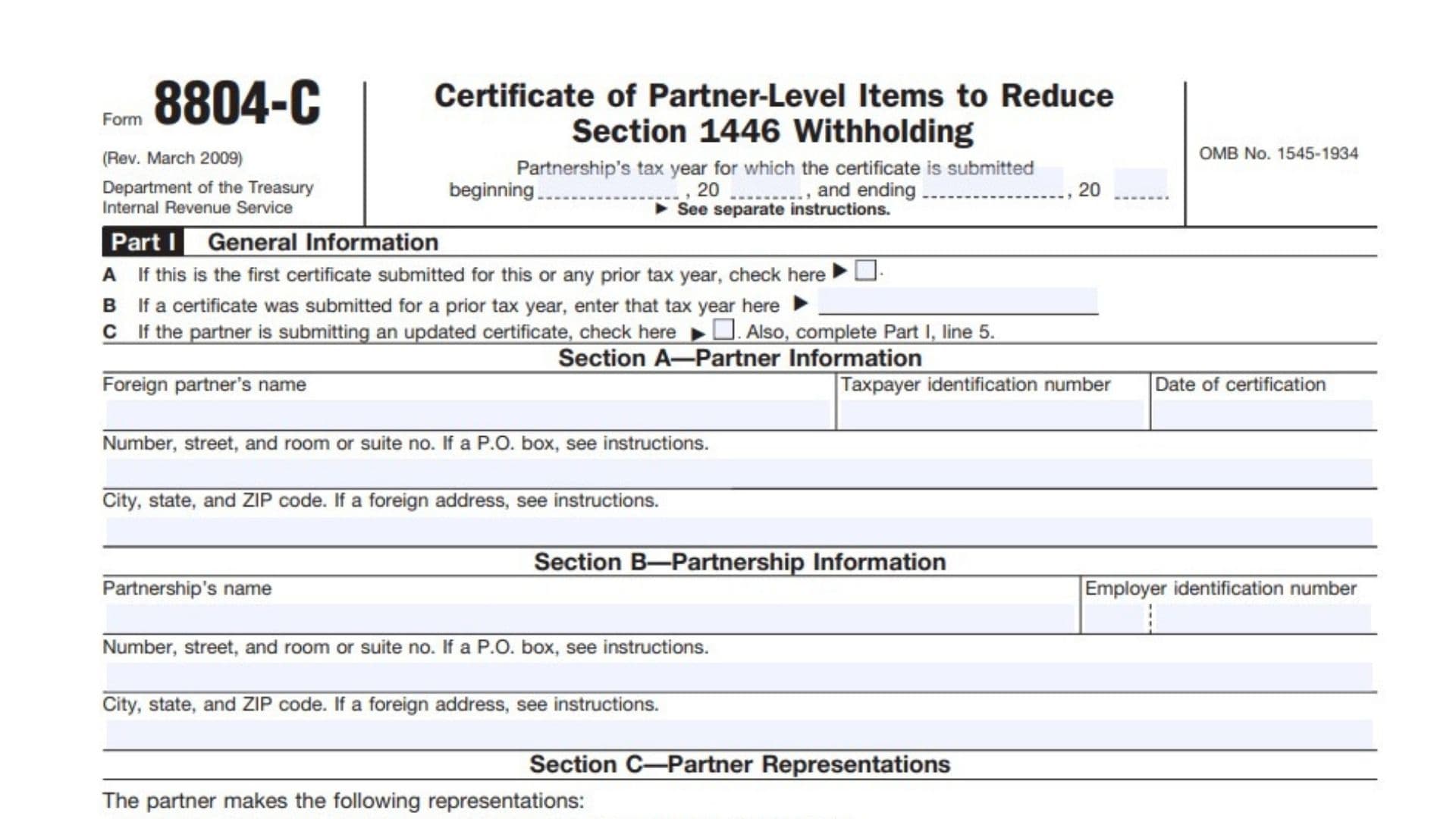

How to File Form 8804-C

Foreign partners must submit the completed Form 8804-C directly to the partnership before the due date of the partnership’s section 1446 withholding tax installment (typically the 15th day of the third, sixth, ninth, or twelfth month of the partnership’s tax year) or by the end of the partnership’s tax year, whichever is earlier, to qualify for reduced withholding. Use the most current version of the form (Rev. March 2009, as per the provided PDF) downloadable from the IRS website at irs.gov/forms-pubs/about-form-8804-c. Prepare the form in English, sign it under penalties of perjury, and provide any required attachments like statements for losses or a power of attorney if signing as a representative. Submit the original to the partnership via certified mail or electronic means if agreed upon, retaining a copy for your records. If circumstances change—such as filing a previously unfiled return or altering deduction amounts—file an updated certificate within 10 days of the change. The partnership then uses the certified items to adjust withholding on Form 8804 and reports via Form 8805 to the partner. Note that submitting this form does not replace filing your annual Form 1040-NR or making estimated payments; the IRS may verify the certificate’s validity and disclose information to the partnership. For first-time submitters, ensure all prior-year compliance representations are accurate to avoid rejection.

How to Complete Form 8804-C

Header and Top Sections

- Partnership’s tax year for which the certificate is submitted beginning, 20__, and ending, 20__: Enter the partnership’s tax year (e.g., “beginning 01/01/2025, and ending 12/31/2025”).

- A If this is the first certificate submitted for this or any prior tax year, check here □: Check the box if this is your first submission.

- B If a certificate was submitted for a prior tax year, enter that tax year here: Enter the ending year of the prior submission (e.g., “2024”).

- C If the partner is submitting an updated certificate, check here □. Also, complete Part I, line 5: Check if updating a prior certificate for this year.

Section A—Partner Information

- Taxpayer identification number: Enter your U.S. Taxpayer Identification Number (e.g., ITIN or SSN).

- Foreign partner’s name: Enter your full legal name.

- Number, street, and room or suite no. If a P.O. box, see instructions: Provide your street address or P.O. box as instructed.

- City, state, and ZIP code. If a foreign address, see instructions: Enter city, state abbreviation, and ZIP code, or format foreign address per instructions.

- Date of certification: Enter the date you sign the form (e.g., “09/15/2025”).

Section B—Partnership Information

- Employer identification number: Enter the partnership’s EIN.

- Partnership’s name: Enter the full legal name of the partnership.

- Number, street, and room or suite no. If a P.O. box, see instructions: Provide the partnership’s street address or P.O. box as instructed.

- City, state, and ZIP code. If a foreign address, see instructions: Enter city, state, and ZIP code, or format foreign address per instructions.

Section C—Partner Representations

- 4a As of the time of submission of this certificate, I had not filed the following U.S. federal income tax return: Form: Enter the form number if unfiled (e.g., “1040-NR”).

- Tax year ended: Enter the ending date of the unfiled tax year (e.g., “12/31/2024”).

- Filing due date: Enter the original due date including extensions (e.g., “04/15/2025”).

Section D—Updated Certificates

- 5 Check the applicable box(es) to indicate the reason(s) for filing an updated certificate:

- a The certificate I submitted to the partnership for this tax year listed a prior tax year U.S. federal income tax return that I had not yet filed. I have now filed this tax return and am submitting this updated certificate to inform the partnership that the return has been filed. This updated certificate must be submitted within 10 days of the return’s filing. Note: Complete Part I, line 4a and substitute the date filed for the filing due date: Check and enter the filing date in Part I, line 4a if applicable.

- b The certificate I submitted to the partnership for this tax year listed a prior tax year U.S. federal income tax return that I had not yet filed. I am submitting this updated certificate to the partnership prior to its final installment due date of 1446 tax (see instructions) to inform the partnership that such tax return remains unfiled, but will be timely filed. Also, I am hereby informing the partnership that the first certificate submitted can continue to be considered by the partnership. Note: Complete Part I, line 4a and include any extension of time in the filing due date: Check and enter the extended due date in Part I, line 4a if applicable.

- c The certificate I submitted to the partnership for this tax year listed a prior tax year U.S. federal income tax return that I had not yet filed. I am submitting this updated certificate to the partnership prior to its final installment due date of 1446 tax (see instructions) to inform the partnership that such tax return remains unfiled. Also, I am hereby informing the partnership that the first certificate submitted can no longer be considered by the partnership. Note: Complete Part I, line 4a and include any extension of time in the filing due date: Check and enter the extended due date in Part I, line 4a if applicable.

- d The amount or character of the deductions and losses listed on the most recent certificate I submitted to the partnership has changed and I am informing the partnership of those changes. This updated certificate must be submitted within 10 days of making that determination. Note: Complete all three columns of Part II, line 7: Check and complete Part II, line 7 columns (a), (b), and (c) if applicable.

- e I previously certified to the partnership that, for this tax year, my investment in the partnership was my only activity giving rise to effectively connected income, gain, loss, or deduction. I am informing the partnership that this certification is no longer accurate. Note: This updated certificate must be submitted within 10 days of this change: Check if applicable.

- f Other information on the most recent certificate I submitted is incorrect. I am providing the corrected information on this updated certificate and I am attaching a statement identifying the information being corrected: Check and attach a statement if applicable.

Part II Certifications of Deductions and Losses Under Regulations Section 1.1446-6(c)(1)(i)

- 7 The deductions and losses described in Regulations section 1.1446-6(c)(1)(i) that meet the requirements of line 7 that I reasonably expect to be available to reduce my U.S. federal income tax liability on my allocable share of effectively connected income or gain from the partnership for this tax year are:

- Net operating loss carryover: Enter amount in column (a). For updates, enter net change in (b) and total in (c).

- 8a Other ordinary deductions and losses described in Regulations section 1.1446-6(c)(1)(i) that are subject to partner level limitation or warrant special consideration. Attach a statement that indicates type, amount, and limitations: Enter amount in column (a). For updates, enter net change in (b) and total in (c).

- 8b Capital losses. Attach a statement that indicates type and amount: Enter amount in column (a). For updates, enter net change in (b) and total in (c).

- 8c Losses suspended under section 704(d) that are attributable to the partnership to which this certificate is being submitted: Enter amount in column (a). For updates, enter net change in (b) and total in (c).

- 8d Suspended passive activity losses that meet the requirements of Regulations section 1.1446-6(c)(1)(i)(D). Attach a statement identifying the partnership activity to which the loss relates: Enter amount in column (a). For updates, enter net change in (b) and total in (c).

- 8e Suspended at-risk losses that meet the requirements of Regulations section 1.1446-6(c)(1)(i)(D). Attach a statement identifying the partnership activity to which the loss relates: Enter amount in column (a). For updates, enter net change in (b) and total in (c).

- 8f Other ordinary deductions and losses described in Regulations section 1.1446-6(c)(1)(i) that are subject to partner level limitation or warrant special consideration. Attach a statement that indicates type, amount, and limitations: Enter amount in column (a). For updates, enter net change in (b) and total in (c).

Part III Certification Under Regulations Section 1.1446-6(c)(1)(ii)

- 12 If the only activity that gives rise to effectively connected income, gain, deduction, or loss during the partner’s tax year is (and will be) the partner’s investment in the partnership, check here □: Check if the partnership is your sole activity.

Part IV Disclosure Consent and Signature

- Sign Here: Signature of partner or authorized representative: Sign your name.

- If signed by an authorized representative, a copy of the power of attorney must be attached: Attach POA if applicable.

- Title: Enter your title (e.g., “Individual” or “Authorized Signer”).

- Date: Enter the signing date (e.g., “09/15/2025”).