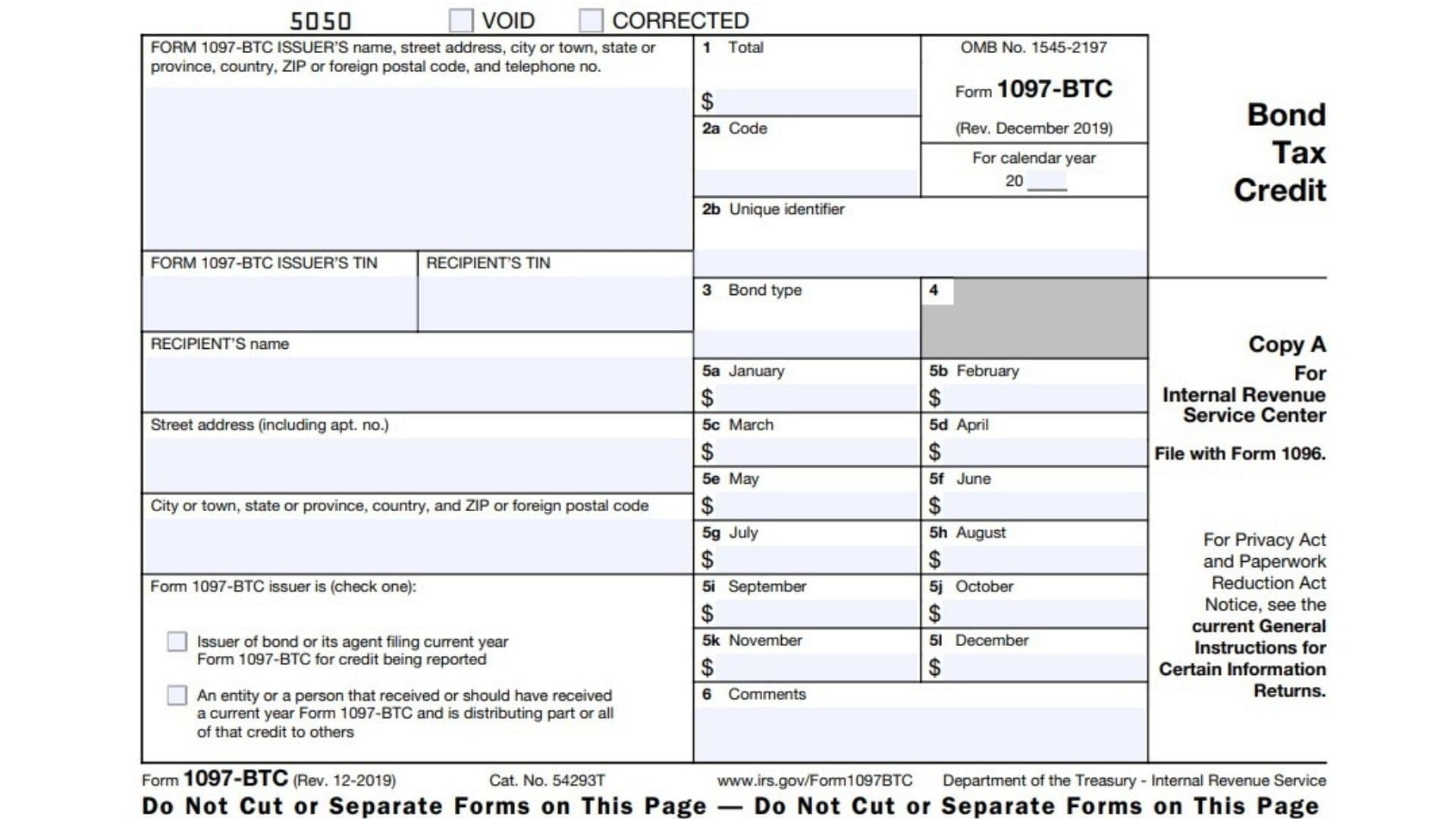

IRS Form 1097-BTC, or the Bond Tax Credit form, is used to report and distribute tax credit amounts from certain tax credit bonds, such as Clean Renewable Energy Bonds, to recipients. This form ensures that individuals or entities receiving tax credits from bond issuers report the correct amount on their tax returns. It is especially used by issuers or agents to report the allowable tax credits for each recipient during the calendar year. The information on the form is provided on a quarterly basis, with an annual aggregate total submitted for the year. The recipients, including entities like mutual funds, brokers, or partnerships, must then report these credits on their income tax returns.

How to File Form 1097-BTC?

To file IRS Form 1097-BTC, the following steps should be followed:

- Obtain Necessary Information: Collect the required details, including the credit amount, bond type, recipient information, and any additional comments or codes relevant to the bond credit being reported.

- Complete the Form:

- Box 1: Enter the total tax credits allowed for the calendar year.

- Box 2a and 2b: Enter the unique identifier for the credit, which may be the CUSIP number or account number.

- Box 3: Indicate the type of bond, such as Clean Renewable Energy Bond (Code 101).

- Boxes 5a–5l: Report the credit amount for each month of the year.

- Box 6: Include any additional comments or information provided by the issuer.

- Distribute the Form:

- Provide Copy B of the form to the recipient on or before the 15th day of the second calendar month following the close of the quarter in which the credit was allowed.

- For the fourth quarter, report the credit as part of the annual filing rather than issuing a separate report.

- File with the IRS:

- Submit Copy A of the form along with Form 1096 to the IRS.

- Ensure that the form is filed by the IRS deadline and contains accurate information.

- If you’re filing electronically, ensure you use the appropriate software to generate the required file.

- File Electronically: If filing 250 or more forms, electronic filing is required. Use IRS specifications (Pub. 1220) for e-filing.

- Provide Annual Report: For the annual filing, report the total credits from each month in boxes 5a–5l and provide the total sum in Box 1.

How to Complete Form 1097-BTC?

Here’s a breakdown of the boxes on IRS Form 1097-BTC:

- Box 1: The total amount of tax credits allowed to the recipient for the year should be entered here.

- Box 2a: This box indicates the code for the unique identifier used to track the bond. It could be a CUSIP number, account number, or another identifier:

- C: CUSIP number

- A: Account number

- O: Any other identifier

- Box 2b: Enter the unique identifier assigned to the bond transaction (e.g., CUSIP number or account number).

- Box 3: The bond type code should be reported here:

- 101: Clean Renewable Energy Bond

- 199: Other types of bonds

- Boxes 5a-5l: These boxes represent the credit amounts for each month of the calendar year. Enter the credit amount allowed for each month, from January (5a) to December (5l).

- Box 6: This box is for additional information or comments that the issuer might provide regarding the credit or bond.