Form 2210, also known as the “Underpayment of Estimated Tax by Individuals, Estates, and Trusts” form, is used by taxpayers to determine if they owe a penalty for underpaying their taxes throughout the year. The IRS requires individuals, estates, and trusts to pay taxes on their income as it is earned or received. This is typically done through withholding or estimated tax payments. If insufficient tax is paid by the deadlines, Form 2210 helps calculate any penalties owed for the shortfall. It also allows taxpayers to request a waiver of the penalty if they meet certain conditions, such as experiencing unusual circumstances or meeting the criteria for exceptions like retirement or disability.

How to Complete Form 2210?

Part I Required Annual Payment

Line 1: Enter your 1040 tax credits here.

Line 2: Enter other taxes (including self-employment tax and, if applicable, Additional Medicare Tax and/or Net Investment Income Tax).

Line 3: Enter other payments and refundable credits

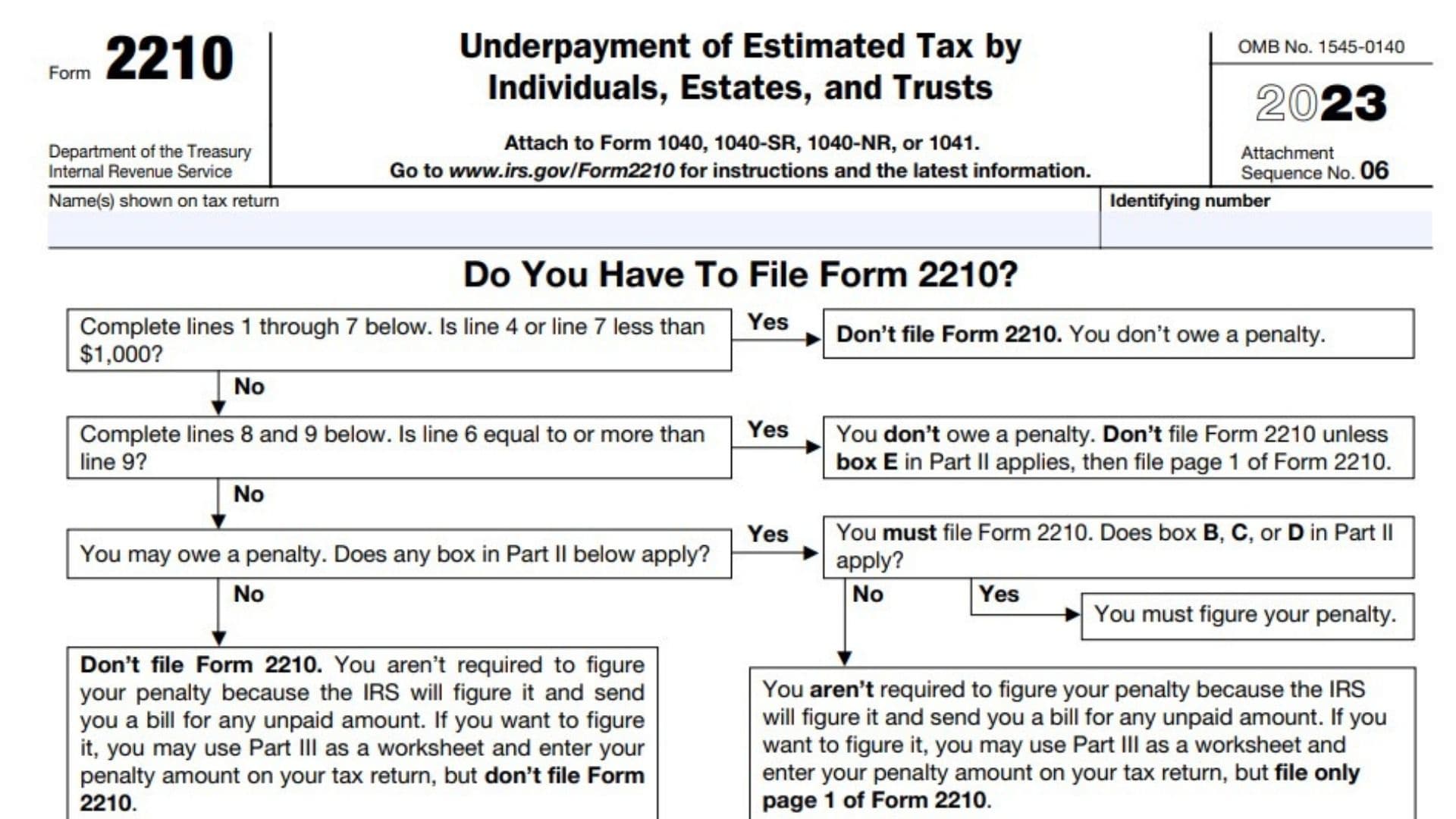

Line 4: Current year tax. Combine lines 1, 2, and 3. If less than $1,000, you can stop here because you don’t owe a penalty. So, don’t file Form 2210.

Line 5: Multiply line 4 by 90% (0.90). Enter the amount here.

Line 6: Don’t include estimated tax payments. Enter Withholding taxes.

Line 7: Subtract line 6 from line 4. If less than $1,000, stop; this means you don’t owe a penalty, so you don’t need to file Form 2210

Line 8: Maximum required annual payment based on prior year’s tax

Line 9: Enter the smaller of line 5 or line 8. This is your Required annual payment.

Is line 9 more than line 6?

- No. You don’t owe a penalty. Don’t file Form 2210 unless box E below applies.

- Yes. You may owe a penalty, but don’t file Form 2210 unless one or more boxes in Part II below applies.

• If box B, C, or D applies, you must figure your penalty and file Form 2210

• If box A or E applies (but not B, C, or D), file only page 1 of Form 2210 .You aren’t required to figure your penalty; the IRS will figure it and send you a bill for any unpaid amount.

- If you want to figure your penalty, you may use Part III as a worksheet and enter your penalty on your tax return, but file only page 1 of Form 2210.

Part II – Reasons for Filing

In this part, you are expected to check applicable boxes. If none of them applies to you, don’t file Form 2210.

Part III – Penalty Computation3

Section A—Figure Your Underpayment

Line 10: If box C in Part II applies to you, enter the amounts from Schedule AI, line 27. Otherwise, enter 25% (0.25) of line 9, Form 2210, in each column. This is the Required installments amount.

Line 11: Estimated tax paid and tax withheld.

- Enter the amount from line 11 on line 15, column (a)

- If line 11 is equal to or more than line 10 for all payment periods, stop here; you don’t owe a penalty.

- Don’t file Form 2210 unless you checked a box in Part II.

IRS warning: Complete lines 12 through 18 of one column before going to line 12 of the next column.

Line 12: Enter the amount, if any, from line 18 in the previous column

Line 13: Add lines 11 and 12

Line 14: Add the amounts on lines 16 and 17 in the previous column

Line 15: Subtract line 14 from line 13.

- If zero or less, enter -0-. For column (a) only, enter the amount from line 11.

Line 16: If line 15 is zero, subtract line 13 from line 14. Otherwise, enter -0

Line 17: Underpayment

- If line 10 is equal to or more than line 15, subtract line 15 from line 10

- Then, go to line 12 of the next column. Otherwise, go to line 18

Line 18: Overpayment

- If line 15 is more than line 10, subtract line 10 from line 15

- Then go to line 12 of the next column.

Section B—Figure the Penalty

Line 19: