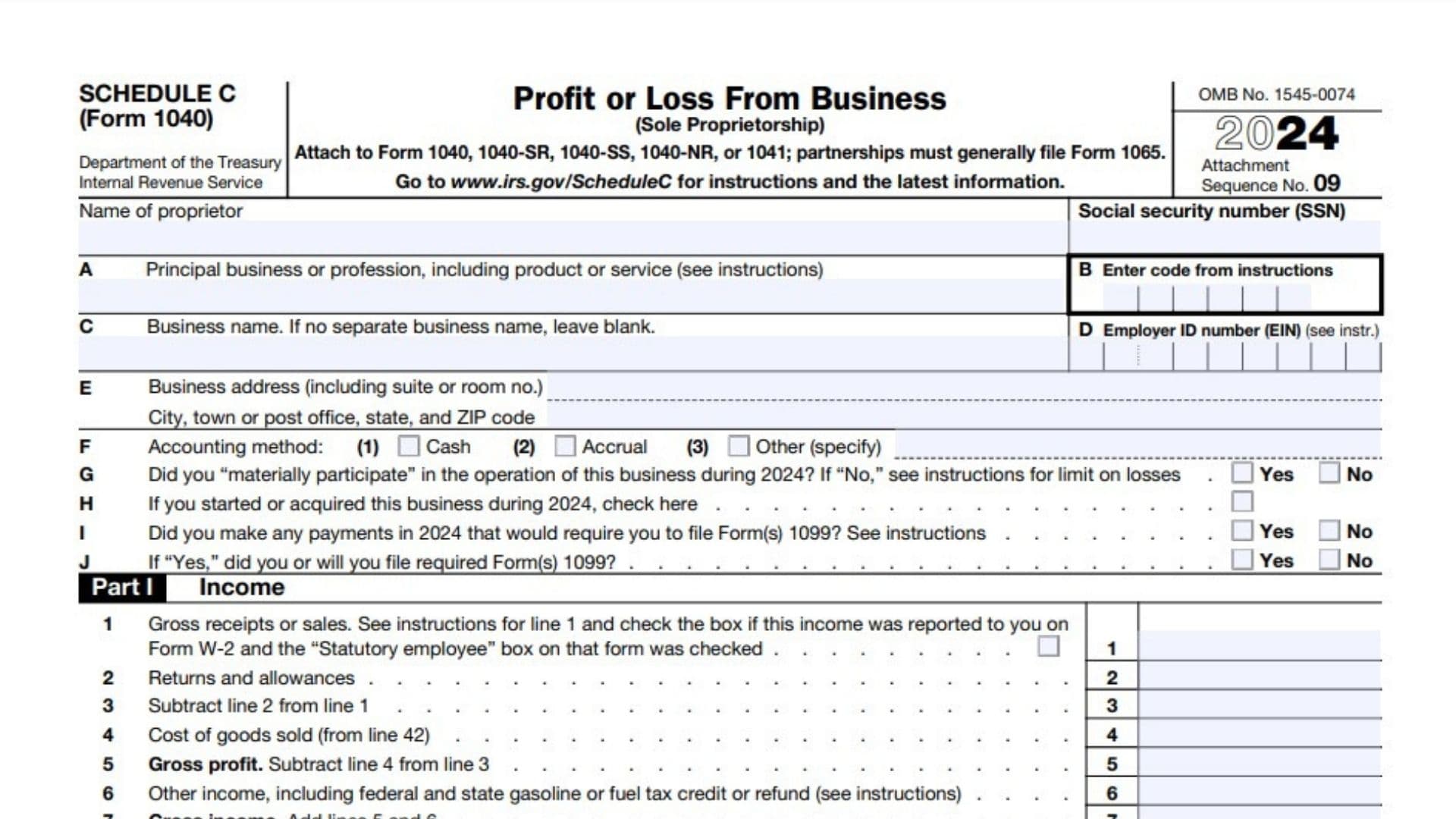

IRS Schedule C, also known as “Profit or Loss from Business,” is a tax form used to report the income, expenses, and overall profitability of a sole proprietorship or single-member LLC. It is filed alongside Form 1040. This form is vital for small business owners and self-employed individuals to calculate their taxable income. It requires detailed information about gross receipts, operating expenses, cost of goods sold, and any other income or deductions. Completing it accurately ensures compliance with tax regulations and minimizes the risk of audits.

How to File IRS Schedule C (Form 1040)?

- Download the Form: Obtain the latest version of Schedule C from the IRS website.

- Gather Business Records: Collect financial statements, receipts, and records for the tax year.

- Understand Your Accounting Method: Use cash or accrual accounting to report income and expenses.

- File Alongside Form 1040: Attach Schedule C to your personal income tax return and submit it by the deadline (typically April 15).

How to Complete Schedule C (Form 1040)?

Part I: Income

- Gross Receipts or Sales: Report total income received during the year. Check the box if reported on Form W-2 as a statutory employee.

- Returns and Allowances: Subtract returns or allowances from gross receipts.

- Total Income: Subtract line 2 from line 1.

- Cost of Goods Sold: Enter the amount from Part III (line 42).

- Gross Profit: Subtract line 4 from line 3.

- Other Income: Include federal/state tax credits or refunds and other business income.

- Gross Income: Add lines 5 and 6.

Part II: Expenses

- Advertising: Enter costs for promoting your business.

- Car and Truck Expenses: Calculate using mileage or actual costs (see instructions).

- Commissions and Fees: Report any commissions paid.

- Contract Labor: Include payments to freelancers or contractors.

- Depletion: Applicable for resource-related industries.

- Depreciation: Report asset depreciation (see Part III for details).

- Employee Benefit Programs: List benefits like health insurance (excluding line 19 items).

- Insurance: Report non-health insurance premiums.

- Interest:

- (a) Mortgage interest.

- (b) Other interest.

- Legal and Professional Services: Include costs for attorneys, accountants, etc.

- Office Expenses: Supplies and small equipment.

- Pension and Profit-Sharing Plans: Contributions for employees.

- Rent or Lease:

- (a) Vehicles, machinery, and equipment.

- (b) Other property (e.g., office space).

- Repairs and Maintenance: Costs to maintain business property.

- Supplies: Include items not part of inventory.

- Taxes and Licenses: Business taxes, permits, and licenses.

- Travel and Meals:

- (a) Travel costs.

- (b) Meals (50% deductible).

- Utilities: Include electricity, internet, phone, etc.

- Wages: Salaries paid to employees (less tax credits).

- Other Expenses:

- (a) From line 48 (Part V).

- (b) Energy-efficient commercial building deductions (Form 7205).

- Total Expenses: Add lines 8 through 27b.

- Tentative Profit or Loss: Subtract line 28 from line 7.

- Home Office Expenses: Use Form 8829 or the simplified method.

- Net Profit or Loss: Subtract line 30 from line 29.

- If your business has a loss, select one of the following:

- 32a: Check this box if all investment is at risk. Enter the loss on Schedule 1 (Form 1040), line 3, and Schedule SE, line 2. For estates and trusts, use Form 1041, line 3.

- 32b: Check this box if some investment is not at risk. Attach Form 6198, as your loss may be limited.

Part III: Cost of Goods Sold

- Inventory Valuation Method: Indicate cost, market, or other method.

- Inventory Changes: Attach explanation for changes in valuation.

- Beginning Inventory: Enter inventory at the start of the year.

- Purchases: Subtract personal use items.

- Labor Costs: Exclude payments to yourself.

- Materials and Supplies: Include direct materials.

- Other Costs: Additional costs related to goods sold.

- Total Costs: Add lines 34 through 38.

- Ending Inventory: Subtract line 41 from line 39.

- Cost of Goods Sold: Enter the total here and on line 4.

Part IV: Information on Your Vehicle

- Vehicle Placement Date: Indicate when the vehicle was used for business.

- Business Miles: Enter miles driven for business purposes.

- Personal Vehicle Use: Answer yes/no for personal vehicle availability.

- Evidence of Use: Indicate whether written records are available.

Part V: Other Expenses

- List Other Business Expenses: Include any items not listed above.

- Total Other Expenses: Add and transfer to line 27a.