State Tax Forms

These forms are issued by state governments to report state income, property, and sales taxes. Taxpayers file them in addition to federal returns, following state-specific rules. Examples include state income and sales tax returns.

-

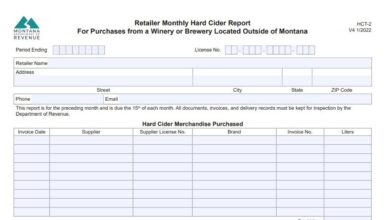

Montana Form HCT-2

Montana Form HCT-2 is the Retailer Monthly Hard Cider Report for businesses purchasing hard cider from a winery or brewery…

-

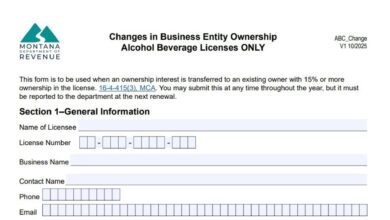

Montana Changes in Business Entity Ownership Form

The Montana “Changes in Business Entity Ownership” form is used by businesses with alcohol beverage licenses to report changes in…

-

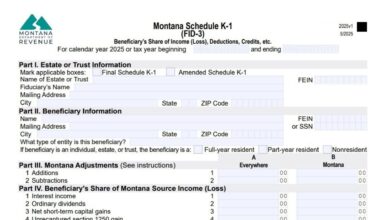

Montana Schedule K-1 (FID-3)

Montana Schedule K-1 (FID-3) reports the portion of income, deductions, credits, and tax adjustments that each beneficiary receives from an…

-

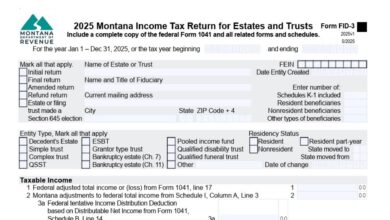

Montana Form FID-3

The Montana Form FID-3 is used by estates and trusts to report their Montana taxable income, calculate Montana income tax…

-

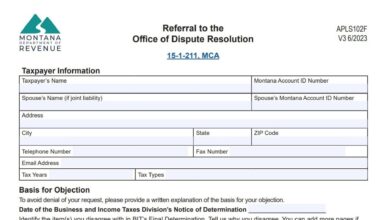

Montana Referral To The Office Of Dispute Resolution Form (APLS102F)

The Montana Referral to the Office of Dispute Resolution Form (APLS102F) is used by taxpayers to appeal a final tax…

-

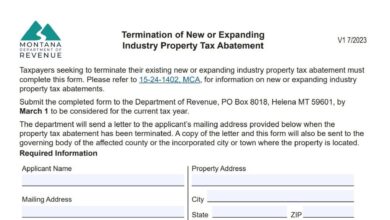

Montana Termination Of New Or Expanding Industry Property Tax Abatement Form

The Montana Termination of New or Expanding Industry Property Tax Abatement Form is used by taxpayers who want to officially…

-

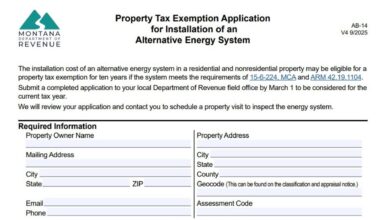

Montana Form AB-14

Montana Form AB-14 is a Property Tax Exemption Application for the installation of an alternative energy system. This application allows…

-

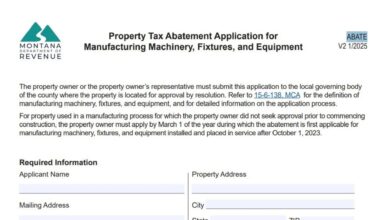

Montana Form ABATE

Montana Form ABATE is an application used to request a property tax abatement for manufacturing machinery, fixtures, and equipment. This…

-

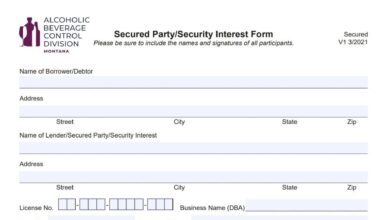

Montana Secured Party/Security Interest Form

The Montana Secured Party/Security Interest Form is used to establish or terminate a secured party or security interest in a…

-

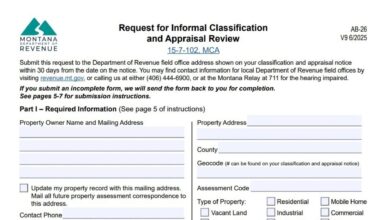

Montana Form AB-26

Montana Form AB-26 enables property owners to challenge their property’s classification or appraised value through the Department of Revenue’s informal…