Self-Employed and Freelancers Tax Forms

This category focuses on forms for independent contractors and the self-employed. These forms help report income, claim business expenses, and pay self-employment taxes. Common forms include Schedule C, 1099-NEC, and Schedule SE.

-

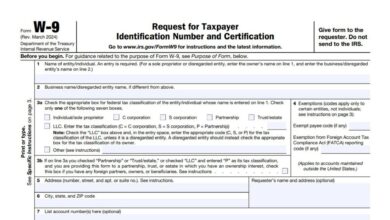

Form W-9

W-9 Form, also known as the Request for Taxpayer Identification Number and Certification, is a tax document used in the…

-

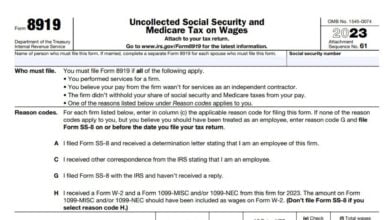

Form 8919

Form 8919 calculates how much of a worker’s wages are due to the government in the form of unpaid social security…

-

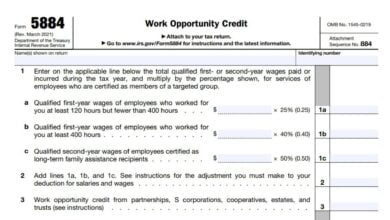

Form 5884

The purpose of Form 5884 is to calculate and claim the Work Opportunity Credit. This credit allows employers to reduce their…