IRS Schedule SE (Form 1040) is used by self-employed individuals, freelancers, and independent contractors to calculate and report Social Security and Medicare taxes (collectively called self-employment tax). If your net earnings from self-employment are $400 or more, you must file this form. The tax covers contributions to Social Security (12.4%) and Medicare (2.9%), with income thresholds applying to Social Security taxes ($168,600 for 2024). Schedule SE also includes optional methods for calculating net earnings for farmers and nonfarm self-employed individuals with low income, allowing them to qualify for Social Security credits.

How to File Schedule SE (Form 1040)?

- Attach to Form 1040: File Schedule SE with your annual federal tax return (Form 1040, 1040-SR, or 1040-NR).

- Deadline: Submit by April 15, 2025, or the deadline of your filing extension.

- Who Must File:

- Self-employed individuals with net earnings of $400+ (or church employee income of $108.28+).

- Ministers, religious workers, and others with exempt income but additional self-employment earnings.

How to Complete Schedule SE (Form 1040)?

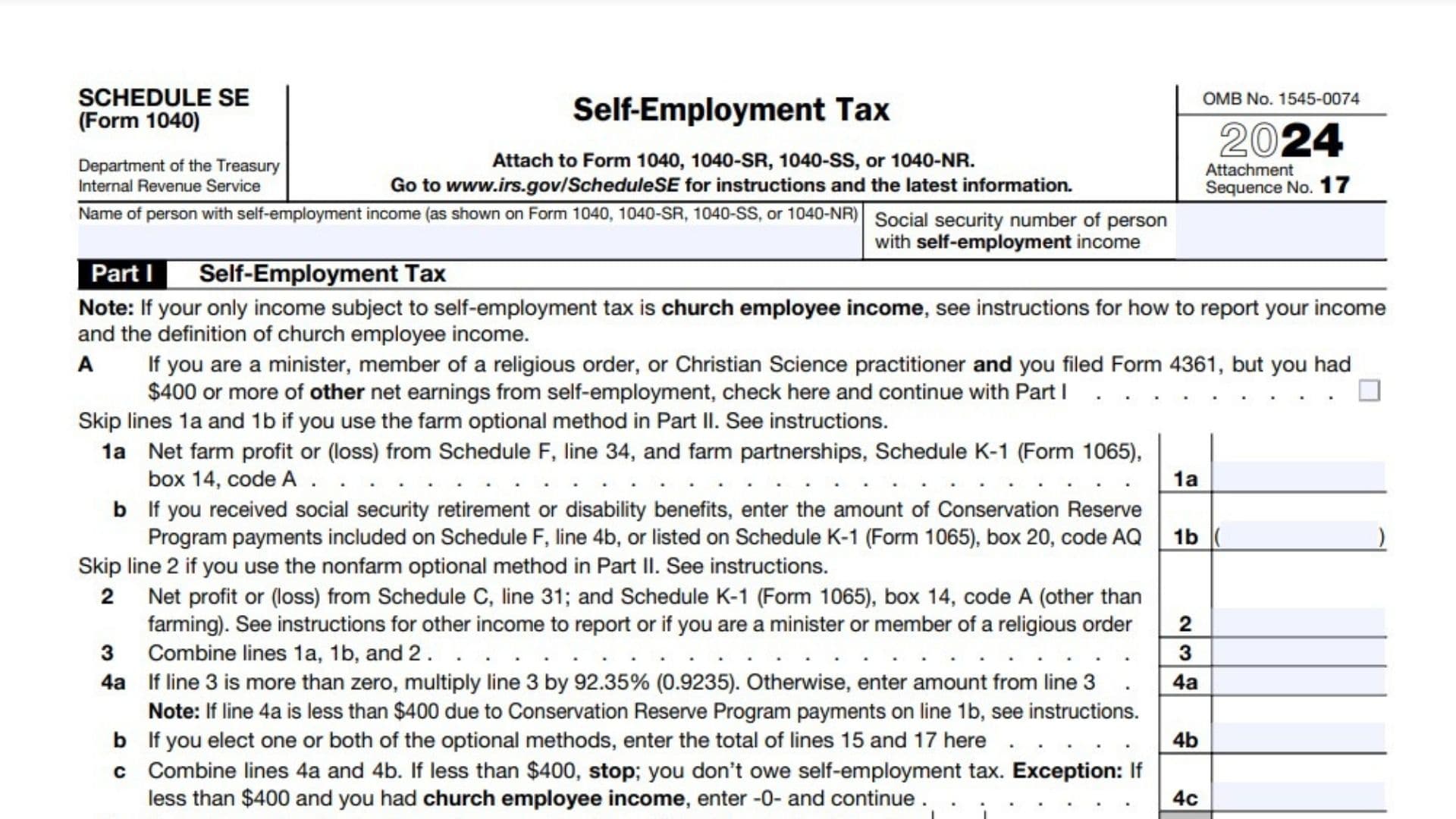

Part I: Self-Employment Tax

Line A: Check if you’re a minister/religious worker who filed Form 4361 but have $400+ in other self-employment income.

Lines 1a–1b (Farmers):

- 1a: Enter net farm profit/loss from Schedule F (line 34) or farm partnerships (Schedule K-1, box 14, code A).

- 1b: If you received Social Security benefits, enter Conservation Reserve Program payments from Schedule F (line 4b) or Schedule K-1 (box 20, code AQ).

Line 2: Enter net nonfarm profit/loss from Schedule C (line 31) or partnerships (Schedule K-1, box 14, code A).

Line 3: Add lines 1a, 1b, and 2.

Line 4a: Multiply line 3 by 92.35% (0.9235). If under $400 due to line 1b, see instructions.

Line 4b: Enter amounts from optional methods (lines 15 and 17 in Part II).

Line 4c: Combine lines 4a and 4b. If below $400 (excluding church income), stop here.

Line 5a: Enter church employee income from Form W-2.

Line 5b: Multiply line 5a by 92.35% (0.9235). Enter $0 if under $100.

Line 6: Add lines 4c and 5b.

Line 7: Enter $168,600 (2024 Social Security wage base).

Lines 8a–8d (Social Security Wages):

- 8a: Total wages/tips from Form W-2 (boxes 3 + 7).

- 8b: Unreported tips from Form 4137 (line 10).

- 8c: Wages from Form 8919 (line 10).

- 8d: Sum lines 8a–8c.

Line 9: Subtract line 8d from line 7. If $0 or less, enter $0.

Line 10: Multiply the smaller of line 6 or 9 by 12.4% (Social Security tax).

Line 11: Multiply line 6 by 2.9% (Medicare tax).

Line 12: Add lines 10 and 11. Enter here and on Schedule 2 (Form 1040), line 4.

Line 13: Deduct half of self-employment tax by multiplying line 12 by 50%. Report on Schedule 1 (Form 1040), line 15.

Part II: Optional Methods to Figure Net Earnings

Farm Optional Method (Lines 14–15):

- Eligibility: Gross farm income ≤ $10,380 or net farm profit < $7,493.

- Line 14: Enter $6,920 (maximum optional income).

- Line 15: Enter the smaller of 2/3 of gross farm income or $6,920. Include on line 4b.

Nonfarm Optional Method (Lines 16–17):

- Eligibility: Net nonfarm profit < $7,493 and < 72.189% of gross nonfarm income.

- Line 16: Subtract line 15 from line 14.

- Line 17: Enter the smaller of 2/3 of gross nonfarm income or line 16. Include on line 4b.