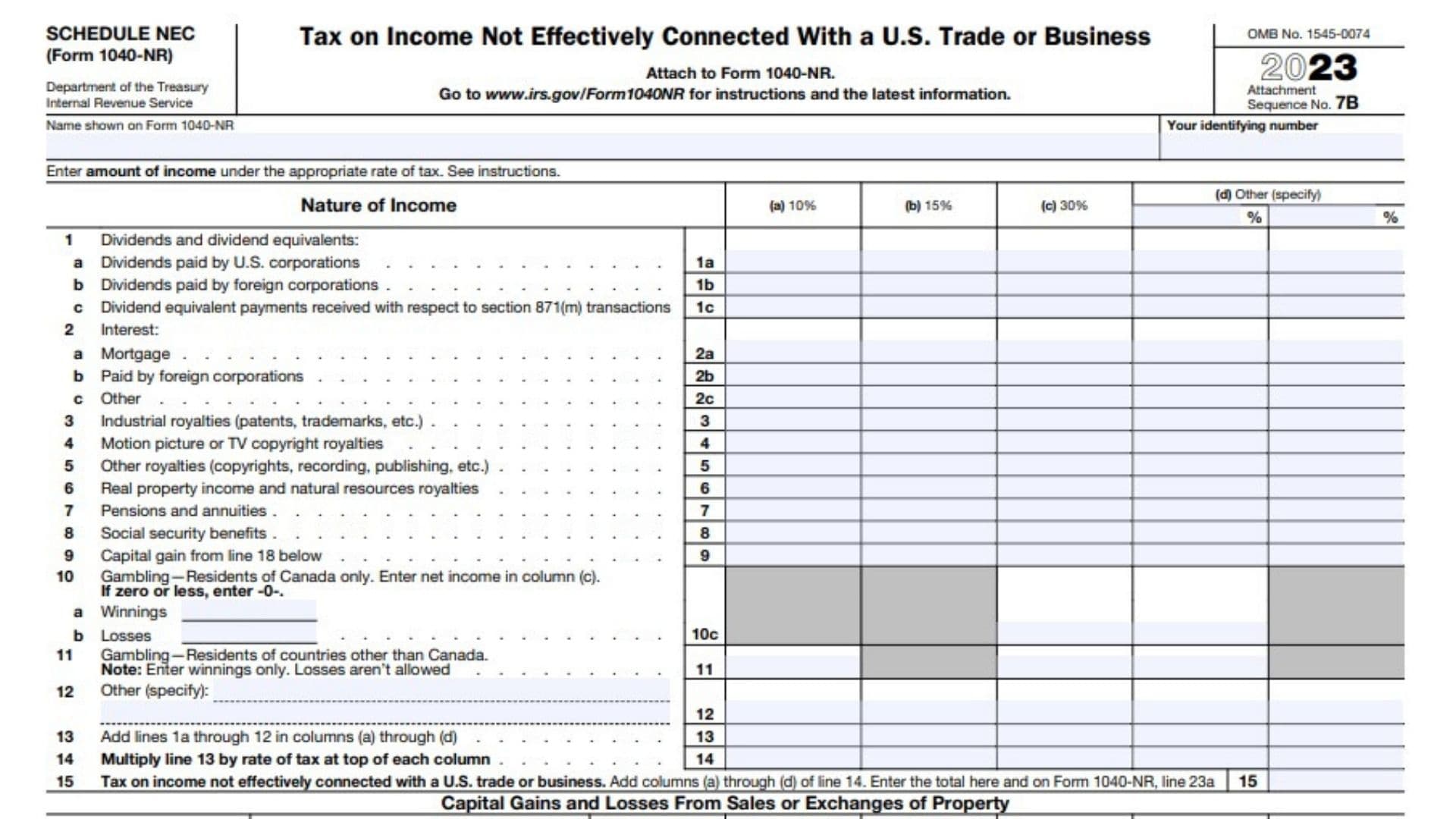

Schedule NEC (Form 1040-NR) is a form used by nonresident aliens to report income that is not effectively connected with a U.S. trade or business. This schedule is attached to Form 1040-NR and is used to calculate the tax on various types of U.S. source income, such as interest, dividends, royalties, and other fixed or determinable annual or periodical income, which are typically subject to withholding at the source.

How to File Schedule NEC (Form 1040-NR)?

To file Schedule NEC (Form 1040-NR), follow these steps:

- Determine if you need to file Schedule NEC. You should file this schedule if you are a nonresident alien with income not effectively connected with a U.S. trade or business.

- Gather all necessary documentation related to your U.S. source income, such as Forms 1042-S, dividend statements, and interest income reports.

- Complete Form 1040-NR first, as some information from this form will be needed for Schedule NEC.

- Fill out Schedule NEC line by line, reporting your income in the appropriate categories and tax rate columns.

How to Complete Schedule NEC (Form 1040-NR)?

Line-by-line instructions for Schedule NEC (Form 1040-NR):

- Enter the amount of dividends paid by U.S. corporations subject to a 30% tax rate.

- Enter the amount of dividends paid by U.S. corporations subject to a 15% tax rate.

- Enter the amount of dividends paid by U.S. corporations subject to a 10% tax rate.

- Enter the amount of dividends paid by U.S. corporations subject to a 5% tax rate.

- Enter the amount of interest income subject to a 30% tax rate.

- Enter the amount of interest income subject to a 10% tax rate.

- Enter the amount of interest income subject to a 0% tax rate.

- Enter the amount of gross rental income subject to a 30% tax rate.

- Enter the amount of royalties subject to a 30% tax rate.

- Enter the amount of royalties subject to a 15% tax rate.

- Enter the amount of royalties subject to a 10% tax rate.

- Enter the amount of royalties subject to a 5% tax rate.

- Enter any other income subject to a 30% tax rate.

- For each column (a) through (d), multiply the amount on the corresponding line by the tax rate shown at the top of the column. Enter the result in the respective column.

- Add the amounts in columns (a) through (d) of line 14. Enter the total here and on Form 1040-NR, line 23a.

- 16-18. These lines are for reporting capital gains and losses from sales or exchanges of property. Enter the appropriate information as instructed on the form.