IRS Schedule J (Form 1040), titled “Income Averaging for Individuals With Income from Farming or Fishing,” is a tax form designed to help eligible farmers and fishers lower their tax liability by averaging their current year’s income over the past three years. This provision is especially valuable for individuals in these professions because their incomes often fluctuate dramatically from year to year due to market conditions or natural factors.

Rather than paying taxes on a large income spike all at once, Schedule J allows taxpayers to treat a portion of their current year’s income as if it had been earned in each of the prior three years. This method can lead to a significantly reduced tax rate, helping those in agricultural and fishing industries to maintain financial stability.

To be eligible, you must have elected farm income, and the process involves calculating what your tax would have been in previous years if you had earned part of your current income back then. The final tax is then the difference between those calculated amounts and your actual liability.

How to File Schedule J (Form 1040)?

- Who Should File?

- Where to File?

- Submit Schedule J along with your federal income tax return.

- When to File?

- Typically by April 15th, unless an extension has been filed.

How to Complete Schedule J (Form 1040)?

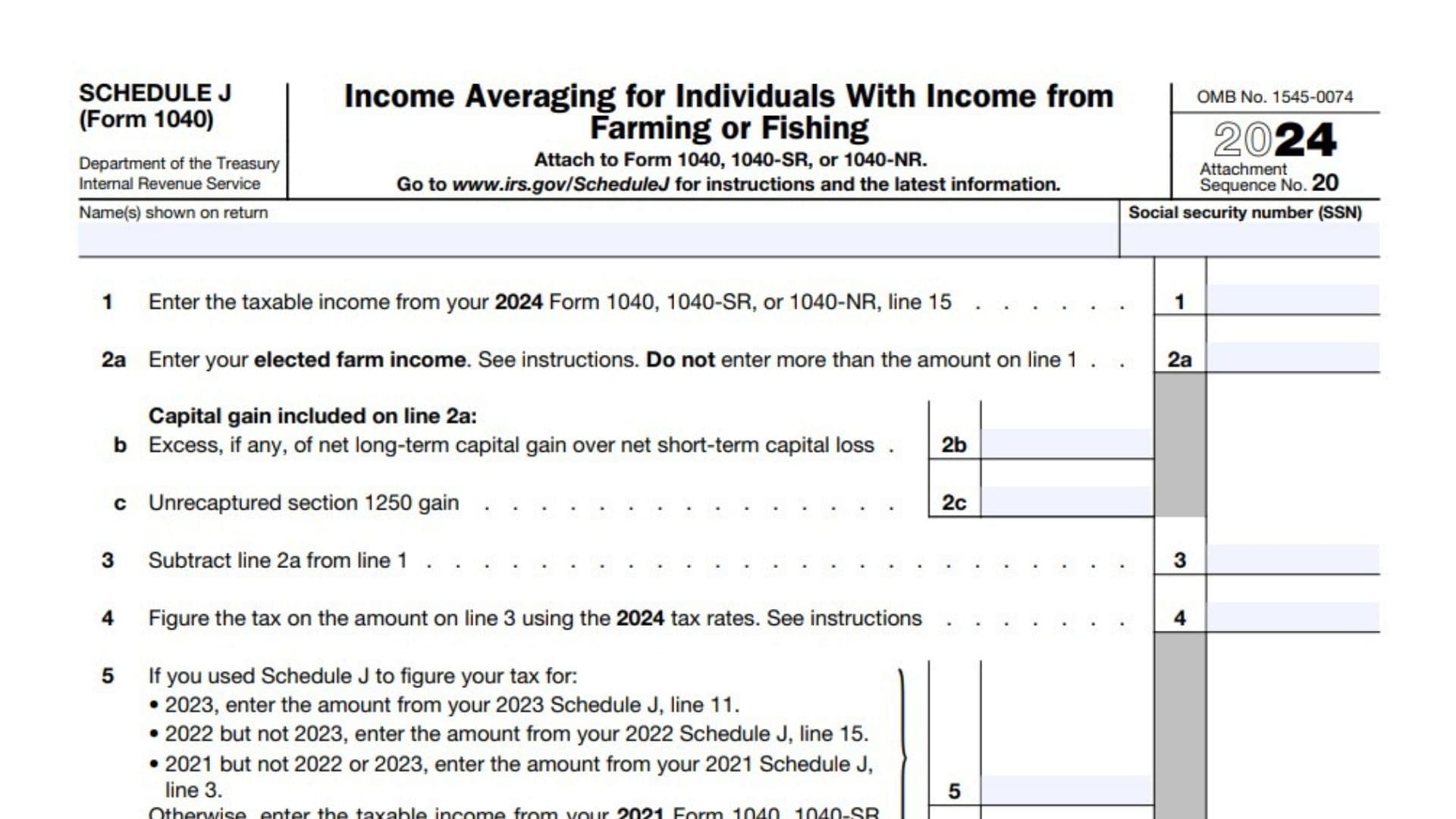

- Line 1 – Enter the taxable income from your 2024 Form 1040, 1040-SR, or 1040-NR, line 15.

- Line 2a – Enter your elected farm income (not more than the amount on line 1).

- Line 2b – Enter the excess of net long-term capital gain over net short-term capital loss included in line 2a.

- Line 2c – Enter any unrecaptured section 1250 gain included in line 2a.

- Line 3 – Subtract line 2a from line 1.

- Line 4 – Figure the tax on the amount on line 3 using the 2024 tax rates.

- Line 5 – Enter prior year taxable income:

- 2023: Schedule J, line 11

- 2022 but not 2023: Schedule J, line 15

- 2021 but not 2022 or 2023: Schedule J, line 3

- Otherwise: 2021 Form 1040 line 15

- Line 6 – Divide the amount on line 2a by 3.

- Line 7 – Add lines 5 and 6. If zero or less, enter -0-.

- Line 8 – Figure the tax on line 7 using 2021 tax rates.

- Line 9 – Enter prior year taxable income:

- 2023: Schedule J, line 15

- 2022 but not 2023: Schedule J, line 3

- Otherwise: 2022 Form 1040 line 15

- Line 10 – Re-enter the amount from line 6.

- Line 11 – Add lines 9 and 10. If negative, enter as a negative amount.

- Line 12 – Figure the tax on line 11 using 2022 tax rates.

- Line 13 – Enter prior year taxable income:

- 2023: Schedule J, line 3

- Otherwise: 2023 Form 1040 line 15

- Line 14 – Re-enter the amount from line 6.

- Line 15 – Add lines 13 and 14. If less than zero, enter as a negative amount.

- Line 16 – Figure the tax on line 15 using 2023 tax rates.

- Line 17 – Add lines 4, 8, 12, and 16.

- Line 18 – Enter the amount from line 17.

- Line 19 – Enter prior year tax:

- 2023: Schedule J, line 12

- 2022 but not 2023: Schedule J, line 16

- 2021 but not 2022 or 2023: Schedule J, line 4

- Otherwise: 2021 Form 1040 line 16

- Line 20 – Enter prior year tax:

- 2023: Schedule J, line 16

- 2022 but not 2023: Schedule J, line 4

- Otherwise: 2022 Form 1040 line 16

- Line 21 – Enter prior year tax:

- 2023: Schedule J, line 4

- Otherwise: 2023 Form 1040 line 16

- Only include tax imposed by IRC section 1

- Line 22 – Add lines 19 through 21.

- Line 23 – Subtract line 22 from line 18.

→ Also enter this amount on your 2024 Form 1040, 1040-SR, or 1040-NR, line 16.

⚠️ Caution:

Your tax might be lower if you use:

- 2024 Tax Table

- Tax Computation Worksheet

- Qualified Dividends & Capital Gain Tax Worksheet

- Schedule D Tax Worksheet

📌 Attach Schedule J ONLY if you are using it to calculate your tax.