Schedule F (Form 1040) is used by farmers to report their income and expenses related to farming activities. This form allows farmers to calculate the net profit or loss from their farming operations, including income from the sale of livestock, crops, and other agricultural products. It also allows farmers to claim various deductions for farm-related expenses, such as machinery costs, labor, feed, and insurance. The form plays a crucial role in determining the tax liability for farmers by subtracting allowable expenses from gross income to determine net profit or loss, which is then reported on the farmer’s personal tax return. If the farmer experiences a loss, the form provides options for reporting the loss based on the investment risk in the farming activity.

How to Complete Schedule F (Form 1040)?

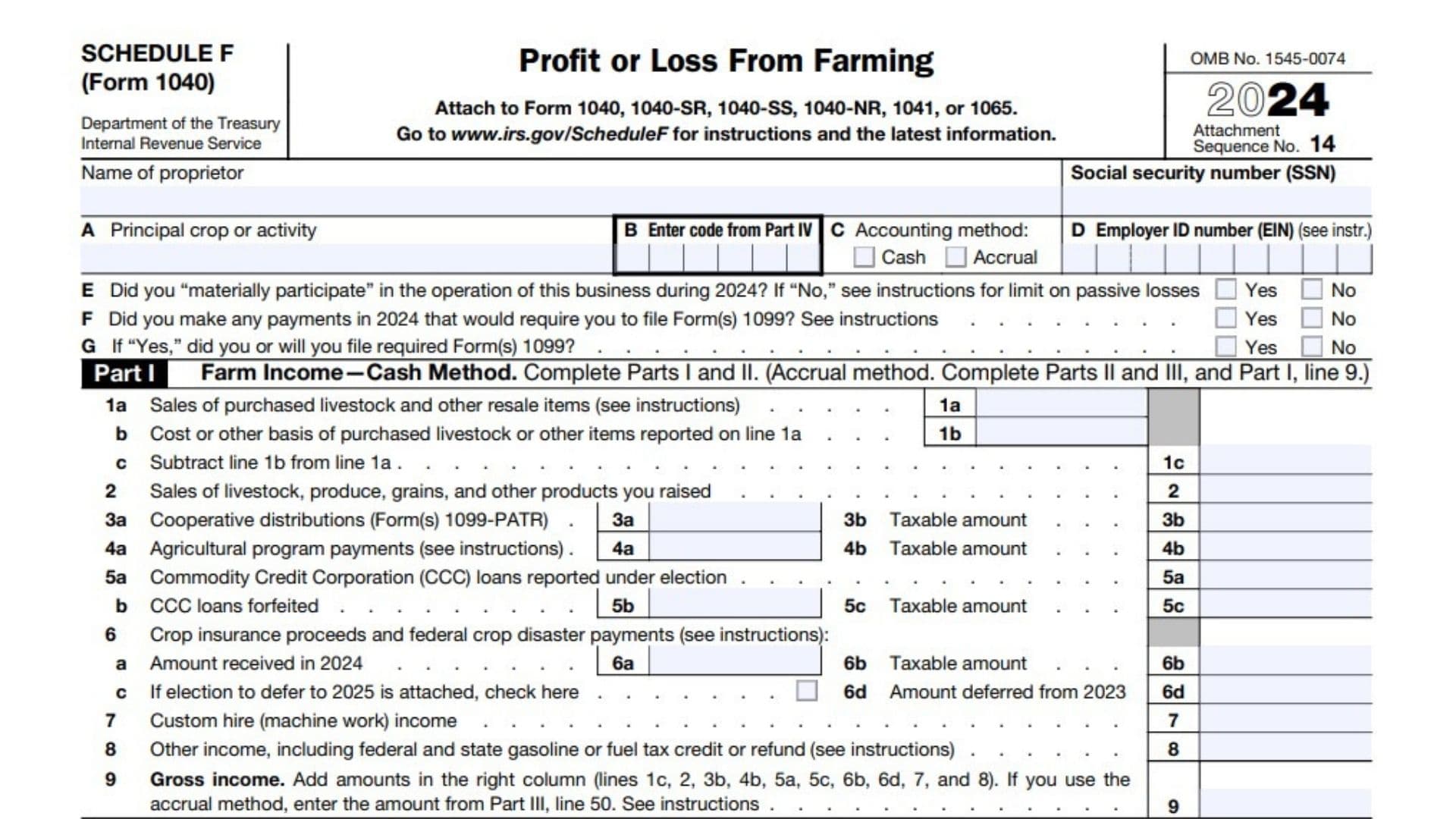

Part I – Farm Income—Cash Method

- Line 1a – Sales of purchased livestock and other resale items (see the IRS instructions):

- Report income from the sale of livestock and other resale items purchased for resale purposes.

- Line 1b – Cost or other basis of purchased livestock or other items reported on line 1a:

- Report the cost or other basis of the purchased livestock or items sold on line 1a.

- Line 1c – Subtract line 1b from line 1a:

- Subtract the cost or basis (line 1b) from the sales price (line 1a) to calculate the profit on the sale.

- Line 2 – Sales of livestock, produce, grains, and other products you raised:

- Report income from the sale of livestock, produce, grains, and other products that you raised, including farm products you grew or bred.

- Line 3a – Cooperative distributions (Form(s) 1099-PATR):

- Report any cooperative distributions received during the year, using Form 1099-PATR for details.

- Line 3b – Taxable amount:

- Report the taxable portion of the cooperative distributions received on line 3b.

- Line 4a – Agricultural program payments (see the IRS instructions):

- Report income from agricultural program payments received from the government or other organizations.

- Line 4b – Taxable amount:

- Report the taxable portion of agricultural program payments received.

- Line 5a – Commodity Credit Corporation (CCC) loans reported under election:

- Report income from CCC loans that were reported under election for income reporting.

- Line 5b – CCC loans forfeited:

- Report income from CCC loans that were forfeited during the year.

- Line 5c – Taxable amount:

- Report the taxable portion of the CCC loans that were forfeited.

- Line 6a – Crop insurance proceeds and federal crop disaster payments (see the IRS instructions):

- Report crop insurance proceeds and federal crop disaster payments received during the year.

- Line 6b – Taxable amount:

- Report the taxable portion of crop insurance proceeds and federal crop disaster payments.

- Line 6c – If election to defer to 2025 is attached, check here:

- If you are electing to defer reporting the crop insurance proceeds to 2025, check this box.

- Line 6d – Amount deferred from 2023:

- Report the amount of crop insurance proceeds deferred from the prior year (2023).

- Line 7 – Custom hire (machine work) income:

- Report income received for custom hire or machine work performed during the year.

- Line 8 – Other income, including federal and state gasoline or fuel tax credit or refund (see the IRS instructions):

- Report any other farm income not previously listed, including any fuel tax credit or refund received.

- Line 9 – Gross income:

- Add all income amounts from lines 1c, 2, 3b, 4b, 5a, 5c, 6b, 6d, 7, and 8. This is the total gross income for the farming operation. If using the accrual method, report the amount from Part III, line 50.

Part II – Farm Expenses—Cash and Accrual Method

- Line 10 – Car and truck expenses (see the IRS instructions). Also attach Form 4562:

- Report expenses for vehicles used in the farming operation. If claiming depreciation or Section 179 deduction for vehicles, attach Form 4562.

- Line 11 – Chemicals:

- Report expenses for chemicals used in farming, including pesticides, herbicides, and fertilizers.

- Line 12 – Conservation expenses (see the IRS instructions):

- Report expenses for conservation practices, such as soil and water conservation, on the farm.

- Line 13 – Custom hire (machine work):

- Report expenses for custom hire or machine work done on the farm.

- Line 14 – Depreciation and section 179 expense (see the IRS instructions):

- Report depreciation expenses for farm assets and Section 179 deductions for qualifying property used in farming. Attach Form 4562 if claiming depreciation.

- Line 15 – Employee benefit programs other than on line 23:

- Report expenses related to employee benefits, excluding pension plans and profit-sharing plans (which are reported on line 23).

- Line 16 – Feed:

- Report expenses for feed purchased for farm animals.

- Line 17 – Fertilizers and lime:

- Report expenses for fertilizers, lime, and other soil amendments used in farming.

- Line 18 – Freight and trucking:

- Report expenses for transporting farm products or materials, including freight and trucking costs.

- Line 19 – Gasoline, fuel, and oil:

- Report expenses for gasoline, fuel, and oil used in the farming operation.

- Line 20 – Insurance (other than health):

- Report premiums paid for insurance, including property, liability, and crop insurance, excluding health insurance.

- Line 21a – Interest (mortgage paid to banks, etc.):

- Report mortgage interest paid on farm property and land used in farming operations.

- Line 21b – Interest (other):

- Report interest paid on loans or credit not related to the mortgage, such as equipment or operating loans.

- Line 22 – Labor hired (less employment credits):

- Report wages and salaries paid to employees, excluding employment credits.

- Line 23 – Pension and profit-sharing plans:

- Report contributions to employee pension and profit-sharing plans related to the farming business.

- Line 24a – Rent or lease (vehicles, machinery, equipment):

- Report rental expenses for vehicles, machinery, and equipment used in farming.

- Line 24b – Rent or lease (other, land, animals, etc.):

- Report rental expenses for land, animals, or other non-equipment property used in farming.

- Line 25 – Repairs and maintenance:

- Report expenses for repairs and maintenance to farm equipment, machinery, buildings, and infrastructure.

- Line 26 – Seeds and plants:

- Report expenses for purchasing seeds, plants, and trees used in farming.

- Line 27 – Storage and warehousing:

- Report expenses for storing farm products, including warehousing and facility costs.

- Line 28 – Supplies:

- Report expenses for farming supplies such as tools, safety equipment, and small items.

- Line 29 – Taxes:

- Report taxes related to the farm business, including property taxes, sales taxes, and payroll taxes.

- Line 30 – Utilities:

- Report expenses for utilities, such as electricity, water, and telephone, used for the farm business.

- Line 31 – Veterinary, breeding, and medicine:

- Report expenses for veterinary services, animal breeding, and medical care for farm animals.

- Line 32 – Other expenses (specify):

- Report any other farm-related expenses not previously listed. Provide a description of the expenses in the space provided.

- Line 33 – Total expenses:

- Add up all the expenses from lines 10 through 32f. This is the total farming expense for the year.

- Line 34 – Net farm profit or (loss):

- Subtract the total expenses (line 33) from the gross income (line 9) to calculate the net farm profit or loss.

- Line 35 – Reserved for future use:

- This line is currently reserved and not used for reporting.

- Line 36 – Check the box that describes your investment in this activity and see the IRS instructions for where to report your loss:

- If you have a loss, check whether all or some of your investment in the farm is at risk. Follow the IRS instructions to report your loss.

Part III – Farm Income—Accrual Method

37 – Sales of livestock, produce, grains, and other products (see the IRS instructions):

- Report sales of livestock, produce, grains, and other products under the accrual method. This includes income earned from the sale of farm products in the year, regardless of when payment was actually received.

38a – Cooperative distributions (Form(s) 1099-PATR):

- Report any cooperative distributions received under the accrual method, including the total amount reported on Form 1099-PATR. These distributions may represent income received from a farming cooperative.

38b – Taxable amount:

- Report the taxable portion of the cooperative distributions received, as indicated in line 38a.

39a – Agricultural program payments:

- Report any agricultural program payments received during the year, including direct payments or subsidies related to farming programs.

39b – Taxable amount:

- Report the taxable portion of the agricultural program payments from line 39a.

40a – Commodity Credit Corporation (CCC) loans reported under election:

- Report any CCC loans received under election, indicating that these loans are included in your income for the year as per the election.

40b – CCC loans forfeited:

- Report any CCC loans that were forfeited during the year.

40c – Taxable amount:

- Report the taxable portion of the forfeited CCC loans from line 40b.

41 – Crop insurance proceeds:

- Report crop insurance proceeds received during the year. These proceeds may include payments received for losses due to natural disasters or other covered events.

42 – Custom hire (machine work) income:

- Report income received for custom hire services, such as machine work (e.g., custom harvesting or planting) performed on behalf of other farmers.

43 – Other income (see the IRS instructions):

- Report any other types of income not previously included in the above lines. This could include miscellaneous farming income such as grants, farm-related sales, or government payments.

44 – Add amounts in the right column for lines 37 through 43 (lines 37, 38b, 39b, 40a, 40c, 41, 42, and 43):

- Add the amounts from lines 37, 38b, 39b, 40a, 40c, 41, 42, and 43 to calculate total farm income under the accrual method.

45 – Inventory of livestock, produce, grains, and other products at beginning of the year. Do not include sales reported on Form 4797:

- Report the inventory of livestock, grains, produce, and other products at the beginning of the year. Do not include any sales already reported on Form 4797 (Sales of Business Property).

46 – Cost of livestock, produce, grains, and other products purchased during the year:

- Report the cost of livestock, produce, grains, and other farm products purchased during the year.

47 – Add lines 45 and 46:

- Add the amounts from lines 45 and 46 to determine the total cost of inventory and purchases during the year.

48 – Inventory of livestock, produce, grains, and other products at end of year:

- Report the inventory of livestock, produce, grains, and other products at the end of the year.

49 – Cost of livestock, produce, grains, and other products sold. Subtract line 48 from line 47:

- Subtract the ending inventory (line 48) from the total cost of inventory and purchases (line 47) to calculate the cost of goods sold for the year.

50 – Gross income:

- Subtract the cost of goods sold (line 49) from the total income (line 44) to calculate the gross income under the accrual method. Enter this result here and on Part I, line 9.

Part IV – Principal Agricultural Activity Codes

- Select the appropriate six-digit code from Part IV to describe your primary agricultural activity. This will help classify your farm activity under the North American Industry Classification System (NAICS). Codes range from crop production to animal production, forestry, and logging.