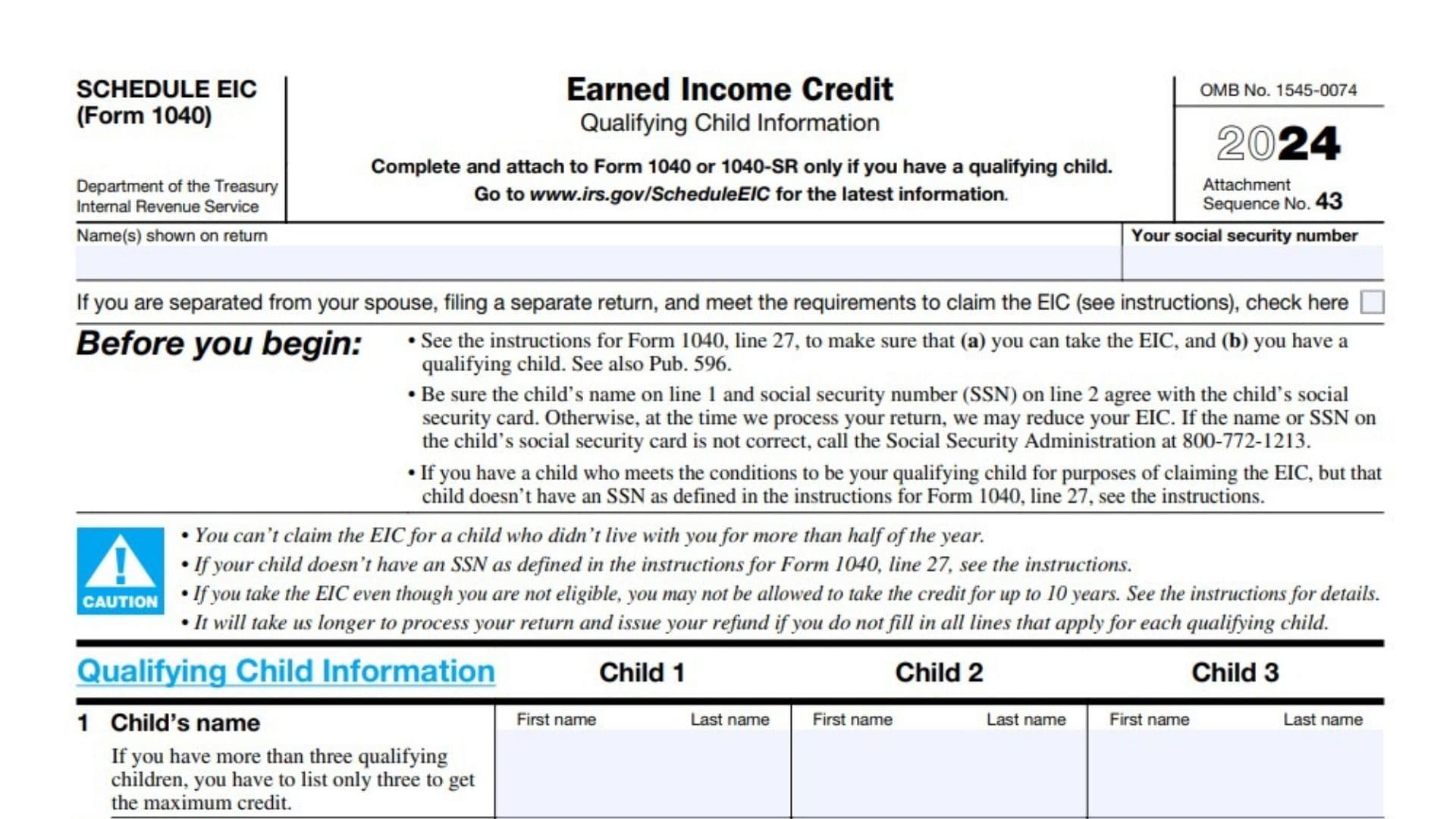

IRS Schedule EIC (Form 1040) is used to claim the Earned Income Credit (EIC) for qualifying children. The EIC is a benefit for working individuals and families with low to moderate income. This form helps taxpayers provide detailed information about their qualifying children to ensure they are eligible for the credit. To qualify, the child must meet specific requirements, such as being under 19 years old (or 24 if a student), being younger than the taxpayer or spouse, and living with the taxpayer for more than half of the year. The Schedule EIC is submitted along with Form 1040 or Form 1040-SR when claiming the EIC. It ensures that the IRS has the necessary information about the taxpayer’s children to determine the correct amount of the earned income credit. If the child does not have a Social Security Number (SSN), the taxpayer may still be eligible for a limited credit called “self-only EIC.” It’s important to complete this schedule accurately to avoid delays in processing the tax return or any future claims for the EIC.

How to File IRS Schedule EIC?

- Ensure Eligibility: Before starting, make sure that you meet the EIC eligibility requirements, including having a qualifying child. See the IRS instructions for Form 1040, line 27, to verify your eligibility.

- Complete Form 1040 or 1040-SR: Schedule EIC should be attached to your Form 1040 or 1040-SR if you are claiming the Earned Income Credit.

- Attach Schedule EIC: Ensure you attach Schedule EIC to your tax return, or the IRS will not be able to process your claim for the credit.

- Check the Box for Separated Spouses (if applicable): If you’re separated from your spouse and meet the requirements to claim EIC, check the designated box at the top of Schedule EIC.

How to Complete Schedule EIC

Part 1: Qualifying Child Information

- Line 1 – Child’s Name: Enter the full name of each child who qualifies for the credit. You can list up to three children, but only three will be considered for the maximum credit. Ensure the child’s name matches the name on the social security card.

- Line 2 – Child’s SSN: Enter the Social Security Number (SSN) of each child. The child must have an SSN that meets the requirements for EIC eligibility. If your child was born and died in 2024, and did not have an SSN, write “Died” and attach appropriate documentation, such as the child’s birth or death certificate.

- Line 3 – Child’s Year of Birth: For each child, enter their year of birth. Skip the next sections if the child was born after 2005 and is younger than you or your spouse (if filing jointly).

- Line 4a – Child’s Age and Student Status: Answer whether the child was under age 24 at the end of 2024, a student, and younger than you or your spouse (if filing jointly). If the child meets these criteria, move to Line 5.

- Line 4b – Permanently and Totally Disabled: If the child was permanently and totally disabled in any part of 2024, answer “Yes” and proceed to Line 5.

- Line 5 – Child’s Relationship to You: Enter the child’s relationship to you, such as son, daughter, grandchild, niece, nephew, or eligible foster child.

- Line 6 – Number of Months the Child Lived With You: Record how many months the child lived with you in the United States during 2024. Do not enter more than 12 months. If the child lived with you for more than half the year but less than seven months, enter “7.” If the child was born or died in 2024 and your home was their home for more than half the time they were alive, enter “12.”

Key Considerations When Filing Schedule EIC

- Eligibility: You can only claim EIC if the child lived with you for more than half of 2024. The IRS will ask for documentation if needed. Documents that may be helpful include school and childcare records, or other evidence showing your child’s address.

- Multiple Qualifying Children: If you have more than three qualifying children, you can only list the first three for EIC purposes.

- Special Rules for Separated Spouses: If you’re married but not filing jointly and meet the requirements for claiming EIC, be sure to check the box at the top of the form indicating your separated status.

- Self-Only EIC: If a child does not have an SSN but is still a qualifying child, you may still be eligible for a self-only EIC by following the special instructions for such cases.

- Error Penalties: If you incorrectly claim the EIC, especially if it’s found to be intentional or reckless, you could face penalties or be disqualified from taking the credit for several years.