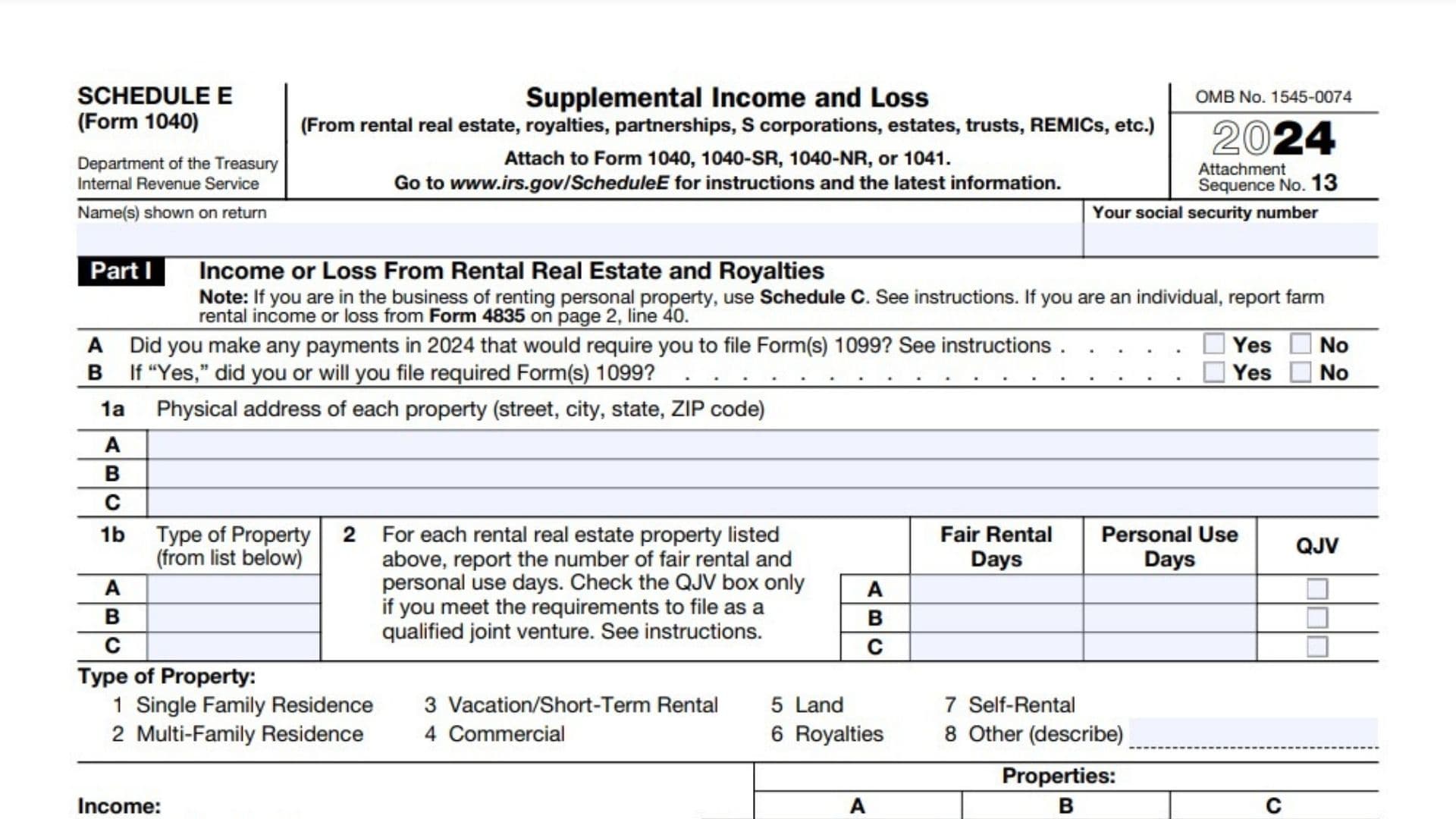

IRS Schedule E, titled “Supplemental Income and Loss,” is a tax form attached to Form 1040, 1040-SR, or 1040-NR. It is used to report income or losses from various sources, including:

- Rental real estate properties.

- Royalties.

- Partnerships.

- S corporations.

- Estates and trusts.

- REMICs (Real Estate Mortgage Investment Conduits).

This form helps taxpayers report income that is not classified as wages or salaries and determine any tax liabilities. If you earn income or incur losses from these sources, filing Schedule E is mandatory.

How to File Schedule E?

- Determine Your Eligibility:

- Confirm that your income or loss sources qualify for Schedule E reporting, such as rental income, royalties, or partnership income.

- Gather Documentation:

- Collect necessary records, such as rental income statements, royalty payments, and Schedule K-1s from partnerships or S corporations.

- Attach to Your Tax Return:

- File by the Deadline:

- Submit your completed tax return, including Schedule E, by April 15 (or the adjusted deadline for the year).

How to Complete Schedule E?

Part I: Income or Loss From Rental Real Estate and Royalties

- Line A & B:

- Indicate whether you made payments in 2024 requiring Form 1099 and whether you filed Form 1099 for such payments.

- Line 1a:

- Enter the physical address for each rental property or royalty source.

- Line 1b:

- Specify the type of property using the codes provided (e.g., 1 for Single-Family Residence, 2 for Multi-Family Residence, etc.).

- Line 2:

- Report the number of days the property was rented at a fair rental price and the number of personal use days.

- Lines 3 & 4:

- Enter total rents received (Line 3) and royalties received (Line 4) for each property.

- Lines 5 to 19:

- List expenses for each property, such as advertising (Line 5), cleaning (Line 7), insurance (Line 9), taxes (Line 16), and depreciation (Line 18).

- Line 20:

- Calculate total expenses by summing Lines 5 through 19.

- Line 21:

- Subtract total expenses (Line 20) from total income (Line 3 or 4) to calculate net income or loss. If the result is a loss, additional forms (e.g., Form 6198) may be required.

- Line 22:

- Report deductible rental real estate losses, subject to limitations.

- Lines 23 to 26:

- Summarize all income, expenses, and losses for all properties and calculate the total income or loss.

Part II: Income or Loss From Partnerships and S Corporations

- Line 27:

- Indicate if you are reporting prior-year disallowed losses, passive activity losses, or unreimbursed expenses.

- Line 28:

- Provide details about each partnership or S corporation, including the name, EIN, and whether it is a foreign partnership.

- Lines 29 to 32:

- Report passive and nonpassive income or losses based on Schedule K-1 from partnerships and S corporations.

Part III: Income or Loss From Estates and Trusts

- Line 33:

- Provide the name and EIN of each estate or trust.

- Lines 34 to 37:

- Report passive and nonpassive income or losses from Schedule K-1 for estates and trusts.

Part IV: Income or Loss From REMICs

- Line 38:

- Provide details about each REMIC, including the name and EIN.

- Lines 39 to 43:

- Calculate excess inclusions, taxable income, and other related income from REMICs.

Part V: Summary

- Line 41:

- Add all income and losses from Parts I through IV to determine the total supplemental income or loss. Report this amount on your Form 1040, 1040-SR, or 1040-NR.

- Line 42: Reconciliation of Farming and Fishing Income:

- Line 43:

- If you are a real estate professional, reconcile your real estate income or loss.