IRS Schedule 8812 (Form 1040) is a crucial tax form used to calculate the Child Tax Credit (CTC), the Credit for Other Dependents (ODC), and, when eligible, the Additional Child Tax Credit (ACTC). Essentially, it’s where you figure out how much credit you can claim for your qualifying children and dependents, helping to lower your tax bill or increase your refund. This form applies if you are filing Form 1040, 1040-SR, or 1040-NR. It ensures that the credits are calculated correctly, considering income limits, number of qualifying dependents, and other special rules. For many taxpayers, understanding Schedule 8812 is the difference between leaving money on the table and receiving the maximum credit available.

How To File Schedule 8812

- Attach to your Form 1040, 1040-SR, or 1040-NR when filing your tax return.

- Use it if you claim dependents and want to calculate the Child Tax Credit or Credit for Other Dependents.

- If you are eligible, it also helps you determine whether you qualify for the Additional Child Tax Credit, which may give you a refund even if you owe no tax.

- Complete the form only after filling out the main parts of Form 1040 through line 27.

How To Complete Schedule 8812?

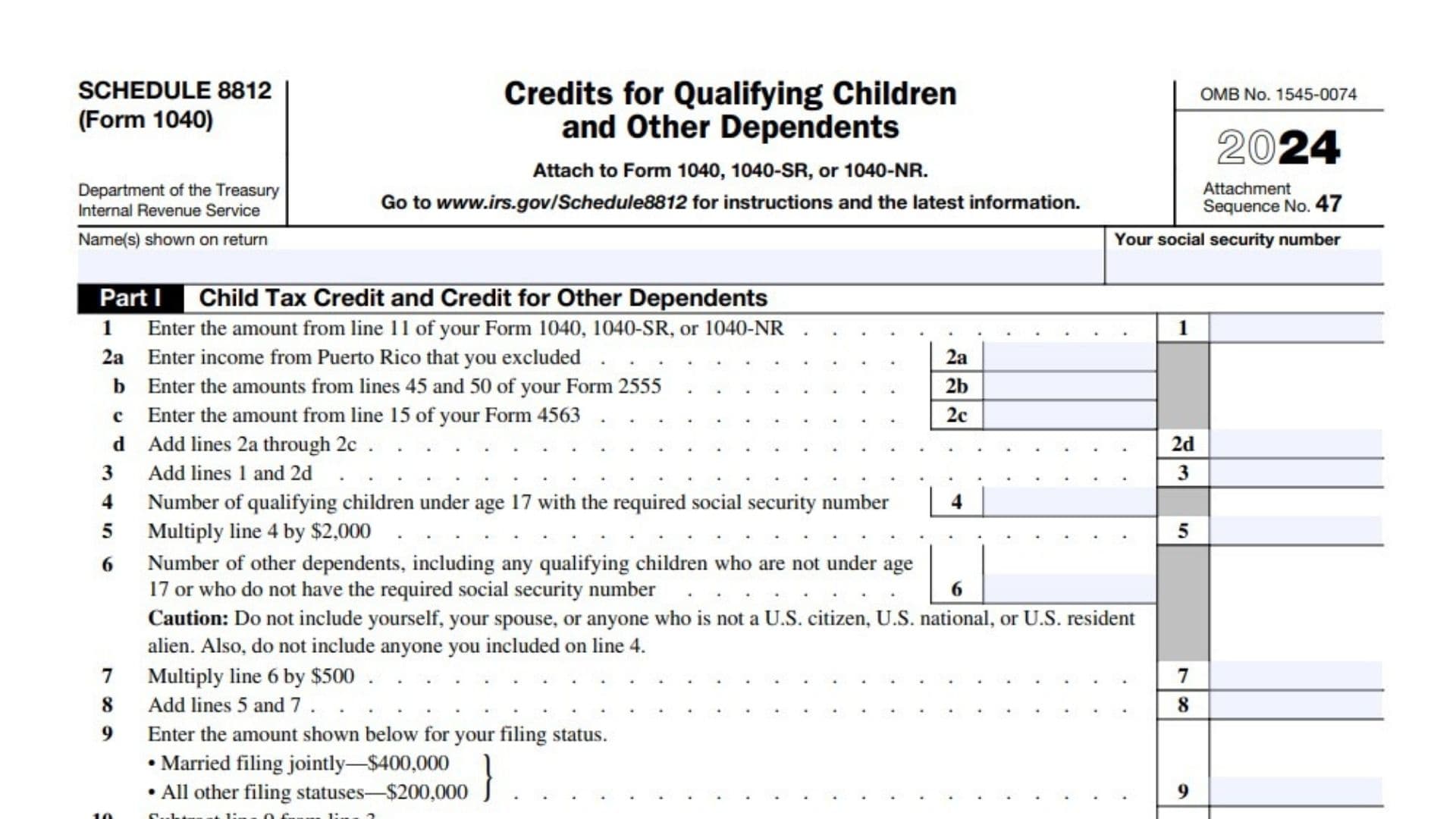

Part I – Child Tax Credit And Credit For Other Dependents

Line 1 – Enter the amount from line 11 of your Form 1040, 1040-SR, or 1040-NR.

Line 2a – Income from Puerto Rico that you excluded.

Line 2b – Amounts from lines 45 and 50 of Form 2555.

Line 2c – Amount from line 15 of Form 4563.

Line 2d – Add lines 2a through 2c.

Line 3 – Add lines 1 and 2d.

Line 4 – Enter number of qualifying children under age 17 with valid SSNs.

Line 5 – Multiply line 4 × $2,000.

Line 6 – Enter number of other dependents (not yourself/spouse/non-resident aliens).

Line 7 – Multiply line 6 × $500.

Line 8 – Add lines 5 and 7.

Line 9 – Enter $400,000 if MFJ, otherwise $200,000.

Line 10 – Subtract line 9 from line 3; adjust to nearest $1,000 if not exact.

Line 11 – Multiply line 10 × 5% (0.05).

Line 12 – Compare line 8 and 11:

- If line 8 ≤ line 11 → You cannot claim these credits. Enter 0 on lines 14 & 27.

- If line 8 > line 11 → Subtract line 11 from line 8.

Line 13 – Enter result from Credit Limit Worksheet A.

Line 14 – Enter smaller of line 12 or 13. This is your Child Tax Credit and Credit for Other Dependents (report on Form 1040, line 19).

Part II-A – Additional Child Tax Credit For All Filers

Line 15 – Check if you do NOT want to claim ACTC. Enter 0 on line 27.

Line 16a – Subtract line 14 from line 12. If zero, no ACTC.

Line 16b – Number of qualifying children under 17 × $1,700.

Line 17 – Enter smaller of 16a or 16b.

Line 18a – Enter earned income.

Line 18b – Enter nontaxable combat pay (if applicable).

Line 19 – If earned income > $2,500, subtract $2,500. If not, enter 0.

Line 20 – Multiply line 19 × 15% (0.15).

Next Step – Compare line 20 and 17:

- If line 20 ≥ line 17 → Enter line 17 on line 27, skip Part II-B.

- If not, go to Part II-B or line 21 (special rules).

Part II-B – Certain Filers With 3+ Children & Puerto Rico Residents

Line 21 – Enter withheld Social Security, Medicare, and Additional Medicare taxes from W-2 box 4 & 6 (include spouse if MFJ).

Line 22 – Add amounts from Schedule 1 (line 15) and Schedule 2 (lines 5, 6, 13).

Line 23 – Add lines 21 + 22.

Line 24 – 1040/1040-SR filers: total of Form 1040 line 27 + Schedule 3 line 11.

1040-NR filers: Schedule 3 line 11.

Line 25 – Subtract line 24 from 23. If zero or less, enter 0.

Line 26 – Enter larger of line 20 or line 25.

Part II-C – Additional Child Tax Credit

Line 27 – Enter smaller of line 17 or 26. Report this as your Additional Child Tax Credit on Form 1040, line 28.