Retirement and Investment Tax Forms

These forms are used to report income from retirement accounts and investments. They help taxpayers claim deductions and manage taxes on capital gains, dividends, and retirement withdrawals. Examples include Forms 1099-R, 8606, and Schedule D.

-

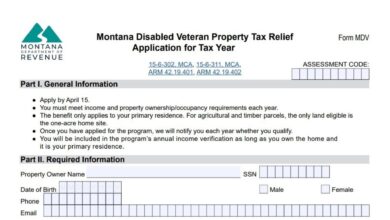

Montana Disabled Veteran Property Tax Relief Application Form

The Montana Disabled Veteran Property Tax Relief Application Form is used by disabled veterans or the surviving spouses of deceased…

-

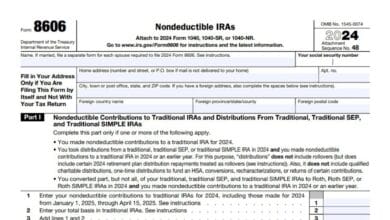

Form 8606

IRS Form 8606, Nondeductible IRAs, is used to report nondeductible contributions to traditional IRAs, distributions from traditional IRAs, and conversions…

-

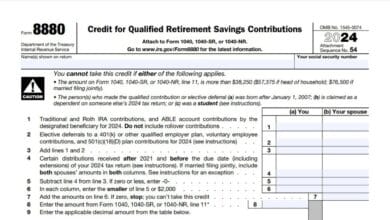

Form 8880

The IRS Form 8880 is used to calculate and claim the Saver’s Credit, which rewards eligible taxpayers for contributing to…

-

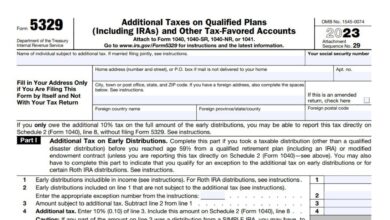

Form 5329

Form 5329, issued by the IRS, is used by taxpayers to report and calculate additional taxes on early distributions, excess…

-

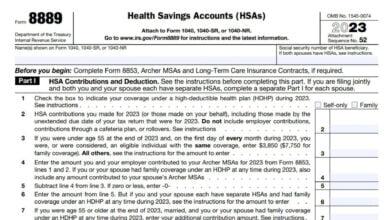

Form 8889

Using an HSA (health savings account) for your health expenses is a great way to keep track of medical costs.…

-

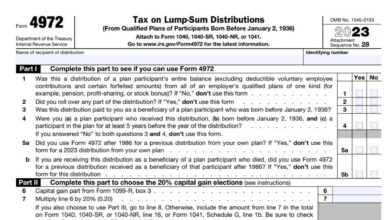

Form 4972

Form 4972 is used by taxpayers and their spouses to determine the tax owed on a qualified lump-sum distribution. Taxpayers choose…