Penalties, Adjustments, and Appeals

This category includes forms for calculating penalties, requesting adjustments, and filing appeals. These forms help resolve tax disputes and correct past filings. Examples include Forms 2210, 843, and 1127.

-

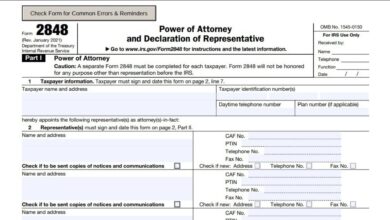

Form 2848

IRS Form 2848, officially titled Power of Attorney and Declaration of Representative, is a critical document that allows taxpayers to…

-

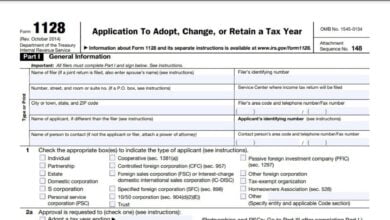

Form 1128

Form 1128, Application to Adopt, Change, or Retain a Tax Year, is used by taxpayers to request IRS approval for…

-

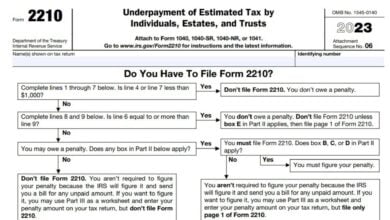

Form 2210

Form 2210, also known as the “Underpayment of Estimated Tax by Individuals, Estates, and Trusts” form, is used by taxpayers…

-

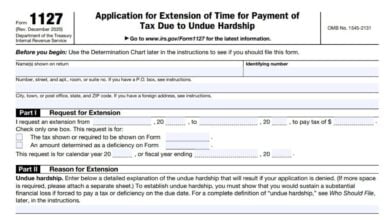

Form 1127

The main function of Form 1127 is to provide a taxpayer additional time to pay taxes, avoiding the usual late…