Montana Schedule K-1 (Form PTE) is the state-specific partner/member/shareholder statement that every partnership, S corporation, LLC taxed as a partnership or S corp, and other pass-through entities doing business in or with Montana-source income must furnish to each owner (individual, trust, estate, another PTE, or corporation) by the due date of the entity’s Montana Form PTE (generally March 15 for calendar-year filers, or the 15th day of the third month after year-end). This four-page form reports the owner’s distributive share of everywhere and Montana-specific income, losses, deductions, statutory additions/subtractions, tax credits, withholding, mineral royalty tax withheld, and entity-level payments such as elective Pass-Through Entity Tax (PTET) or composite income tax paid on the owner’s behalf. Unlike the federal Schedule K-1, Montana’s version is mandatory even when federal K-1s are issued, and it includes unique Montana adjustments, source income breakdowns, and details about elections that can eliminate or reduce an owner’s personal filing obligation (e.g., PTET or composite participation). Owners use the information to correctly report Montana taxable income on Form 2 (individuals), Form FID-3 (estates/trusts), or their own entity returns, while nonresidents/part-year residents rely on Column B for Montana-source amounts only. Accurate and timely distribution of Schedule K-1 helps owners claim credits for taxes paid by the entity, avoid double taxation, and comply with Montana filing requirements without unnecessary penalties.

What Is Montana Schedule K-1 (Form PTE)?

Schedule K-1 (Form PTE) is the official Montana statement detailing each owner’s allocable portion of the pass-through entity’s income, deductions, credits, and Montana-specific tax attributes for the year. It supports the entity’s Form PTE filing and serves as critical documentation for owners when preparing their own Montana returns or claiming refunds/credits for entity-level taxes paid on their behalf.

Who Must Receive Schedule K-1?

Every direct or indirect owner – including partners, members, shareholders, beneficiaries, and tiered entity owners – must receive a personalized Schedule K-1, even if the owner has no Montana tax liability or the entity elected PTET/composite filing.

When And How To Distribute Schedule K-1

Furnish completed Schedule K-1 to each owner no later than the due date of the entity’s Form PTE (including extensions). Provide electronically if the owner consents; otherwise deliver paper copies. Do not file copies with the Montana Department of Revenue unless specifically requested – retain them for your records.

How to Complete Montana Schedule K-1 (Form PTE)

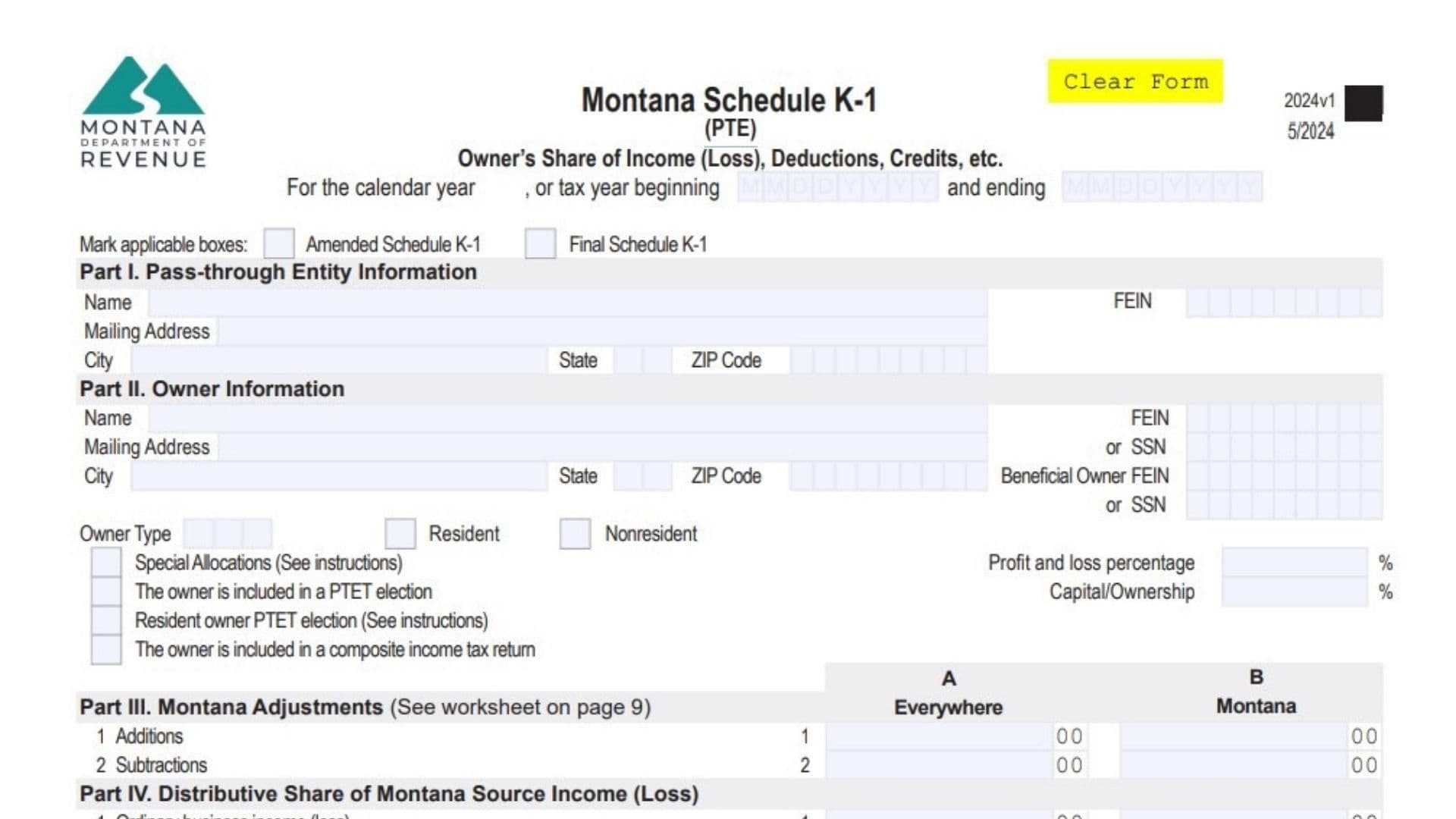

Header Information

- Tax Year — Enter the beginning and ending dates of the entity’s tax year (calendar or fiscal year).

- Amended Schedule K-1 — Check if this replaces a previously issued K-1.

- Final Schedule K-1 — Check if the entity is terminating or the owner is fully exiting.

Part I. Pass-Through Entity Information

- Entity legal name, FEIN, full mailing address, city, state, and ZIP code (exactly as reported on Form PTE).

Part II. Owner Information

- Owner’s full legal name (or entity name).

- Owner’s FEIN or SSN.

- Owner’s complete mailing address, city, state, ZIP code.

- Beneficial Owner FEIN or SSN — Enter the ultimate taxpayer’s identification number who will report the income (e.g., parent corporation in unitary group, grantor for grantor trust).

Owner Type And Elections

- Check Resident or Nonresident.

- Check The owner is included in a PTET election if the entity elected and is paying PTET on this owner’s distributive share.

- Check Resident owner PTET election if a resident individually elected PTET (Form PT-AGR).

- Check The owner is included in a composite income tax return if participating in the entity’s composite filing.

- Enter Profit and loss percentage and Capital/Ownership percentages (may differ with special allocations – see instructions).

- Check Special Allocations if profit/loss/capital percentages vary from standard agreement.

Part III. Montana Adjustments (Columns A – Everywhere, B – Montana)

- Line 1 Additions — Owner’s share of Montana additions to income.

- Line 2 Subtractions — Owner’s share of Montana subtractions from income.

- Line 1 Ordinary business income (loss)

- Line 2 Net rental real estate income (loss)

- Line 3 Other net rental income (loss)

- Line 4a Guaranteed payments for services

- Line 4b Guaranteed payments for capital

- Line 5 Interest income

- Line 6 Ordinary dividends

- Line 7 Royalties

- Line 8 Net short-term capital gain (loss)

- **Line ** Net long-term capital gain (loss)

- Line 10 Net section 1231 gain (loss)

- Line 11 Other income (loss) – attach statement

- Line 12 Section 179 expense deduction

- Line 13 Other expense deductions

- Line 14 Total distributive share (sum of lines 1–13 in each column)

Part V. Supplemental Information

- Check The owner filed Form PT-AGR and enter year if resident individually elected PTET.

- Check The owner is a Domestic 2nd tier PTE if applicable.

Payments And Withholding On Behalf Of Owner

- Line 1 PTET paid on behalf of owner (entity-level tax credit for owner)

- Line 2 Montana composite income tax paid on behalf of owner

- Line 3a Montana income tax withheld directly by this entity

- Line 3b Montana income tax withheld by lower-tier pass-through entity

- Line 3c Total Montana income tax withheld (sum 3a + 3b)

- Line 4 Montana mineral royalty tax withheld

- Line 5 Other information – list type and amount (e.g., nonresident withholding on real estate sales)

Part VI. Tax Credits

For each credit:

- Enter Code (from Montana credit list)

- Credit Authorization Number (if required)

- Amount of Credit allocated to this owner

Part VII. Montana Adjustments Detail

List up to six individual adjustments that make up Part III totals:

- Amount and corresponding Code for each addition/subtraction (see Form PTE instructions for complete code list).