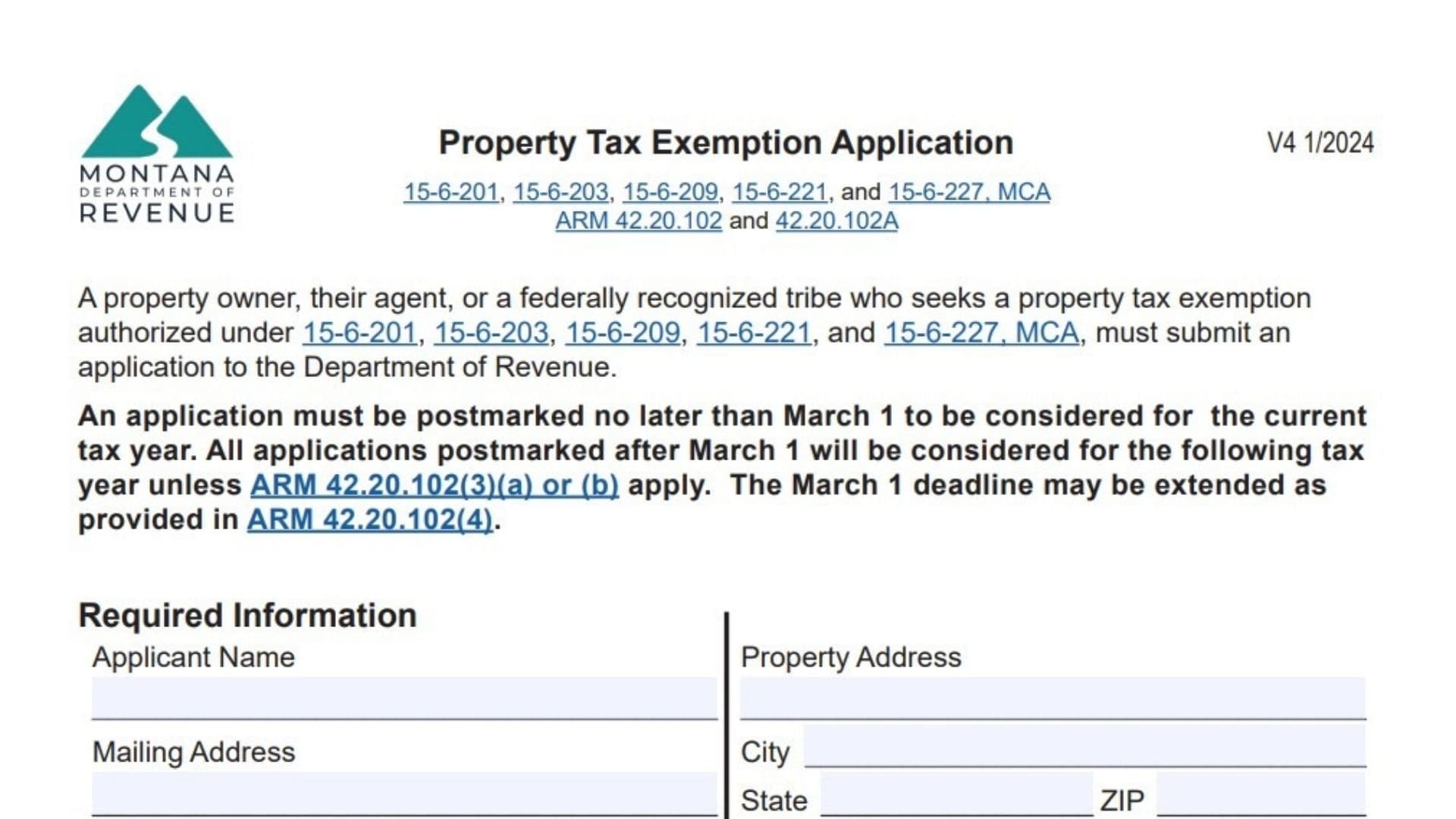

Applying for a property tax exemption in Montana can significantly reduce the financial burden on qualifying organizations, but the process requires meticulous attention to detail and adherence to strict deadlines. The Montana Property Tax Exemption Application is the official document used by property owners, their agents, or federally recognized tribes to request tax-exempt status for properties used for specific public, religious, charitable, or educational purposes. This application covers a wide range of categories, from churches and nonprofit healthcare facilities to low-income housing and public museums. A critical component of this process is the “March 1 Deadline”—applications must be postmarked by this date to be considered for the current tax year. Applications sent after this cutoff will generally apply to the following year. This guide provides a line-by-line breakdown of the application form, ensuring you understand exactly what information is required, which supporting documents to include, and how to verify your eligibility to maximize your chances of approval.

How to Complete Montana Property Tax Exemption Application Form

Required Information Section

The first section of the application gathers essential details about the applicant and the property itself.

Applicant Details:

- Applicant Name: Enter the full legal name of the property owner or organization applying for the exemption.

- Mailing Address: Provide the complete mailing address where correspondence should be sent.

- City, State, ZIP: Fill in the city, state, and zip code for the mailing address.

- Email: Include a valid email address for electronic communication.

- Contact Phone: Provide a phone number where a representative can be reached.

- FEIN: Enter the Federal Employer Identification Number (FEIN) of the organization.

Property Address Details:

- Property Address: Enter the physical street address of the property seeking exemption.

- City, State, ZIP: Fill in the location details for the physical property.

- County: Specify the county where the property is located.

- Geocode: Enter the unique Geocode for the property. This can be found on your classification and appraisal notice.

- Assessment Code: Provide the assessment code associated with the property.

Property Type Selection:

- Real Property: Check this box if the application is for land and buildings. You must provide a legal description of the real property.

- Personal Property: Check this box if the application is for movable assets like vehicles or furniture. You must provide a description, such as vehicle make and model.

Required Documentation Checklist

You must submit specific documents with your application. Photocopies are acceptable; do not send originals.

- Proof of Ownership: For real property, include a recorded deed or contract for deed. For personal property like vehicles, include the title; otherwise, provide a letter identifying ownership.

- Organizational Documents: Submit articles of incorporation, organization, or partnership agreements if the applicant is an entity.

- Tax-Exempt Status: Include verification of IRS tax-exempt status or a written explanation of why it is unavailable.

- Usage Documentation: Provide documents stating the specific and actual use of the property.

- Photograph: Include a photo of the property (not required for furniture/fixtures).

Additional Documentation Based On Specific Use

Depending on how the property is used, you must check the appropriate box and attach the listed documents.

Religious Purposes:

- Proof that buildings/furnishings are owned by a church and used for worship or clergy residence.

- Proof that land does not exceed 15 acres (or 1 acre for clergy residence) and is used for educational/recreational activities open to the public.

- Proof that the parsonage resident is a member of the clergy (e.g., ordination certificate).

Tribal Religious Land:

- A copy of the tribal resolution designating the land (max 15 acres) as sacred and used exclusively for religious purposes.

Agricultural/Horticultural Societies:

- Documentation verifying the property is not operated for profit.

Educational Purposes (Schools/Colleges):

- Proof the property does not exceed 80 acres.

- Verification that the organization is non-profit.

- Copies of attendance policies and curriculum.

- A lease agreement if the property is not owned by the educational organization.

Tribal Educational Corporations:

- Verification of non-profit status.

- Attendance policies and curriculum.

- Lease agreement if applicable.

Nonprofit Healthcare Facilities:

- Copy of the license from the Department of Public Health and Human Services.

- Lease agreement if the property is not owned by the non-profit.

Cemeteries:

- Documentation of a permanent care and improvement fund.

- Verification that the property is not operated for profit.

Public Charities (up to 160 acres or 8-year exemption):

- Lease agreement if leasing from a government organization.

- Verification of direct use for public charitable purposes.

Public Museums, Zoos, Observatories:

- Verification of non-profit status.

- Verification that property is necessary for public display.

- If privately owned, proof that it is actually used by a non-profit/government entity for public display.

Facilities for Developmental Disabilities/Mental Illness:

- Verification that the organization is not operated for profit.

Care of Retired/Aged/Chronically Ill:

- Verification of non-profit status.

- Verification that residents meet age and income requirements.

Parks and Recreational Facilities:

- Proof the facility is open to the public.

- Proof the property is land-only (no buildings) or leased to a municipality for under $100/year.

- Proof land does not exceed 10 acres (or 640 acres for tribal land) and is used for park purposes.

Veterans’ Organizations (Applicant is NOT the Society):

- Lease verifying that the tax savings are realized by the veterans’ society.

Nonprofit Community Service Organizations:

- Proof the organization has been active continuously since January 1, 1981.

Low-Income Housing:

- Proof property is dedicated to affordable housing.

- Copy of hearing minutes/notice regarding community housing need.

Low-Income Housing (Specific Entities):

- IRS tax exemption letter (or 501(c)(3) status for general partner).

- Montana Board of Housing letter allocating tax credits.

- Deed restricting property usage.

- Verification of rent-restricted units and compliant rent charges.

- Letter stating the property serves an underserved population.

- Partnership agreement showing eventual transfer of ownership to a non-profit.

Low-Income Housing (Nonprofit Owned/Constructed):

- Verification that construction used a HOME investment partnership grant.

Other:

- Contact the exemption business analyst if your category is not listed.

Affirmation And Signature

Legal Statement:

The applicant must sign under penalty of law, affirming they are the owner/agent, the use is for a non-profit purpose, and all information is true.

Signature Fields:

- Applicant Signature: Sign the document.

- Date: Enter the date of signing.

- Printed Name and Title: Print the name and title of the signer.

Submission Instructions:

Mail the signed application and all supporting documents to:

Department of Revenue

PO Box 8018

Helena MT 59604-8018

Important: Keep a copy for your records.