The Montana Property Tax Assistance Program (PTAP) provides essential tax relief to homeowners with limited income, potentially reducing their property taxes by up to 80% on the first $200,000 (standard limit, though the form notes limits for agricultural/timber parcels) or specifically the first $418,000 of their primary residence’s value as noted in the updated 2026 guidelines. The Form PTAP is the official document used to apply for this benefit, which is designed to help single individuals, heads of households, and married couples who meet specific income thresholds. To qualify, you must own or be under contract to purchase your home and have lived in it as your primary residence for at least seven months of the year. One of the most critical aspects of this process is the April 15 deadline—your application must be postmarked or hand-delivered by this date to be effective for the current tax year. Once you are accepted into the program, you generally do not need to reapply every year; the state will verify your income annually. This guide breaks down the Form PTAP line-by-line, explaining how to report your Federal Adjusted Gross Income (FAGI), what documentation is required if you haven’t filed a tax return, and how to verify your ownership of the land for mobile homes, ensuring you don’t miss out on these valuable savings.

How to Complete Montana PTAP Form

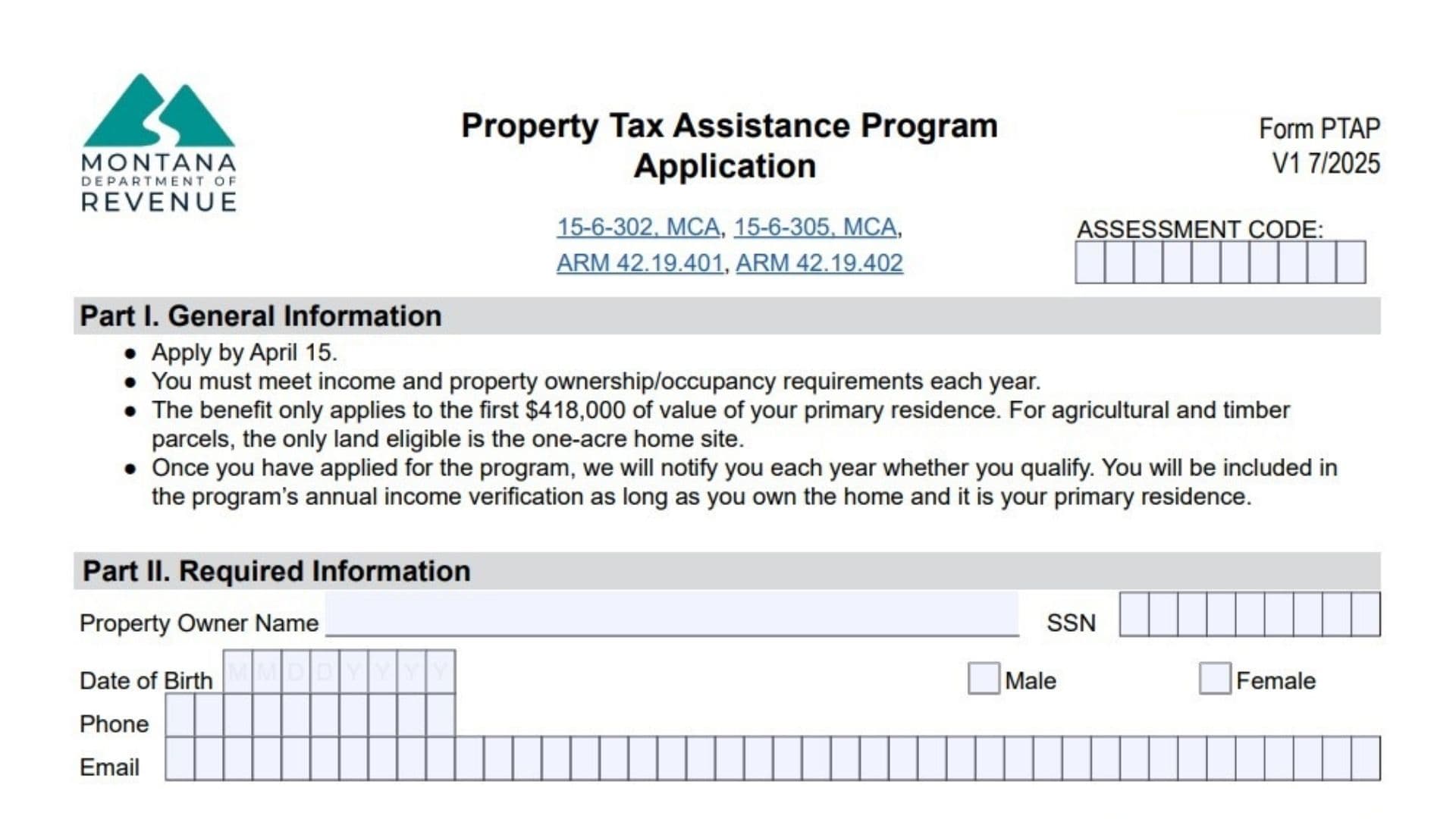

Part I: General Information

This section outlines the basic rules of the program.

- Deadline: You must apply by April 15.

- Eligibility: You must meet income and property ownership/occupancy requirements every year.

- Benefit Limit: The tax reduction applies to the first $418,000 of value for your primary residence. (Note: For agricultural/timber land, only the one-acre home site is eligible).

- Automatic Renewal: Once you apply, you are in the system. The state will check your eligibility annually as long as you own the home and it remains your primary residence.

Part II: Required Information

This section collects personal data to verify your identity and property.

Property Owner Details:

- Name & SSN: Enter the Property Owner’s full Name and Social Security Number.

- Demographics: Enter Date of Birth and check the box for Male or Female.

- Contact Info: Provide a Phone number and Email address.

Spouse Details (if applicable):

- Name & SSN: Enter Spouse’s Name and Social Security Number.

- Demographics: Enter Date of Birth and check the box for Male or Female.

- Phone: Provide the spouse’s phone number.

Property Location:

- County: Enter the County where the property is located.

- Mailing Address: Fill in the full mailing address (City, State, ZIP).

- Physical Address: Fill in the physical address of the primary residence (City, State, ZIP).

Income Verification:

- Tax Filing Status: Answer “Yes” or “No” to “Did you file a Montana income tax return for Tax Year 2024?”

- If Yes: You do not need to provide extra income documentation.

- If No: You must attach a copy of your 2024 federal tax return (if you are a new resident) OR a copy of your Social Security statement/other benefit statements if your only income is non-taxable.

Mobile/Manufactured Homes:

- Land Ownership: Answer “Yes” or “No” if you own the land your mobile home sits on.

- If Yes: You must provide the Geocode for the land.

General Comments:

- Use the blank lines provided to add any additional notes or explanations if necessary.

Part III: Qualifying Criteria

This section explains the specific rules for approval. You do not fill this out, but you must meet these standards.

- Occupancy: You must own/be buying the home and live there for at least 7 months of the year.

- 2026 Income Guidelines (based on 2024 FAGI):

- Single Applicant: 2024 Federal Adjusted Gross Income (FAGI) must be less than $29,037.

- Head of Household/Married: 2024 FAGI must be less than $38,917.

- Note: Capital and income losses are excluded from the FAGI calculation.

- Income Reporting: Spouses’ incomes are included in the total even if they are not listed as owners.

Part IV: Affirmation And Signature(s)

This is the legal binding section of the application.

Declaration:

By signing, you affirm under penalty of law that you own the property, occupied it for at least 7 months, and that all information is true.

Signatures:

- Property Owner: Sign and date the form.

- Spouse: Sign and date the form (if applicable).

- Preparer: If someone other than the applicant filled out the form, they must sign, date, and provide their name, phone, relationship, email, and other contact info.

Submission Instructions

Where to Send:

Return the completed form to your local Department of Revenue field office.

- Online Map: You can find addresses at

revenue.mt.gov. - Mailing: You generally mail it to the local field office, not a central Helena address (unlike the exemption form).

Missed Deadline:

If you miss the April 15 deadline, apply anyway to get into the system for the following tax year.

Income Guidelines Table 2026

The form provides a table showing the percent of tax reduction based on income brackets:

Single Person:

- $0 – $14,286: 80% Reduction

- $14,287 – $19,532: 50% Reduction

- $19,533 – $29,037: 30% Reduction

Married or Head of Household:

- $0 – $19,249: 80% Reduction

- $19,250 – $29,085: 50% Reduction

- $29,086 – $38,917: 30% Reduction