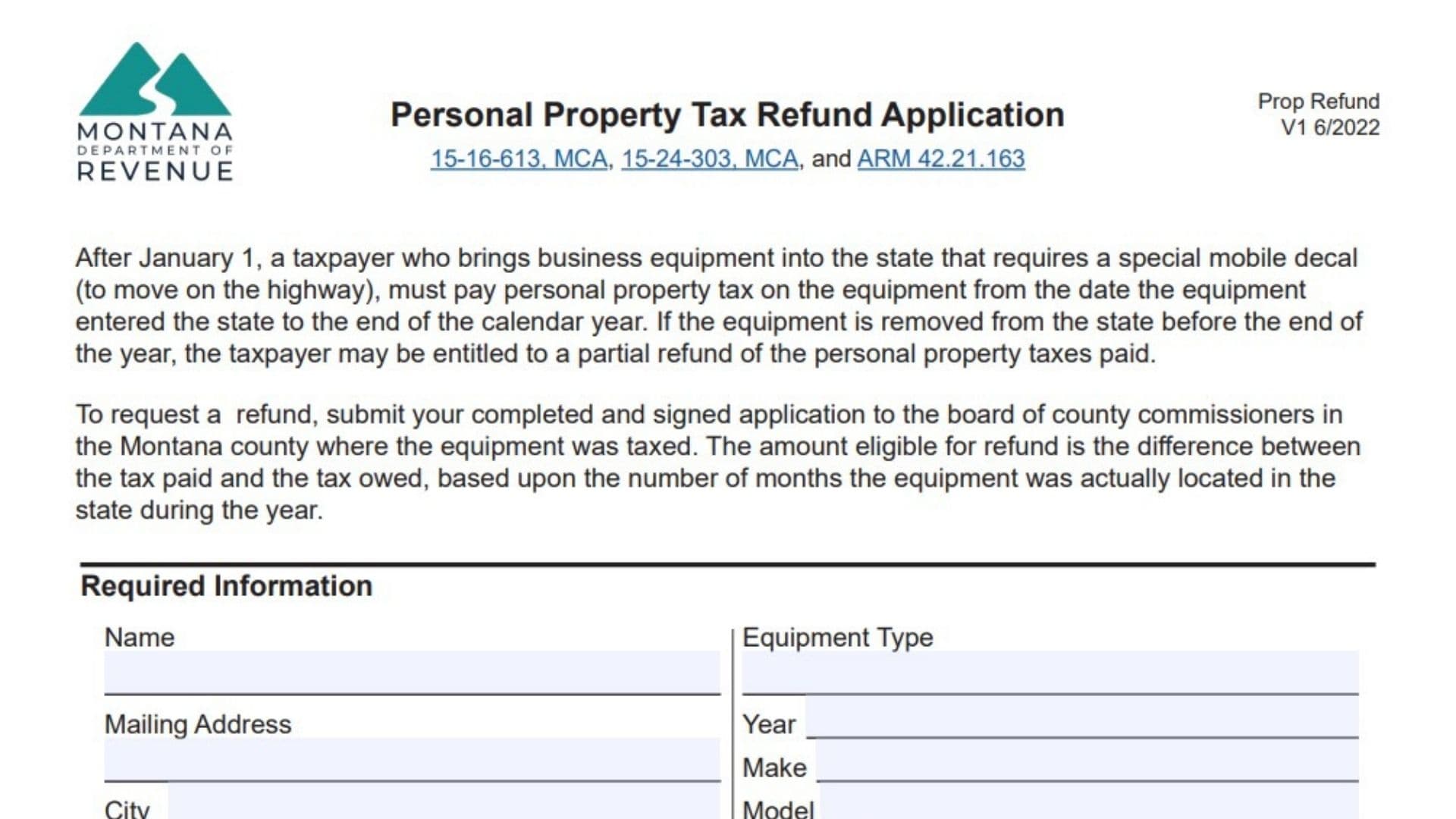

The Montana Personal Property Tax Refund Application is for taxpayers who have paid personal property tax on equipment brought into the state, but the equipment was removed from the state before the end of the calendar year. If you meet the criteria, you may be entitled to a partial refund of the personal property tax paid.

How to File the Montana Personal Property Tax Refund Application

- Obtain the Form: The Personal Property Tax Refund Application form can be downloaded from the Montana Department of Revenue website or obtained from your local county office.

- Complete the Form: Follow the detailed line-by-line instructions below to fill out the form correctly.

- Submit the Form: Submit your completed form to the board of county commissioners in the Montana county where the equipment was taxed.

How to Complete Montana Personal Property Tax Refund Application Form

Required Information

- Name: Enter the name of the taxpayer (individual or business) requesting the refund.

- Equipment Type: Specify the type of equipment for which the refund is being requested.

- Mailing Address: Provide your mailing address, including street address, city, state, and ZIP code.

- Year: Enter the year in which the equipment was taxed.

- Make: Provide the make (manufacturer) of the equipment.

- Model: Specify the model of the equipment.

- Serial No.: Enter the serial number of the equipment for identification purposes.

- Tax Paid Receipt No.: Include the receipt number for the property tax payment.

- Email: Provide an email address where you can be reached.

- Contact Phone: Enter a phone number for contact.

- Date Property Entered the State of Montana: Provide the exact date the equipment entered Montana.

- Date Property Removed from the State of Montana: Indicate the date when the equipment was removed from Montana.

Required Documentation

You must provide the following documents along with your application:

- Copy of Montana property tax bill showing proof of full payment.

- Proof of property tax payment in another state for the equipment, if applicable.

Certification and Signature

- Certification Statement: By signing the form, you are certifying under penalty of law that all information provided is true, correct, and complete.

- Signature: The property owner must sign and date the form.

- Printed Name: Print the name of the person who is signing the form.

Refund Calculation (For County Commission Use)

- Number of months equipment was taxed in-state: Enter the total number of months that the equipment was taxed while in Montana.

- Number of months equipment was actually located in-state: Enter the number of months the equipment was actually in Montana.

- Total personal property tax paid: Enter the total amount of personal property tax that was paid.

- Formula:

- Calculate the percentage of the total tax owed based on the number of months the equipment was actually in-state. Use the formula:

- B ÷ A = % (where B is the number of months the equipment was in Montana, and A is the number of months it was taxed).

- Then, multiply the percentage by the total tax paid to determine the actual tax due:

- % x C = $ (Actual tax due).

- The refund amount is calculated by subtracting the actual tax due from the total tax paid:

- Total tax paid (C) – actual tax due = $ (Refund amount).

- Calculate the percentage of the total tax owed based on the number of months the equipment was actually in-state. Use the formula:

For County Commission Use Only

- The county commission will review and approve or deny the partial property tax refund based on the calculated refund amount.

- Signature and Date: The county commission representative signs and dates the form, confirming their review of the application.

Final Submission

Once the application is complete, including all required documentation, submit it to the board of county commissioners in the county where the equipment was taxed. The county commission will process the application and send it to the Department of Revenue for further calculation and approval of the refund.