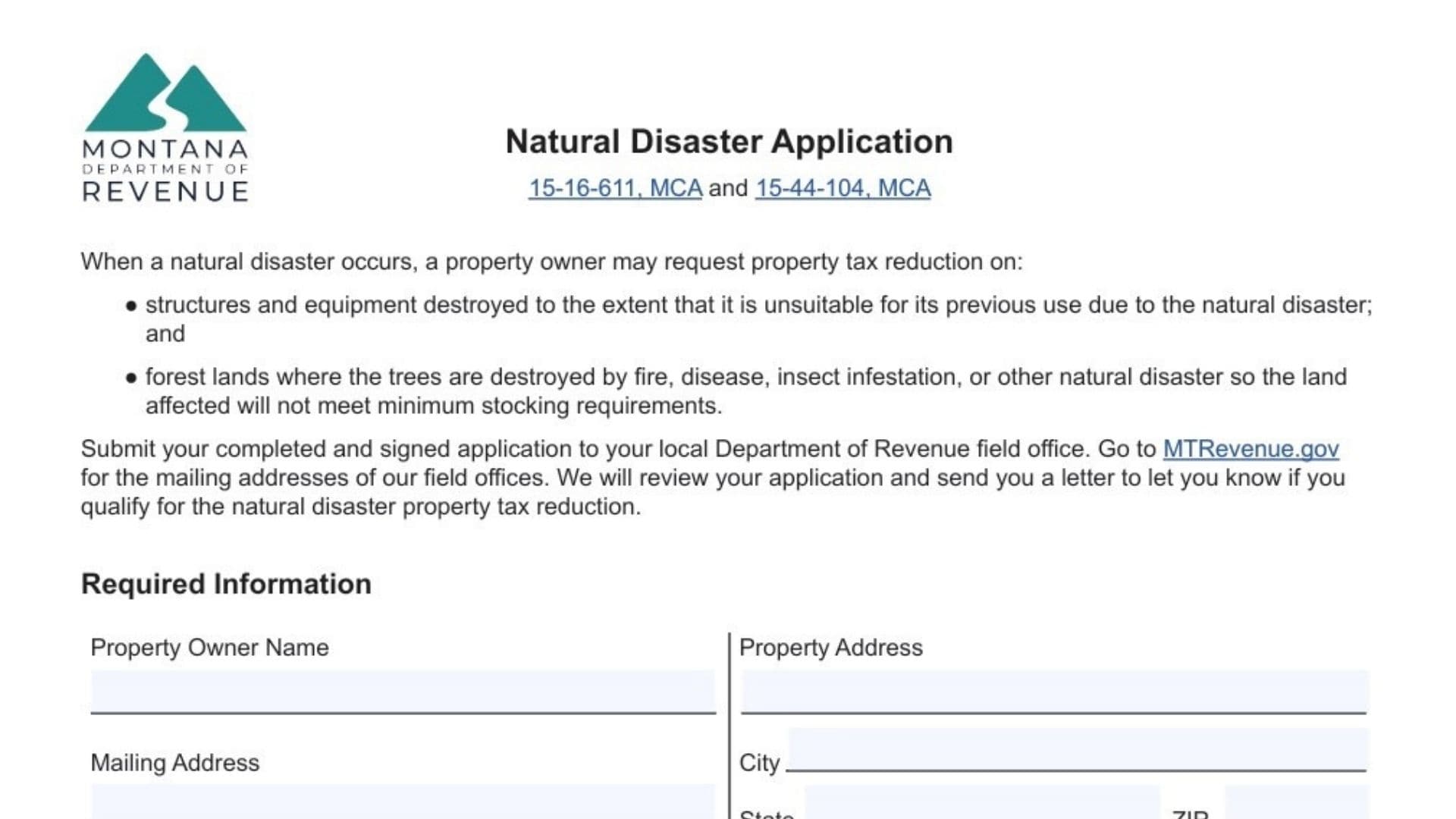

Montana’s Natural Disaster Application (AB-25) is a Montana Department of Revenue form that lets a property owner ask for a property tax reduction after a natural disaster, under the Montana statutes cited on the form (15-16-611, MCA and 15-44-104, MCA). The form is intended for two main situations: (1) structures and equipment that were destroyed or damaged so severely that they’re no longer suitable for their previous use, and (2) forest lands where trees are destroyed by fire, disease, insect infestation, or another natural disaster such that the affected land won’t meet minimum stocking requirements. After submission, the Department reviews the application and sends you a letter indicating whether you qualify for the natural disaster property tax reduction.

Where And How To Submit It

Submit the completed, signed application to your local Montana Department of Revenue field office (not a generic statewide address). The form directs you to MTRevenue.gov to locate the mailing addresses for the field offices.

How To Complete Montana Natural Disaster Application Form

Page 1: Required Information

Fill in every field in the “Required Information” section clearly and completely.

- Property Owner Name: Enter the full legal name of the property owner.

- Property Address: Enter the physical address of the damaged property.

- Mailing Address: Enter the address where the Department should send correspondence (may be different from the property address).

- City / State / ZIP (Mailing): Complete the city, state, and ZIP code for the mailing address.

- City / County / State / ZIP (Property Location): Complete the location details for where the property sits, including county.

- Geocode(s): Enter the geocode number(s); the form notes this can be found on your classification and appraisal notice.

- Email: Provide an email address for follow-up.

- Contact Phone: Provide a phone number where you can be reached.

- Date Of Natural Disaster: Enter the date the event occurred.

- Type Of Natural Disaster That Caused The Damage: Describe the event type (for example: wildfire, flood, windstorm, insect infestation).

- Property Type Destroyed By The Natural Disaster: Indicate which category applies: structure(s), equipment, and/or forest land trees (select all that apply).

- Legal Description Of The Property Where The Natural Disaster Occurred: Provide the legal description for the affected property (as shown on property records).

Page 2: Damage Details (Answer The Correct Questions)

On page 2, answer the question set that matches what was damaged: structures/equipment (Questions 1–2) and/or forest land trees (Questions 3–4).

Structures And Equipment (Questions 1 And 2)

The form instructs you to answer Questions 1 and 2 if the natural disaster destroyed structures and/or equipment.

- Note About Refunds: If the property was destroyed after you already paid the current year’s property taxes, the form explains you may be entitled to a prorated refund for the part of the year the property was unsuitable for use.

- Question 1 – Description Of Structural Damage: Describe what happened to the structure(s), what parts were impacted, and why the damage makes them unsuitable for their prior use.

- Question 2 – Description Of Equipment Damage: Describe what equipment was damaged/destroyed and why it can’t be used as before.

- Replacement Equipment Note: If you receive a reduction for damaged equipment and replace it in the same tax year, the form says you must report the replacement to the Department because the replacement equipment may become taxable from purchase date through year-end.

Forest Land Trees (Questions 3 And 4)

If the disaster affected forest lands (trees destroyed by fire, disease, insect infestation, or other natural disaster), answer Questions 3 and 4.

- Note About 20-Year Reduction: The form states that if the Department approves the application for forest lands, it will reduce the forest land value by 50% of the original forest productivity value for 20 years after the year the disaster occurred.

- Question 3 – Description Of Timber Stocking Damage: Explain how the event impacted stocking (what was destroyed, severity, and how it affects minimum stocking).

- Question 4 – Number Of Acres Affected: Enter the acres impacted by the natural disaster.

Certification And Signature

Read the certification statement and sign only after verifying your details are accurate.

- Property Owner Signature (X): The property owner signs here.

- Date: Enter the signature date.

- Printed Name: Print the signer’s name.

Help And Contact Information

For questions, the form provides a phone number: (406) 444-6900, and notes Montana Relay 711 for the hearing impaired, plus the website MTRevenue.gov.