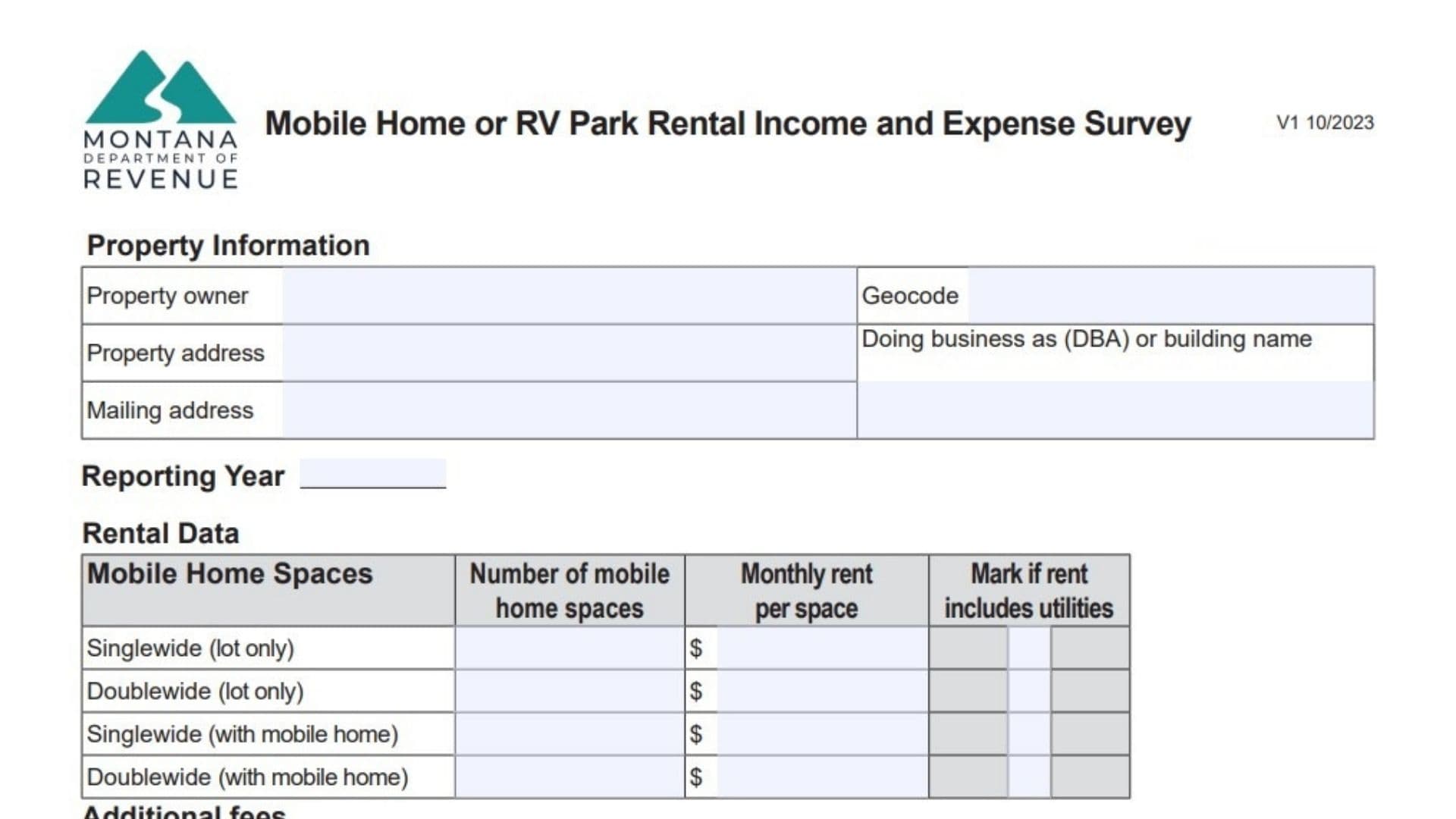

The Montana Form IE-MH, titled “Mobile Home Park or RV Park Rental Income and Expense Survey,” is a specific document used by the Montana Department of Revenue to collect financial information from owners of mobile home parks and RV parks. The primary purpose of this survey is to gather accurate market data on rental income and operating expenses, which helps the state’s appraisers determine fair and equitable property values for tax assessment purposes. By providing this information, property owners ensure that the state has a realistic picture of the economic conditions affecting their specific type of business, rather than relying on general estimates. The form requests detailed data on various revenue streams—such as lot rentals, RV spaces, and marina slips—as well as a comprehensive breakdown of annual operating costs like utilities, maintenance, and taxes.

How To File This Survey

While the document does not explicitly list a submission address on the form itself, these surveys are typically returned to the local Department of Revenue field office that requested the information. You should ensure that all sections are completed accurately, using your actual financial records or income tax forms as a reference. If you have questions about where to send it, the form provides a contact number: (406) 444-6900.

How Complete Montana Survey Form IE-MH

Property Information Instructions

Property Identification

Enter the full name of the property owner, the property’s Geocode (a unique identifier found on your tax bill), and the physical property address.

Business Name And Address

If the park operates under a trade name or “Doing Business As” (DBA) name, enter it here. Also, provide the mailing address where you receive business correspondence.

Reporting Year

Clearly indicate the specific calendar year for which you are providing financial data.

Rental Data Instructions (Page 1)

Mobile Home Spaces

Break down your inventory by type: Singlewide (lot only), Doublewide (lot only), Singlewide (with mobile home), and Doublewide (with mobile home). For each category, enter the number of spaces and the monthly rent charged per space. Check the box if the rent includes utilities.

RV Spaces

Separate your RV spaces into “Full Service” and “Limited Service.” Enter the total number of spaces, the average daily rent per space, and the total days of operation per year.

Other Rental Types

If applicable, provide details for Marina Boat Storage (slips, daily rent, days open), Tent Sites (number of sites, daily rent, days open), Cabins (number of units, daily rent, days open), and Parking Spaces (number of spaces, daily rent, days open).

Additional Fees And Comments

List any extra fees charged to tenants in the “Service Description” and “Fee Amount” table. Use the comments section to explain any concessions, specials, or unique circumstances affecting your income.

Annual Income And Operating Expenses Instructions (Page 2)

Annual Income Section

- Potential Gross Income: Enter the total rent the property would generate if it were 100% occupied for the entire year.

- Actual Rent Collected: Enter the actual total amount of rent received during the reporting year.

- Vacancy And Collection Loss: Enter the amount of income lost due to empty spaces or unpaid rent.

- Subsidized Rental Income: Include any income from government housing assistance programs (e.g., Section 8).

- Miscellaneous Income: Report income from other sources like laundry facilities, vending machines, or parking fees.

Operating Expenses Section

Enter your annual costs for each specific category:

- Advertising: Marketing costs, including online ads and signage.

- Cleaning: Janitorial services, snow removal, and common area upkeep.

- Commissions: Fees paid for leasing or marketing.

- Insurance: Annual property insurance premiums.

- Legal And Accounting Fees: Professional services for business operations.

- Management Fees: Costs paid to a third-party management company.

- Payroll And Benefits: Wages, salaries, and benefits for park staff.

- Mortgage Interest: Interest payments on property loans.

- Maintenance And Repairs: Routine upkeep costs for systems like plumbing and electrical (exclude major capital improvements).

- Supplies: Office and cleaning materials.

- Property Taxes: Total property tax paid.

- Utilities: Costs for water, sewer, gas, electric, internet, and trash.

- Depreciation Expense: Non-cash expense for asset value loss.

- Reserves For Replacement: Funds set aside for future replacement of short-lived items.

- Capital Expenses: Major one-time costs like road paving or building additions.

- Other Expenses: List any costs that do not fit the above categories.

Final Certification

Signature And Contact

The person completing the survey must sign and date the form. You must also provide your printed name, title, phone number, and email address so the department can contact you for clarification if needed.