The Montana Gifting Statement Form is an official document issued by the Montana Department of Revenue’s Alcoholic Beverage Control Division (ABCD) designed to formally document and authorize the transfer of ownership interest or funds in an alcoholic beverage licensed business. This form serves a critical regulatory function in Montana’s alcohol licensing framework by ensuring complete transparency and accountability when one party gifts either a percentage of business ownership or monetary funds to another party involved in an alcohol license application. The form typically accompanies other licensing applications such as the Form 5 or Short Form applications submitted to ABCD. Whether you are transferring an ownership stake in a brewery, bar, liquor store, or any other alcohol-licensed establishment, or you are providing financial support to help another party obtain an alcohol license, this form must be completed and approved before any transaction occurs. The Montana ABCD takes gifting statements seriously because they help prevent unlicensed individuals from exercising hidden control over licensed premises, ensure that all financial sources are legitimate and traceable, and maintain compliance with Montana Code Annotated (MCA) Section 16-4-401 regarding qualifications for alcoholic beverage licensure. Understanding each field on this two-page form is essential for applicants, business owners, and anyone facilitating the transfer of ownership or funds related to Montana alcohol licenses.

When And Why You Need The Montana Gifting Statement Form

You must complete and submit the Montana Gifting Statement Form if you are involved in any of the following transactions:

Gifting or Transferring Ownership Percentage – If one party is transferring a percentage of ownership in an alcoholic beverage licensed entity to another party without receiving direct compensation, you must disclose this on the form. This ensures all owners are identified and their qualifications are assessed by ABCD.

Providing Gifted Funds – If one party is providing financial assistance to another party to help fund an alcohol license application or to support the purchase of an alcohol-licensed business, you must document this transfer on the form. The funds must be traced to legitimate sources.

Accompanying License Applications – This form is typically submitted alongside a primary license application (Form 5 or Short Form), never as a standalone document. The ABCD uses both forms together to evaluate the complete financial and ownership structure of the proposed business.

Critical Requirement – ABCD explicitly states that no gifting transaction should be completed without prior written approval from the agency. Attempting to execute a gift without approval may result in application denial, license suspension, or other enforcement actions.

How To File The Montana Gifting Statement Form

Filing the Gifting Statement Form involves a structured process with several mandatory steps:

Step 1: Obtain the Form – Download the Montana Gifting Statement Form (Version 1, 2/2025) from the Montana Department of Revenue ABCD website or contact the division directly at DORABCD-O&E@mt.gov.

Step 2: Complete All Applicable Sections – Depending on your transaction type, you will complete either the “Gifting/Transferring Percentage of Ownership” section or the “Gifting Funds” section (or both if applicable).

Step 3: Gather Supporting Documentation – If gifting funds, collect 6 months of bank statements or other documents verifying the source of the funds. If transferring ownership, prepare documentation proving the ownership transfer.

Step 4: Sign and Date – The person gifting (whether ownership or funds) must personally sign and date the form. Printed name and phone number are also required.

Step 5: Obtain Notarization – The form must be notarized by a Montana Notary Public. The notary will verify your identity, witness your signature, and complete the notarization section on page 2.

Step 6: Submit Complete Application – Mail the completed, signed, and notarized Gifting Statement Form along with all required supporting documents and your primary license application to the address provided: Alcoholic Beverage Control Division, PO BOX 1712, Helena, MT 59604-1712.

Step 7: Await ABCD Approval – Do not proceed with any gifting transaction until you receive written approval from ABCD. Processing times vary, but the agency typically responds within 2-4 weeks.

How to Complete Montana Gifting Statement Form

Page 1: Gifting Statement Section

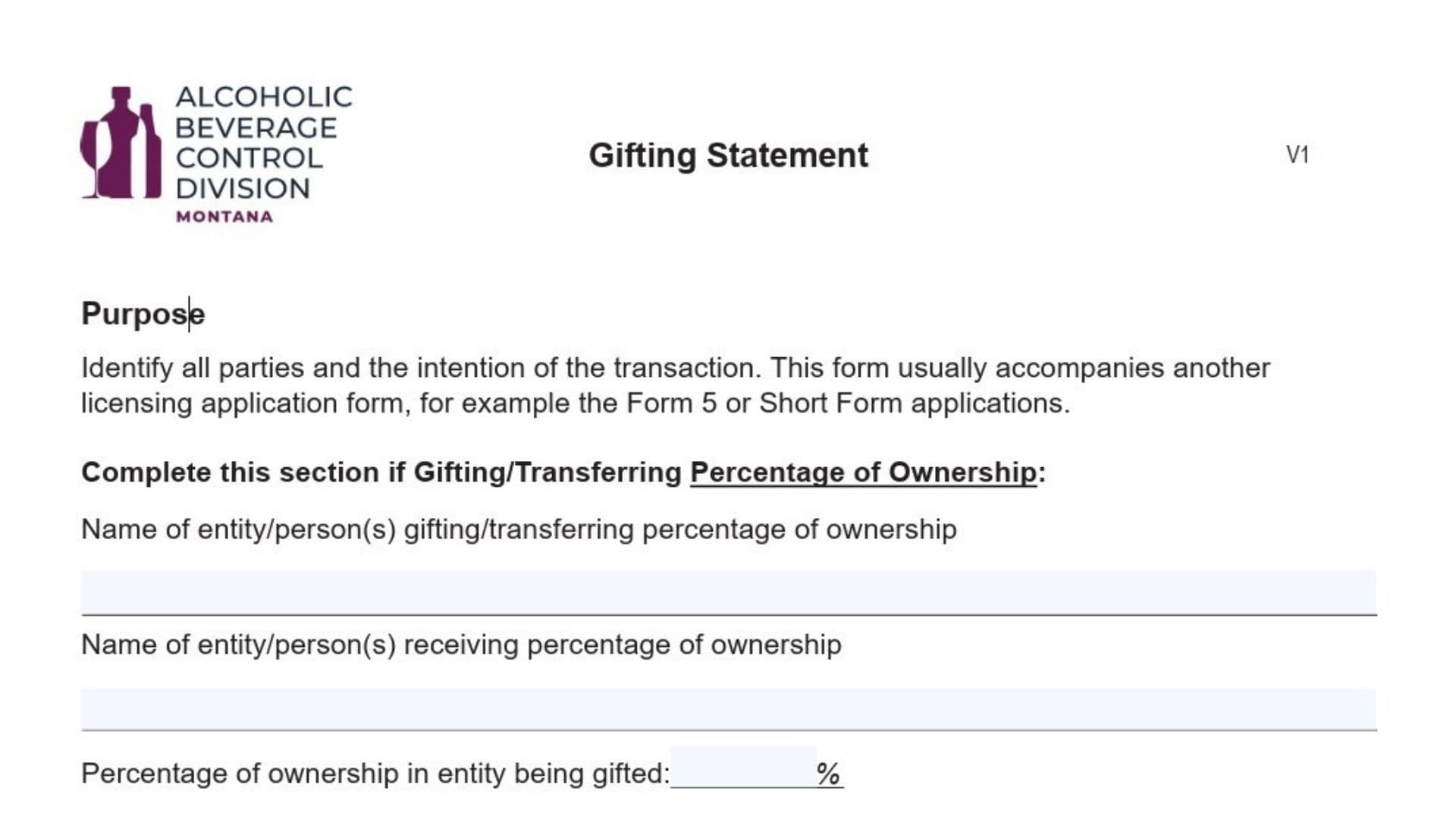

Section 1: Gifting/Transferring Percentage of Ownership

Complete this section if your transaction involves the transfer of an ownership stake in an alcoholic beverage business. This section is required even if you are also gifting funds.

Name of Entity/Person(s) Gifting/Transferring Percentage of Ownership – Enter the full legal name of the person or business entity that currently owns the percentage stake being transferred. If the current owner is an individual, use their legal first and last name. If the owner is a corporation, LLC, partnership, or other business structure, use the full registered business name as it appears in official state records. Do not use nicknames or abbreviated versions.

Name of Entity/Person(s) Receiving Percentage of Ownership – Write the full legal name of the person or entity that will receive the ownership percentage. This must be the exact name that will appear on the revised business registration and license documents.

Percentage of Ownership in Entity Being Gifted – Enter the specific percentage stake being transferred (for example, 25%, 50%, 100%, etc.). This percentage must match the ownership records of the business and should be supported by documentation such as articles of incorporation, partnership agreements, or buy-sell agreements. Do not leave this field blank; it is crucial for ABCD’s assessment of business control.

Section 2: Gifting Funds

Complete this section if you are providing financial assistance to help another party obtain or operate an alcohol license. You may complete both Section 1 and Section 2 if both an ownership transfer and a fund gift are occurring.

Name of Entity/Person(s) Gifting Funds – Identify the full legal name of the person or business that is providing the gift funds. This is the party that will be signing the form and providing the authorization and release.

SSN/FEIN – If the entity gifting funds is an individual, provide their Social Security Number (SSN). If the entity is a business (corporation, LLC, partnership, etc.), provide the Federal Employer Identification Number (FEIN). This information allows ABCD to verify the identity and tax status of the gifting party and cross-reference records with other state agencies.

Mailing Address – Enter the complete street address where mail related to this transaction should be sent. Include the street number and street name. Do not use a post office box alone; provide the actual mailing address.

City – Write the name of the city or town where the mailing address is located.

State – Enter the two-letter state abbreviation (MT for Montana, or another state if the gifting party resides out of state).

ZIP – Provide the five-digit postal zip code for the mailing address.

Phone – Enter a current telephone number where the gifting party can be reached. Include the area code.

Email – Provide an email address for correspondence. While this field helps ABCD contact you quickly, verify that you monitor this email account regularly.

Name of Entity/Person(s) Receiving Gifted Funds – Write the full legal name of the party that will receive the gifted funds. This is typically the license applicant or the business owner who will use the funds to establish or operate the alcohol-licensed premise.

Amount of Funds Being Gifted – Enter the exact dollar amount of the gift in the space marked “$”. For example, if you are gifting $50,000, write “50000” or “$50,000.00” depending on the format preference. Be precise; approximations are not acceptable. This amount must match all supporting bank statements and documentation.

Source of Funding – Describe where the gift funds originated. Examples include: “Personal savings account,” “Sale of real estate,” “Inheritance from estate,” “Business revenue,” “Loan proceeds,” or “Investment withdrawal.” Be specific enough that ABCD can understand the legitimate basis for the funds. Vague descriptions such as “cash on hand” or “personal funds” may trigger additional scrutiny or requests for clarification.

Supporting Documentation Required – You must provide documents verifying the source of funding with this form. The standard requirement is 6 months of bank statements from the account(s) from which the funds originated. If funds come from multiple sources (for example, savings account plus sale of property), provide documentation for each source. Bank statements must clearly show the account holder’s name, the time period covered, and the account balance. If funds are coming from a business, provide the last 6 months of business bank statements or profit/loss statements. If funds are from an inheritance or settlement, provide copies of the relevant legal documents (will, trust distribution documentation, settlement agreement, etc.).

Critical Warning – The form explicitly states: “Do not complete any transactions above without prior approval from ABCD.” This means you cannot transfer funds or ownership, sign any agreements, or take any steps to execute the gift until ABCD has reviewed and approved the gifting statement and all supporting documentation. Proceeding without approval may result in denial of your alcohol license application.

Date Field

Date – Enter the date you are completing and signing the form in MM/DD/YYYY format (for example, 01/15/2026). This date should match the date you sign the form on page 2.

Page 2: Signature and Authorization Section

Signature of Person Gifting

Sign Here (X) – The person gifting funds or ownership must personally sign this line. Your signature certifies that all information provided on the form is accurate and truthful. A printed or stamped signature is not acceptable; the signature must be in the signer’s own handwriting.

Printed Name – Below the signature line, print your full legal name in legible block letters. This name must match the name provided in the “Name of Entity/Person(s) Gifting” field on page 1.

Phone – Provide a current phone number where you can be contacted regarding this gifting statement.

Date – Write the date you signed the form in the same MM/DD/YYYY format as page 1. The date on page 2 should match the date on page 1.

Authorization and Release Section

This section is a binding legal authorization that permits Montana state agencies to access, review, and use your personal and financial records to evaluate your eligibility and the legitimacy of the gifting transaction.

Opening Statement – The form begins: “I, [your name] (person gifting), do hereby authorize a review, full disclosure, and release of any and all records concerning me to any duly authorized officer, agent, or employee of the Montana Department of Revenue, Alcoholic Beverage Control Division, or Montana Department of Justice, Gambling Control Division, that they determine relates to the applicant’s qualifications for alcoholic beverage licensure, whether the records are of a public, private, or confidential nature.”

By signing this authorization, you are explicitly allowing Montana state officials to obtain and review records that might normally be protected, including:

- Bank records and financial account information

- Tax returns and IRS documents

- Criminal history records

- Gambling records

- Employment history

- Business registration documents

- Property ownership records

Understanding Point 1 – “The information reviewed, disclosed, or released may be used by the State of Montana to determine whether to issue an alcoholic beverage license to the applicant in accordance with MCA§16-4-401.”

This means state officials will use the records they obtain to assess whether the applicant (the party receiving the gift) meets Montana’s qualifications for holding an alcohol license. Records may reveal criminal convictions, prior license denials, financial instability, or other disqualifying factors.

Understanding Point 2 – “I release the providers of the information collected pursuant to this authorization of any liability under state or federal privacy laws and further release the State of Montana, its officers, agents and employees from any liability that may be incurred as a result of the collections and lawful use of the information.”

This clause protects banks, employers, government agencies, and other record providers from lawsuits if they disclose your information to ABCD. It also protects ABCD from liability for how they use the information. By signing, you waive your right to sue for unauthorized disclosure of private information in this context.

Understanding Point 3 – “If this authorization is not sufficient to obtain access to certain records, I may be requested to execute some other appropriate authorization or release and that any failure to do so may be taken into consideration by the Montana Department of Revenue, Alcoholic Beverage Control Division, in its review of this alcoholic beverage license application.”

Some banks or agencies may require additional specific authorizations to release records. If ABCD requests an additional form, you must sign it. Refusing to do so may result in ABCD denying the alcohol license application, even if other aspects of your gifting statement are acceptable.

Understanding Point 4 – “I understand that I may revoke this authorization in writing at any time and that the Montana Department of Revenue, Alcoholic Beverage Control Division alcoholic beverage license application.”

You retain the right to withdraw your authorization in writing, but doing so after your application has been submitted may negatively affect the outcome of your alcohol license application.

Understanding Point 5 – “The validation period for this authorization is not to exceed one year and may be reaffirmed if required by the Montana Department of Revenue, Alcoholic Beverage Control Division.”

This authorization is valid for up to one year from the date of signing. If ABCD needs to extend their review beyond one year or if circumstances change, they may ask you to sign an updated authorization. Plan accordingly and keep signed copies.

Understanding Point 6 – “A photocopy or electronic copy of this authorization has the same force and effect as the original.”

This confirms that if you submit a scanned or photocopied version of the signed form, it has the same legal weight as the original. You do not need to mail the original document.

Notarization Section

State of – Enter the name of the state where the notarization is taking place.

County of – Write the name of the county within that state.

Date – Enter the date of notarization in the format provided (day of February, 202026).

Notary’s Attestation – The notary public will write the text: “[Your name] personally appeared before me, a Notary Public of the State of [state].”

Notary Signature – The notary must sign their name in full.

Print Name of Notary – The notary must legibly print their name below their signature.

My Commission Expires – The notary will write the expiration date of their notary commission.

Critical Requirement – The notary’s seal or stamp must be affixed to the form. An unnotarized form will not be accepted by ABCD.

Mailing Instructions and Contact Information

Where to Mail – Send your completed, signed, notarized Gifting Statement Form along with all supporting documentation (bank statements, proof of source of funds, primary license application, etc.) to:

Alcoholic Beverage Control Division

PO BOX 1712

Helena, MT 59604-1712

Important Note – The form instructions state: “This form usually accompanies a license application form.” Do not submit the Gifting Statement Form by itself; include it with your primary alcohol license application (Form 5, Short Form, or other applicable ABCD form).

Contact ABCD – If you have questions while completing the form, email the Alcoholic Beverage Control Division at DORABCD-O&E@mt.gov. The division staff can clarify field requirements, advise on documentation standards, and provide estimated processing timelines.

Important Considerations And Best Practices

Approval Is Mandatory – Never execute any gifting transaction before ABCD approves the Gifting Statement Form. Transferring funds or ownership before approval may void the application or result in license denial.

Documentation Must Be Complete – Incomplete or unclear bank statements, missing proof of source, or vague descriptions of the funding source will result in requests for additional information, delaying your application.

Accuracy Is Critical – Any discrepancies between the amounts listed on the Gifting Statement Form and the supporting bank statements will trigger additional review. Ensure all figures match exactly.

Use Current Contact Information – Provide phone numbers and email addresses you actively monitor. ABCD may need to contact you quickly to request clarifications or additional documents.

Plan for Processing Time – Factor in 2-4 weeks (or longer during peak licensing periods) for ABCD to review and approve your gifting statement. Do not plan to launch your alcohol business until you receive written approval.

Keep Copies – Retain copies of the completed, signed, and notarized form along with all supporting documentation for your records.