Tax laws are the foundation of public services, and when individuals or businesses evade them, it harms everyone in the state. Montana Form STFIR, officially the Information Referral Form, is the confidential channel provided by the Department of Revenue for citizens to report suspected tax fraud or non-compliance. Whether it’s unreported income, false deductions, or a failure to file returns, this form allows you to provide the department with the leads they need to investigate. It is designed to gather specific details about the alleged violator and the nature of the offense. It is important to know that the Department of Revenue does not offer rewards for this information, and due to strict confidentiality laws, you will not receive any feedback or updates on the status of your referral. However, your report can be the key to recovering lost public funds. While you have the option to remain anonymous, providing your contact information can be incredibly helpful if investigators need to clarify details.

How To File Montana Form STFIR

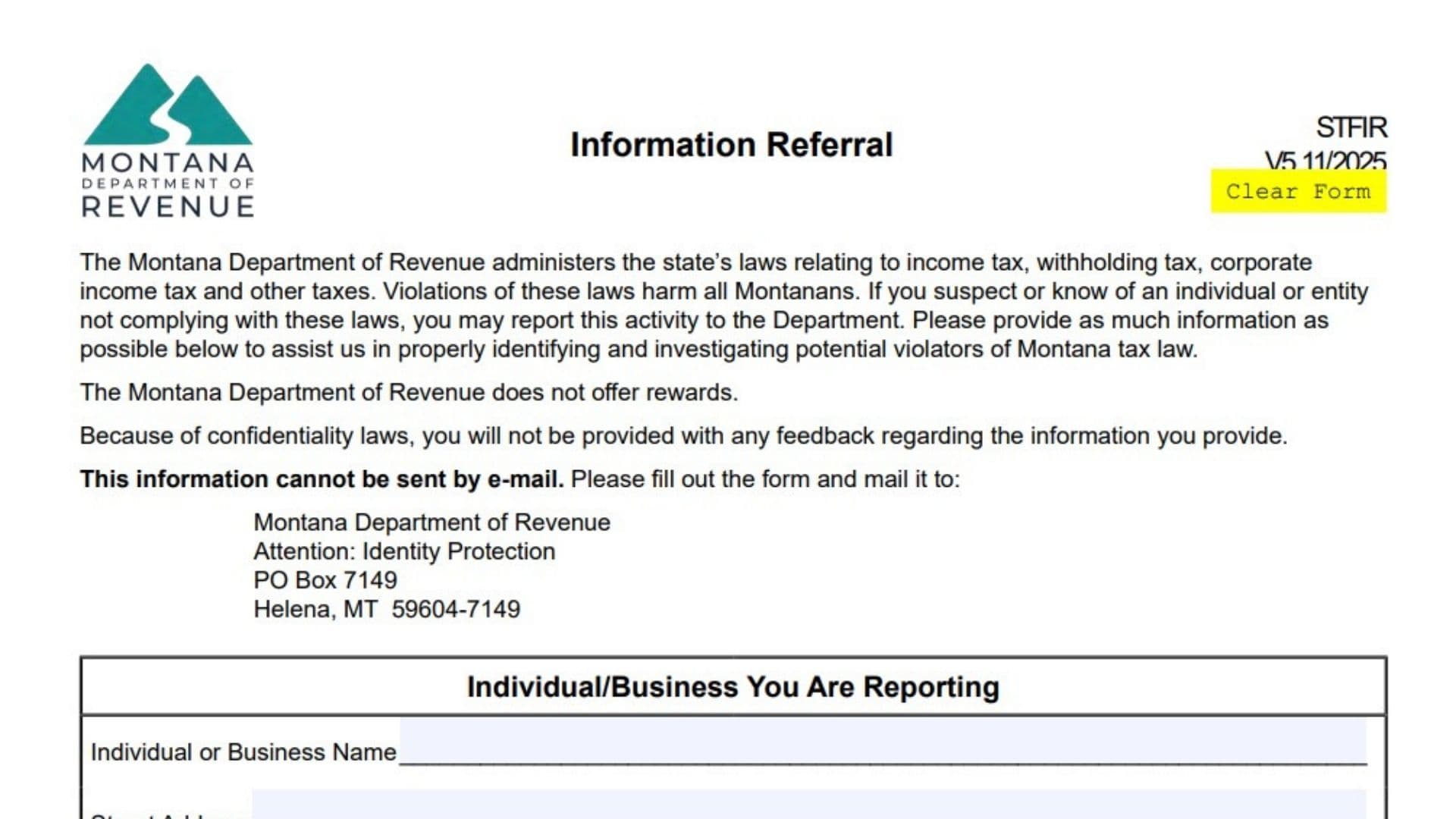

Due to the sensitive nature of the information, this form cannot be submitted digitally via email.

- Preparation: Gather as much factual information as possible about the individual or business you are reporting.

- Completion: Fill out the form with clear, specific details.

- Submission: Mail the completed form to the dedicated security unit at:

Montana Department of Revenue

Attention: Identity Protection

PO Box 7149

Helena, MT 59604-7149

How to Complete Montana Form STFIR

Individual/Business You Are Reporting

This section identifies the suspect. Fill in as much as you know; it’s okay if you don’t have every single detail.

- Individual or Business Name: Enter the full name of the person or company you suspect of violating tax laws.

- Street Address: Enter their physical location.

- Mailing Address: Enter their mailing address, if different.

- City/State/ZIP Code: Fill in the location details.

- Occupation or Type of Business: Describe what they do for a living or what industry the business is in.

- Name of Spouse: If applicable, provide the spouse’s name.

Identifying Numbers, If Known

- Social Security Number: Enter the suspect’s SSN if you have it.

- Federal I.D. Number: Enter the business’s FEIN if available.

Alleged Violation Of Montana Tax Law

Check all the boxes that apply to the situation you are reporting:

- False Exemption: Claiming exemptions they don’t qualify for.

- Failure to Pay Tax: Ignoring payment obligations.

- False Deductions: Inflating expenses to lower tax liability.

- Unreported Income: Earning money “off the books.”

- Multiple Filing: Filing more than one return for the same period.

- Unreported Sales: Selling goods without recording the transaction.

- Unsubstantiated Income: Income sources that can’t be proven.

- Failure to File Return: Not submitting tax forms at all.

- False/Altered Documents: Forging or changing financial records.

- Failure to Withhold Tax: Employers not taking tax out of paychecks.

- Other: Use this line for violations not listed above.

Detailed Narrative

- Description: Use the space provided to describe the facts leading to your suspicions. Focus on the Who, What, Where, When, and How. Be as specific as possible. If you need more room, you can attach another sheet of paper.

- Books/Records: Check Yes or No if you know whether financial records are available.

- Location of Records: If you checked Yes, describe where they are kept.

- Warning: The form explicitly instructs: “Please do not attempt to obtain and/or make photocopies of books or records yourself.” Leave the investigation to the professionals.

Your Contact Information (Optional)

This section is not required, but providing it allows the department to contact you if they have further questions. Your identity will be kept confidential to the extent permitted by Montana law.

- Your Name: Enter your full name.

- Address: Enter your mailing address.

- City/State/ZIP Code: Enter your location details.

- Telephone Number: Provide a number where you can be reached, including the area code.