Montana Form PWR, officially known as the Partnership E-File Waiver Request, serves as a critical tool for partnerships in Montana that face significant challenges in meeting the state’s electronic filing mandate for their Pass-Through Entity Tax Return (Form PTE). For tax years beginning after December 31, 2013, any partnership with more than 100 partners at any point during the tax year must electronically submit Form PTE using approved software from the Montana Department of Revenue, a requirement designed to streamline processing and reduce errors but which can create substantial burdens for certain entities due to technical limitations, high costs, or other barriers. This form allows qualifying partnerships to seek an exemption by proving that e-filing would cause undue hardship, such as prohibitive expenses for software upgrades, compatibility issues with existing systems, or operational disruptions that outweigh the benefits of electronic submission. By submitting Form PWR with detailed supporting documentation at least 30 days before the return due date (including extensions), partnerships can request permission to file a paper return instead, potentially avoiding late penalties that start at $10 per partner per month up to $2,500. The Department of Revenue reviews each request individually, responding within 25 days with an approval or denial, and approvals are granted only when clear evidence of hardship is provided alongside efforts to comply in the future. Understanding and properly completing Form PWR is essential for larger partnerships to maintain compliance without incurring unnecessary financial or administrative strain, especially as the state continues to emphasize digital filing while providing this waiver pathway under Montana Code Annotated 15-30-3315.

What Is Montana Form PWR?

Montana Form PWR enables partnerships required to e-file their Form PTE to request a waiver based on demonstrated undue hardship. The state mandates electronic filing for partnerships exceeding 100 partners during the tax year to improve efficiency and accuracy in processing pass-through entity returns. Waivers are not automatic and require thorough justification. The form ensures the Department of Revenue can evaluate whether paper filing is truly necessary while encouraging future e-filing capabilities. Filing a waiver does not extend the original due date of Form PTE, and late submissions still trigger penalties even if a waiver is later approved.

Who Needs To File Form PWR?

Any partnership with more than 100 partners (counted at any time during the tax year) that cannot comply with Montana’s e-filing rule for Form PTE must submit this waiver request if they wish to file on paper. Smaller partnerships generally face no e-filing mandate and do not need this form. Entities must prove hardship rather than preference to qualify for approval.

When And How To Submit Form PWR

Submit Form PWR along with all supporting documents no later than 30 days before the due date of your Form PTE, including any automatic extensions. The Department of Revenue processes requests and issues a decision (approval or denial) within 25 days of receipt.

You have three submission options:

- Electronically — Log into the TransAction Portal (TAP) at https://tap.dor.mt.gov and use the Web Messaging feature to upload the form and attachments.

- By Fax — Send to 406-444-7723, attention Form PWR.

- By Mail or Delivery — Use USPS to Montana Department of Revenue, Attn: Form PWR, PO Box 5805, Helena, MT 59604-5805; or hand-deliver to 340 N Last Chance Gulch, Helena, MT 59601.

Do not submit the waiver with your actual tax return, extension request, or payment.

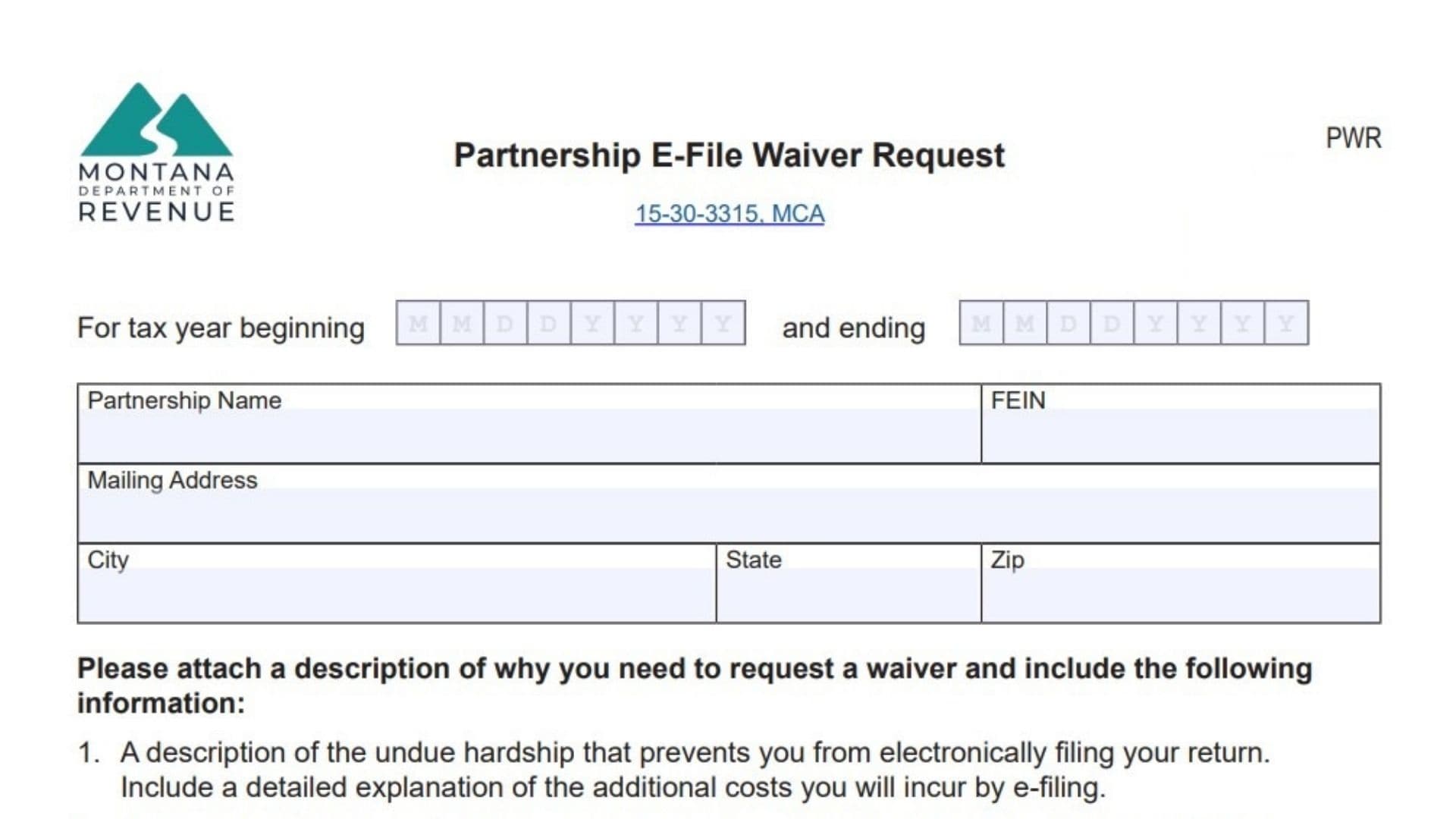

How to Complete Form PWR

Follow these detailed steps to fill out every section accurately—incomplete forms will be rejected automatically.

Tax Year Fields

Enter the starting month, day, and year of the tax period in the “For tax year beginning” boxes (MM DD YYYY format), then do the same for the ending date. Use the exact same tax year as your federal and Montana reporting to avoid mismatches.

Partnership Name

Provide the full legal name of the partnership exactly as it appears on federal and state tax documents.

FEIN

Input your Federal Employer Identification Number (the nine-digit EIN assigned by the IRS).

Mailing Address

Write the complete mailing address where the partnership receives correspondence.

City, State, Zip

Fill in the city, state abbreviation (MT if applicable), and full ZIP code associated with the mailing address.

Attachment Requirement

You must attach a separate written explanation addressing three specific points (numbered 1–3 on the form). Provide clear, detailed responses for each—vague or incomplete answers often lead to denial.

- Description of Undue Hardship → Explain thoroughly why electronic filing creates an excessive burden for your partnership. Include specifics like technical barriers, lack of compatible software for your operations, or other obstacles preventing e-filing. Always detail any extra costs involved, such as software purchases, training expenses, or consulting fees required to comply.

- Steps Taken to E-File → List any attempts you made to electronically file the return on time. For each effort, describe what happened and why it failed (e.g., software errors, vendor issues, or incompatibility problems).

- Steps for Future Compliance → Outline actions your partnership has taken or plans to take to enable electronic filing in upcoming tax years, such as researching new software, budgeting for upgrades, or training staff.

Number of Pages Submitted

Count this form plus all attachments (including your written explanation) and enter the total here.

Current Tax Software

Enter the name and version of any tax preparation software your partnership currently uses, even if it does not support Montana e-filing—this helps the department understand your situation.

Declaration Statement

Read the pre-printed declaration carefully. By signing, you affirm under penalty of perjury that you are authorized to submit this request and that all information is accurate to the best of your knowledge.

Signature and Date

An authorized partner or officer must sign here and enter the date (MM DD YYYY).

Printed Name and Title

Print the full name of the signer and their official title within the partnership (e.g., Managing Partner, CFO).

Contact Phone, Email, and Fax

Provide reliable contact details so the Department of Revenue can reach you with questions or clarification.

Preferred Response Method

Check one or more boxes to indicate how you want to receive the approval/denial decision:

- Fax

- Email with follow-up by mail

If you submit via TAP and leave this blank, the response will come through TAP messaging. Otherwise, mail is the default.

Important Reminder

Double-check that every field is complete—incomplete requests are returned unprocessed, which could leave you without a waiver and exposed to penalties.

Tips For A Successful Waiver Request

- Submit early — at least 30 days before your PTE due date — to allow time for processing and any follow-up.

- Be detailed and honest in your hardship explanation — approvals depend on strong evidence.

- Keep copies of everything you submit.

- Check approved e-filing software lists at MTRevenue.gov if exploring options for future years.

- Contact the Montana Department of Revenue at (406) 444-6900 or via MTRevenue.gov for questions.

Following these instructions carefully increases your chances of securing a waiver and avoiding costly late-filing penalties. Always refer to the latest form version on the official Montana Department of Revenue website.