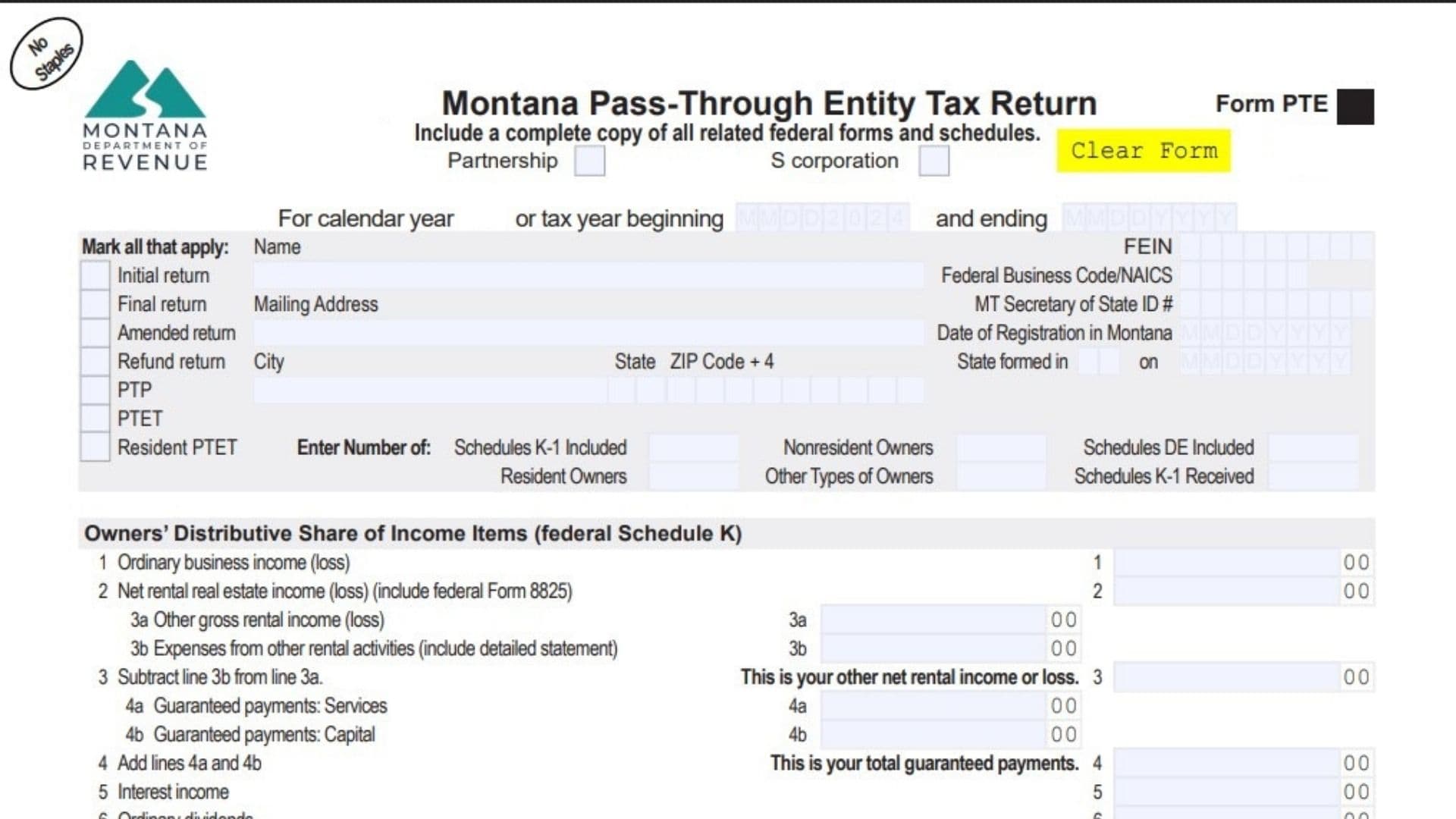

Montana Form PTE is the Pass-Through Entity Tax Return for the state of Montana. This form is used by pass-through entities, such as partnerships and S corporations, to report their income, deductions, and calculate any pass-through entity tax, composite tax, or withholding tax on behalf of their owners. It is a comprehensive document that accounts for the distributive share of income items for all owners, calculates Montana-source income, and determines the total tax liability for the entity and its members. The form consolidates information from various federal schedules and is used to report the entity’s activities and income that are apportioned or allocated to Montana. It is a critical document for ensuring that both the entity and its owners are compliant with Montana’s tax laws, especially for entities with non-resident owners or those making a pass-through entity tax election.

How To File Montana Form PTE

To file Form PTE, you must include a complete copy of all related federal forms and schedules. The form should be mailed to the Montana Department of Revenue. Ensure that all required fields are filled out, including the entity’s name, Federal Employer Identification Number (FEIN), and address. You will also need to indicate the tax year, whether it is a calendar year or a specific fiscal year. Mark the appropriate boxes for the type of entity (Partnership or S corporation) and the type of return (initial, final, amended, etc.). The form must be signed by an authorized officer of the entity. If a paid preparer was used, their information must also be included.

How To Complete Montana Form PTE

- Line 1: Ordinary business income (loss) – Enter the ordinary income or loss from the entity’s business activities.

- Line 2: Net rental real estate income (loss) – Report the net income or loss from rental real estate activities. Include federal Form 8825.

- Line 3a: Other gross rental income (loss) – Input the gross income or loss from other rental activities.

- Line 3b: Expenses from other rental activities – Provide the expenses associated with the other rental activities. Include a detailed statement.

- Line 3: Other net rental income or loss – Subtract line 3b from line 3a.

- Line 4a: Guaranteed payments: Services – Enter the guaranteed payments made to partners for services rendered.

- Line 4b: Guaranteed payments: Capital – Input any guaranteed payments made to partners for the use of capital.

- Line 4: Total guaranteed payments – Add lines 4a and 4b.

- Line 5: Interest income – Report the total interest income.

- Line 6: Ordinary dividends – Enter the total amount of ordinary dividends.

- Line 7: Royalties – Report any royalty income.

- Line 8: Net short-term capital gain (loss) – Input the net short-term capital gain or loss. Include federal Schedule D.

- Line 9: Net long-term capital gain (loss) – Enter the net long-term capital gain or loss. Include federal Schedule D.

- Line 10: Net section 1231 gain (loss) – Report the net gain or loss from the sale of business property. Include federal Form 4797.

- Line 11: Other income (loss) – Input any other income or loss not reported on the lines above. Include a detailed statement.

- Line 12: Total federal income or loss – Add lines 1 through 11.

- Line 13a: Section 179 deduction – Enter the Section 179 expense deduction. Include federal Form 4562.

- Line 13b: Contributions – Report any charitable contributions.

- Line 13c: Investment interest expense – Input the amount of investment interest expense.

- Line 13d: Section 59(e)(2) expenditures – Enter the amount of Section 59(e)(2) expenditures. Include a detailed statement.

- Line 13e: Other deductions – Report any other deductions. Include a detailed statement.

- Line 13: Total federal deductions – Add lines 13a through 13e.

- Line 14: Federal income from all sources – Subtract line 13 from line 12.

- Line 15: Montana additions to the PTE’s apportionable activities – Report any additions to income required by Montana law.

- Line 16a: Montana subtractions from the PTE’s apportionable activities – Enter any subtractions from income allowed by Montana law.

- Line 16b: Total everywhere income (loss) from federal Schedules K-1 – Input the total income or loss from all federal Schedules K-1 received.

- Line 16c: Total everywhere income (loss) from disregarded entities – Report the total income or loss from any disregarded entities.

- Line 16d: Other nonapportionable income (loss) from the PTE’s own activities – Input any other income or loss that is not subject to apportionment.

- Line 16: Deductions including nonapportionable income – Add lines 16a through 16d.

- Line 17: Add lines 14 and 15, then subtract line 16.

- Line 18: Business activity and apportionment – Mark the box that describes your business activity or enter your apportionment factor and multiply it by the amount on line 17.

- Line 19a: Total Montana source income received from pass-through entities – Enter the Montana source income from all Montana Schedules K-1 issued to this entity.

- Line 19b: Total Montana source income from Schedules VII – Input the total Montana source income from Schedule VII.

- Line 19c: Nonapportionable income allocated to Montana – Report any nonapportionable income specifically allocated to Montana.

- Line 19: Total nonapportionable income (loss) sourced to Montana – Add lines 19a through 19c.

- Line 20: Total Montana source income – Add lines 18 and 19.

Prepayments

- Line 21: 2024 payments – Enter the total estimated tax payments made for the 2024 tax year.

- Line 22: 2023 overpayment applied to 2024 – Report any overpayment from your 2023 return that was applied to your 2024 estimated tax.

- Line 23: Total prepayments – Add lines 21 and 22.

Pass-through Entity Tax, Composite Tax, and Pass-Through Withholding

- Line 24: Total taxable income subject to pass-through entity tax – Enter the total from all owners’ Montana Schedules K-1, Part IV, line 14.

- Line 25: Total pass-through entity tax – Input the total from all owners’ Montana Schedules K-1, Part V, line 1.

- Line 26: Flow-Through Payments Schedule, Column A, line 12 – Enter the amount from the Flow-Through Payments Schedule.

- Line 27: Pass-through entity tax due or (overpayment) – Subtract lines 23 and 26 from line 25.

- Line 28: Total composite tax from Schedule IV, Column H – Report the total composite tax from Schedule IV.

- Line 29: Flow-Through Payments Schedule, Column B, line 12 – Enter the amount from the Flow-Through Payments Schedule.

- Line 30: Composite tax and pass-through entity tax due or (overpayment) – Add lines 27 and 28, then subtract line 29.

- Line 31: Interest on underpayment of estimated tax – Calculate and enter any interest due on the underpayment of estimated tax.

- Line 32: Total pass-through withholding – Enter the total from all owners’ Montana Schedules K-1, Part V, line 3a.

- Line 33: PTE’s tax liability from an adjustment to partnership income – Report any tax liability resulting from an adjustment to partnership income.

- Line 34: Flow-Through Payments Schedule, Column C, line 12 – Enter the amount from the Flow-Through Payments Schedule.

- Line 35: Pass-through withholding and other partnership liability due or (overpayment) – Add lines 32 and 33, then subtract line 34.

- Line 36: PTE information return late filing penalty – Enter any penalty for filing the information return late.

- Line 37: Total PTE taxes with interest and/or penalty – Add lines 30, 31, 35, and 36.

Amended Return

- Line 38: For amended returns only – previously issued refunds – If filing an amended return, enter the amount of any refund issued for the original return.

- Line 39: For amended returns only – payments made with original return – If filing an amended return, enter the amount of any payment made with the original return.

- Line 40: Add lines 37 and 38, then subtract line 39.

Penalty and Interest

- Line 41: Late payment penalty – Enter any penalty for late payment of tax.

- Line 42: Interest – Enter any interest due on unpaid taxes.

- Line 43: Total tax, penalties, and interest – Add lines 40 through 42.

Amount Owed or Refund

- Line 44: Amount you owe – If line 43 is more than zero, enter the amount here.

- Line 45: Overpayment – If line 43 is less than zero, enter the amount of your overpayment here.

- Line 46: Amount to be applied to 2025 tax – Enter the portion of the overpayment on line 45 that you want to be applied to your 2025 estimated tax.

- Line 47: Refund – Subtract line 46 from line 45 to determine your refund amount.