The Montana Form PT-AGR, officially known as the Pass-Through Entity Owner Tax Agreement, is a crucial tax document for nonresident owners of pass-through entities (such as S corporations, partnerships, or disregarded entities) doing business in Montana. Its primary purpose is to establish a formal agreement between the nonresident owner and the Montana Department of Revenue. By signing this form, the nonresident owner (whether an individual, estate, trust, foreign C corporation, or domestic second-tier entity) agrees to timely file their own Montana income tax return and pay any taxes due on their share of the entity’s Montana-source income. This agreement effectively exempts the pass-through entity from having to withhold and remit taxes on behalf of that specific owner or include them in a composite return. Essentially, it shifts the responsibility of tax compliance from the entity back to the individual or business owner, ensuring the state still has jurisdiction to collect what is owed. Importantly, once filed, this agreement remains valid for subsequent tax years until it is explicitly revoked.

How To File Form PT-AGR

Filing this form is straightforward, but it requires attention to deadlines and submission methods.

- Due Date: You must file Form PT-AGR by the due date of the pass-through entity’s tax return, including any extensions.

- Do Not Attach: Never attach this form directly to the owner’s personal tax return or the entity’s Form PTE. If you do, it will not be processed as filed.

- Electronic Filing (Recommended): The most secure and efficient way to file is online through the Montana Department of Revenue’s TransAction Portal at

https://tap.dor.mt.gov. - Paper Filing: If you prefer mail, send the completed form to:

- Montana Department of Revenue

- Attn: Form PT-AGR

- P.O. Box 5805

- Helena, MT 59604-5805

- Retention: The pass-through entity itself is not required to file a new agreement every single year for existing owners. However, it must file new agreements for any new qualifying owners and keep copies of all effective agreements as part of its tax records.

How to Complete Form PT-AGR

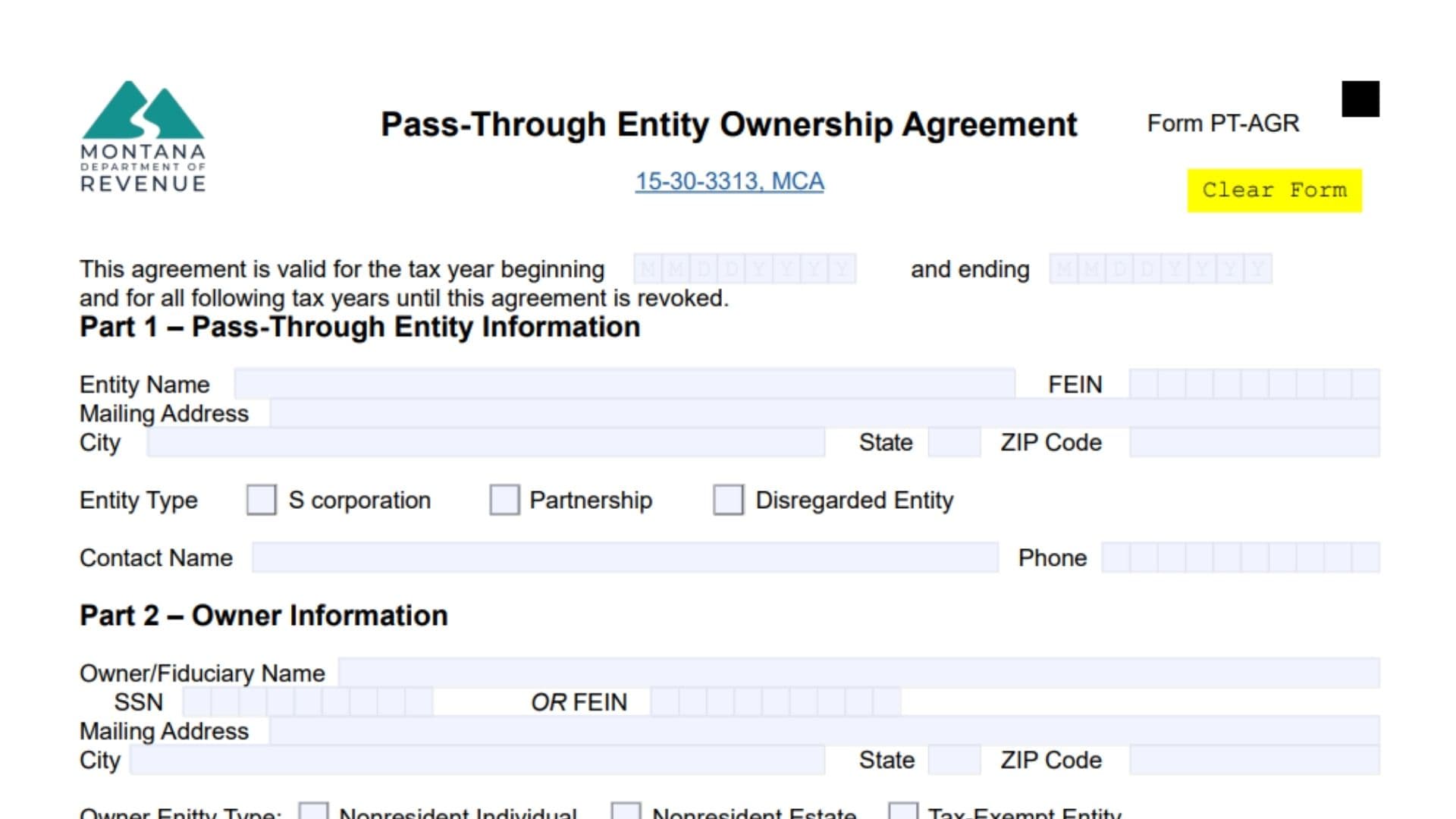

Header Information

- Tax Year Validity: Enter the beginning and ending dates for the tax year this agreement will first apply. Remember, this agreement stays valid for future years automatically unless you revoke it.

Part 1 – Pass-Through Entity Information

- Entity Name: Write the full legal name of the pass-through entity (the business) for which this agreement is being made.

- FEIN: Enter the entity’s Federal Employer Identification Number.

- Mailing Address: Provide the complete mailing address, including city, state, and ZIP code.

- Entity Type: Check the box that corresponds to how the entity is treated for federal tax purposes:

- S corporation (includes LLCs treated as S corps).

- Partnership (includes LLCs treated as partnerships).

- Disregarded Entity (includes single-member LLCs, qualified subchapter S subs, etc.). Note: Since 2019, disregarded entities already included on an owner’s Form PTE or CIT usually don’t need to file this form.

- Contact Information: Provide the name and phone number of a contact person for the entity.

Part 2 – Owner Information

- Owner/Fiduciary Name: Enter the full legal name of the owner (individual or business) entering into this agreement.

- SSN or FEIN: Provide the owner’s Social Security Number or Federal Employer Identification Number.

- Address: Fill in the owner’s full mailing address.

- Owner Entity Type: Check the specific box that describes the owner:

- Nonresident Individual

- Nonresident Estate

- Nonresident Trust

- Tax-Exempt Entity

- Foreign C corporation: Only check this if the corporation is not already doing business in Montana (if they are, they must file their own corporate return anyway).

- Domestic Second-Tier Pass-Through Entity: If you check this box, you must also complete Page 2 of the form.

Part 3 – Agreement And Signature

This section is the legal binding commitment. By signing, the owner agrees to:

- Timely file a Montana tax return (under relevant MCA codes depending on if they are an individual, corporation, or entity).

- Timely pay all taxes owed on their share of the entity’s income.

- Submit to Montana’s legal jurisdiction for tax collection purposes.

- Signature: The owner or fiduciary must sign and date the form.

- Phone: Provide a contact number.

- Foreign C Corp: If the owner is a Foreign C Corporation, print the name and title of the person signing.

Part 4 – Revoke The Agreement

- Revocation: Only use this section if you want to cancel a previously filed agreement.

- Years: Specify the tax years for which the revocation applies.

- Signature: Sign and date here to finalize the revocation.

Page 2: Domestic Second-Tier Pass-Through Entity Owner Information

(Only complete this page if you checked “Domestic Second-Tier Pass-Through Entity” in Part 2)

- Entity Identification: Enter the Name and FEIN of the Domestic Second-Tier Entity again at the top.

- Owner List (Lines 1-12): You must list all direct and indirect owners (partners, shareholders, members) of this second-tier entity. For each owner, provide:

- Name: Full legal name.

- Address: Street, City, State, ZIP.

- Entity Type: How is this owner classified?

- ID Number: Their FEIN or SSN.

- Ownership Details: Enter the FEIN of the specific entity this person owns an interest in, along with their percentage of ownership.

- Additional Space: If you have more than 12 owners, make copies of this page to list the rest. Do not submit this data in a different format (like a spreadsheet); use the official form page.Pass-Through_Entity_Owner_Tax_Agreement_Form_PT-AGR.pdf