Montana Form PIRA is an annual report required under Montana law for farm implement and construction equipment dealers who rent equipment under a purchase incentive rental program. The report covers farm implements as defined in Montana Code Annotated 30-11-801 and construction equipment as defined in MCA 30-11-901, and it must be filed annually by March 31.

Qualification Rules For The Exemption

To qualify for the exemption, the equipment must meet all three of these conditions:

- Owned by a farm implement or construction equipment dealership

- Held for sale (inventory)

- Rented to a single user as an incentive for purchasing the property

Equipment does not qualify if any of these apply:

- Rented to a person for more than nine months

- Rented more than once to the same person

- Not owned by a farm implement or construction equipment dealership

Where To File Montana Form PIRA

Return the completed form to the local Montana Department of Revenue field office serving the county where your dealership is located. Mailing addresses and contact information for local field offices are available at MTRevenue.gov.

How To Complete Montana Form PIRA

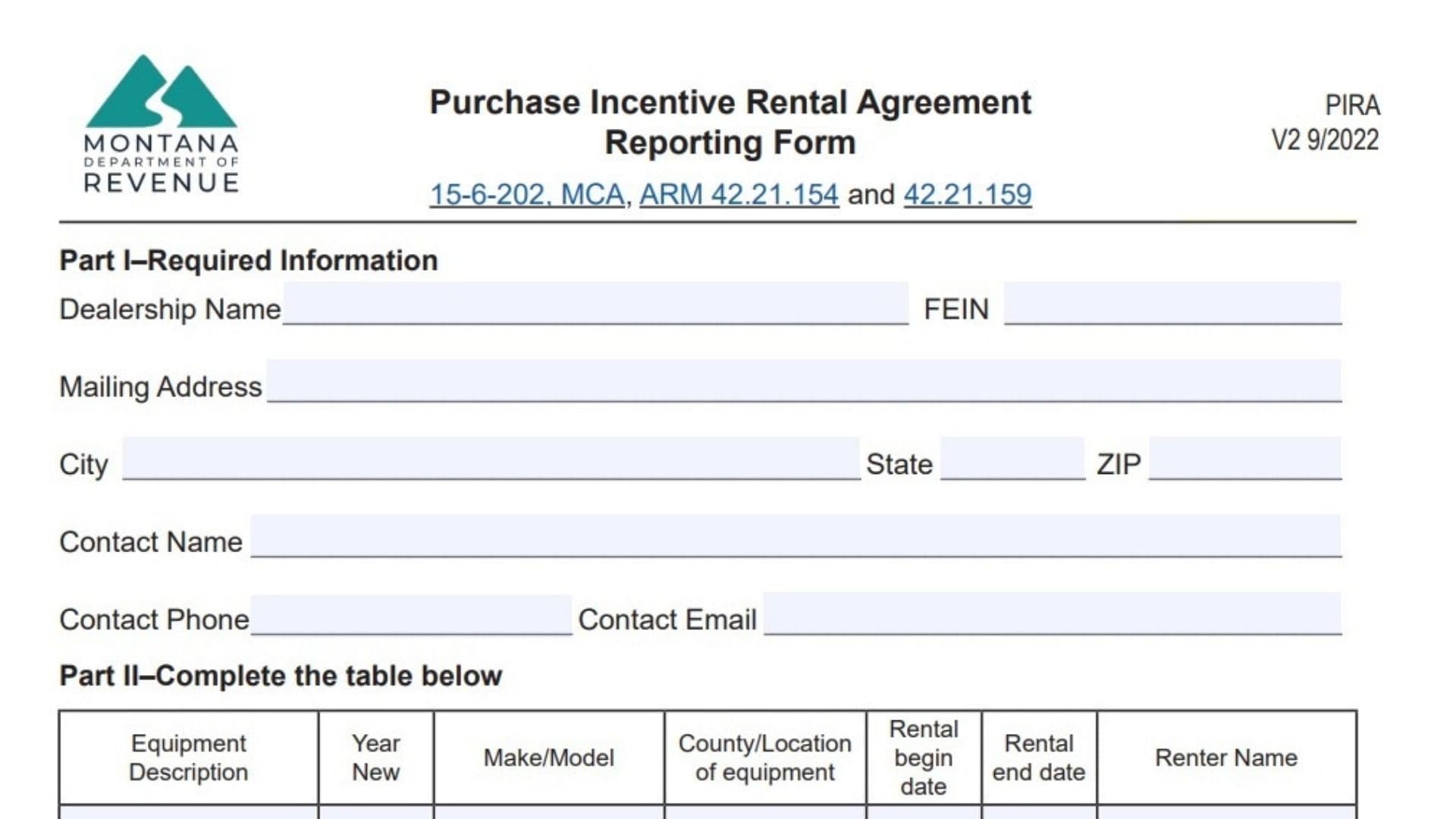

Form Header

Purchase Incentive Rental Agreement Reporting Form / PIRA / V2 9/2022

This identifies the form name, abbreviation, and version; you don’t fill this in.

15-6-202, MCA, ARM 42.21.154 And 42.21.159

These are the legal authority references; you don’t fill this in.

Montana Law Requires Farm Implement And Construction Equipment Dealers To Report Annually By March 31…

This is the filing requirement notice; note the March 31 deadline.

Part I – Required Information

Dealership Name

Enter the legal name of your dealership.

FEIN

Enter your Federal Employer Identification Number.

Mailing Address

Enter your dealership’s mailing address.

City

Enter the city.

State

Enter the state.

ZIP

Enter the ZIP code.

Contact Name

Enter the name of the person the department should contact if they have questions about the report.

Contact Phone

Enter the contact person’s phone number.

Contact Email

Enter the contact person’s email address.

Part II – Complete The Table Below

This table lists each piece of equipment rented under your purchase incentive rental program during the reporting period.

Equipment Description

Describe the type of equipment (for example, tractor, excavator, combine, bulldozer).

Year New

Enter the year the equipment was new (the model year or year of manufacture).

Make/Model

Enter the manufacturer name and model designation.

County/Location Of Equipment

Enter the Montana county where the equipment is located while rented, or specify the location as appropriate.

Rental Begin Date

Enter the date the rental agreement started.

Rental End Date

Enter the date the rental agreement ended (or is scheduled to end).

Renter Name

Enter the name of the person or business renting the equipment.

For Auditing Purposes, The Department May Request Copies Of The Purchase Incentive Rental Program Agreements

This is a notice that you should keep copies of rental agreements on file because the department may ask for them during an audit.

Signature Section

Signature

The authorized person (dealer representative) signs here.

Date

Enter the date the form is signed.

Printed Name

Print the name of the person who signed.

Title

Enter the signer’s title (for example, owner, manager, accountant).

Questions And Contact Information

Questions? Call Us At (406) 444-6900, Or Montana Relay At 711 For Hearing Impaired

Use this contact information if you need help completing or filing the form.

Filing Checklist

- Confirm all equipment listed qualifies (owned by dealership, held for sale, rented to single user as purchase incentive, not rented to same person more than once, rental period does not exceed nine months).

- Complete Part I with accurate dealership and contact information.

- List each qualifying rental agreement in Part II.

- Sign and date the form.

- Submit by March 31 to your local Montana Department of Revenue field office.

- Keep copies of rental agreements for audit purposes.