Montana Form MW-4, also known as the Montana Employee’s Withholding and Exemption Certificate, is a tax form used by employees to guide their employer in withholding the correct amount of Montana state income tax from their wages. This form is critical for both employees and employers, as it ensures that the proper tax amount is withheld, reducing the chance of underpayment at the end of the year. Employees complete this form when they start a new job, wish to claim exemptions, or when there are significant changes in their personal or financial situation, such as marriage or additional dependents. The form also allows employees to specify additional withholding amounts for tax purposes. If you’re exempt from withholding or want to change your withholding amounts for other reasons, completing this form is essential. It’s also important for employees who receive pensions, annuities, or unemployment compensation as they can have Montana tax withheld from those payments as well.

How to File Montana Form MW-4

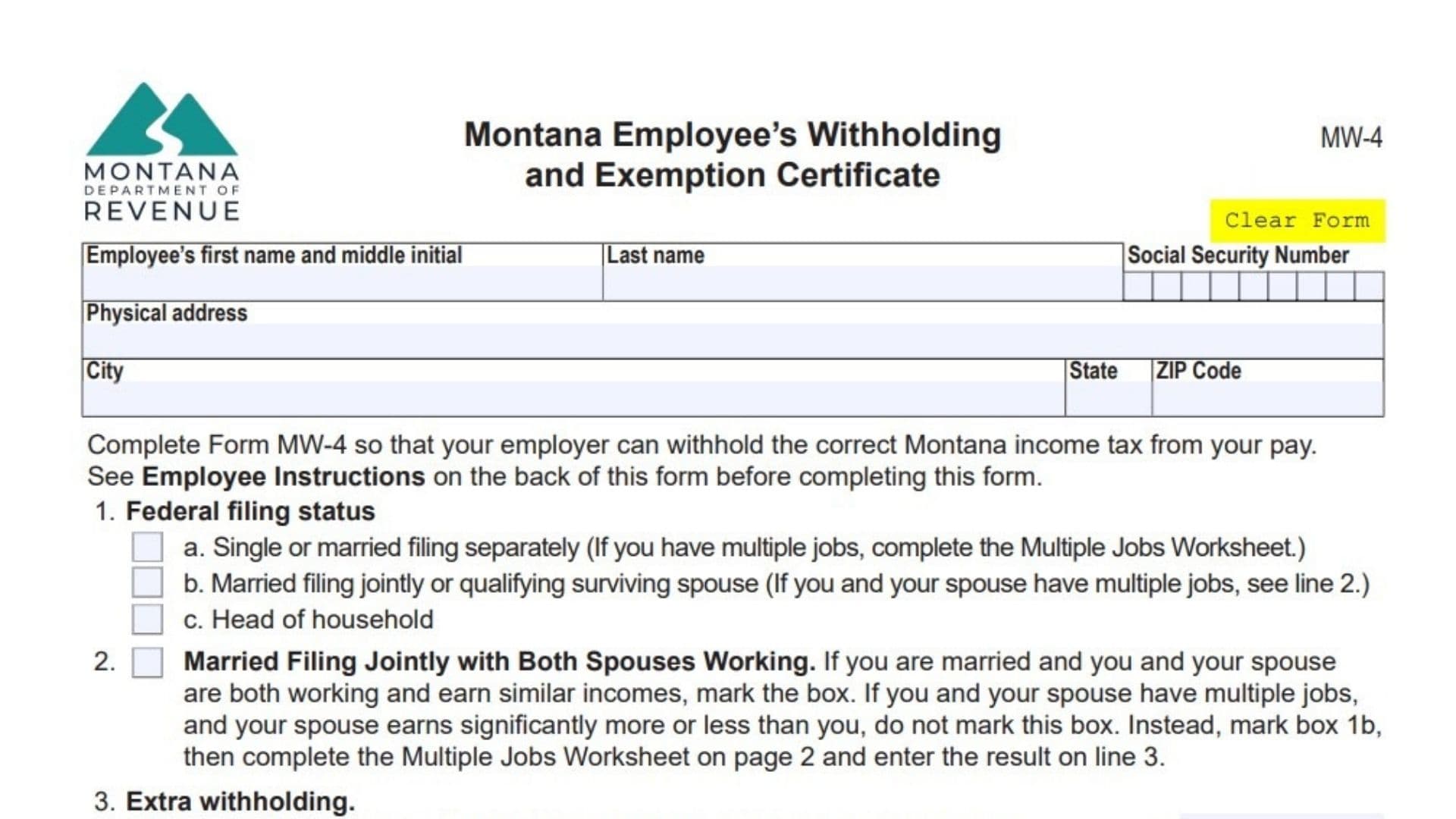

- Download the Form:

- You can obtain the Form MW-4 from the Montana Department of Revenue website, or you can request it from your employer.

- Fill Out Your Personal Information:

- On the form, enter your full name, Social Security number, address, and contact details (optional). Make sure to complete the name and address used on the original tax return if they differ from your current details.

- Complete the Withholding Information:

- Line 1: Choose your federal filing status (Single, Married filing jointly, or Head of Household). This will help determine your withholding rate. If you have multiple jobs, complete the Multiple Jobs Worksheet.

- Line 2: If both you and your spouse are working and earning similar amounts, check the box for Married Filing Jointly with both spouses working. If your incomes are significantly different, do not mark this box and instead complete the Multiple Jobs Worksheet on the highest-paying job.

- Line 3: If you wish to have extra withholding (beyond the standard rate), enter the additional amount you would like withheld each pay period.

- Line 4: For specified withholding, you can indicate a set amount you wish to withhold from retirement distributions or unemployment compensation.

- Line 5: Claim exemptions if applicable. You can claim exemption from Montana income tax if your income meets specific criteria, such as being an enrolled tribal member working on a reservation, a member of the military, or a North Dakota resident. Make sure to mark the correct exemption box and complete line 1 or 2.

- Employee’s Signature:

- Sign and date the form to confirm that all information is correct to the best of your knowledge.

- Employer Information:

- The form will require employer details such as the employer’s name, Federal Employer Identification Number (EIN), and Montana Withholding Account ID.

How to Complete Montana Form MW-4

Part I: Personal Information

- Employee’s Name, SSN, Address:

- Fill in your full name, Social Security Number, and physical address.

- If your address on the original return is the same as above, simply write “Same” for quicker processing.

- Federal Filing Status:

- Select your federal filing status:

- Single or Married Filing Separately

- Married Filing Jointly or Qualifying Surviving Spouse

- Head of Household

- Select your federal filing status:

- Married Filing Jointly with Both Spouses Working:

- If you and your spouse both work and earn similar incomes, check the box for “Married Filing Jointly with Both Spouses Working.” If not, and you have multiple jobs, mark Box 1b and complete the Multiple Jobs Worksheet.

- Extra Withholding (Line 3):

- If you want an additional amount withheld from each paycheck, fill in Line 3 with the amount.

- Specified Withholding (Line 4):

- Enter the amount you wish to be withheld from retirement distributions or unemployment compensation. If applicable, adjust withholding to match anticipated tax credits or adjustments.

- Claim Exemptions (Line 5):

- If you believe you are exempt from Montana withholding due to residency, tribal enrollment, or military status, mark the corresponding box. Be sure to also complete Line 1 or 2.

- Examples of exemptions:

- Enrolled tribal members working on their reservation.

- Members of the U.S. military under certain orders.

- North Dakota residents due to the reciprocity agreement between Montana and North Dakota.

Part II: Multiple Jobs Worksheet

- If you have multiple jobs or are married with both spouses working, complete this worksheet:

- Line 1: For two jobs, find the withholding amount based on your household income and enter the value.

- Line 2: If there are three jobs, complete Lines 2a, 2b, and 2c for a more accurate withholding amount. This helps calculate the correct extra withholding across all jobs.

What to Do Next

- Submit the Form to Your Employer: After filling out the form, submit it to your employer to ensure that the correct amount of Montana income tax is withheld from your paycheck.

- Update Annually or When Situations Change: If your income, filing status, or exemption status changes during the year, submit an updated form to avoid under-withholding or over-withholding of taxes.

- Renewal for Exemptions: Exemptions need to be renewed each year, so ensure your employer has an updated Form MW-4 each year or if your situation changes.

Where to File

- Employers are responsible for filing a copy of the Form MW-4 with the Montana Department of Revenue for employees claiming an exemption. This form is due annually by January 31st or by the last day of the payroll period when the form was received. The filing is done electronically via the Montana TransAction Portal (TAP).