Montana Form MW-1 (Montana Withholding Tax Payment Voucher) is a simple remittance form used by employers and other withholding agents to accompany a check when paying Montana state withholding tax liabilities. It helps the Montana Department of Revenue accurately credit your payment to the correct account and tax period, preventing processing delays or misapplications. While the state strongly promotes electronic payments via the TransAction Portal (TAP) or tax software (especially for payments of $50,000 or more, which are mandatory electronically), this voucher serves as the paper alternative for smaller amounts or situations where e-filing isn’t feasible. Use it when paying for paper-filed returns or estimated payments, and always detach it from your return without stapling.

How To File Montana Form MW-1

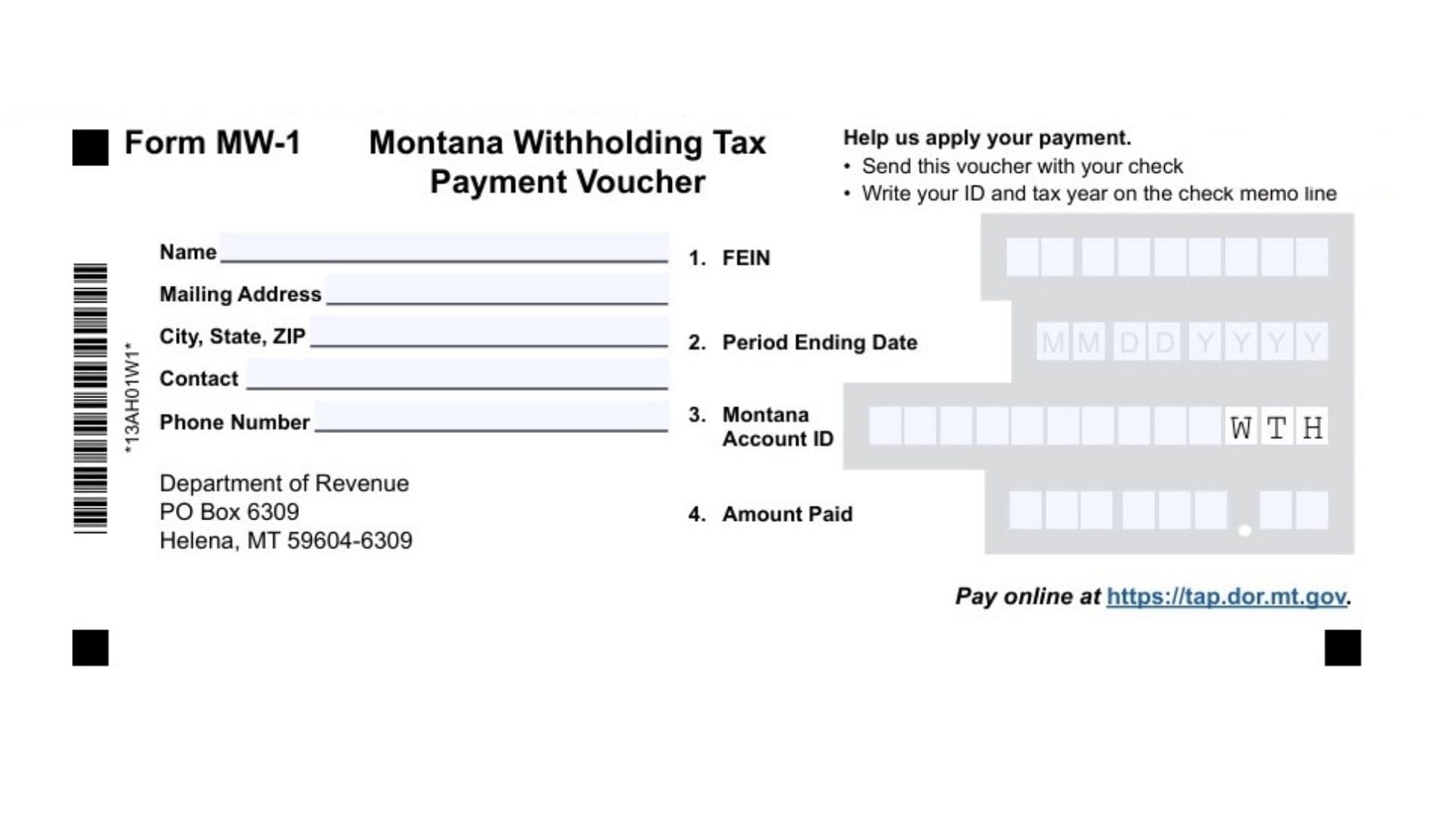

Form MW-1 is submitted with your check (never cash) to the Montana Department of Revenue. Do not staple or tape the voucher to the check or your tax return.

Mailing Address:

Montana Department of Revenue

PO Box 6309

Helena, MT 59604-8021

Electronic Alternatives (Recommended):

- TransAction Portal (TAP): Free e-check or credit/debit card (small fee) at

https://tap.dor.mt.gov. - Tax Software: Many programs allow payments during e-filing or scheduled future payments.

- Mandatory E-Pay: Required for payments ≥ $50,000.

Key Tips: Use a separate voucher for each tax period if paying multiple. Write your ID and tax year on the check’s memo line.

How To Complete Montana Form MW-

The form is straightforward—fill out the voucher section, detach along the cut line, and mail with your check.

- Name: Enter the full legal name of the business or entity making the payment.

- Mailing Address: Provide your street address, city, state, and ZIP code.

- Contact: Enter the contact person’s name.

- Phone Number: Write a daytime phone number for any questions.

- Line 1: FEIN: Enter your Federal Employer Identification Number (9 digits).

- Line 2: Period Ending Date: Enter the tax period end date in MM/DD/YYYY format (e.g., for Q1 2026, use 03/31/2026).

- Line 3: Montana Account ID: Enter your Montana Withholding Tax Account ID.

- Line 4: Amount Paid: Enter the dollar amount of the enclosed check.

Detach and Mail: Cut along the perforated line, place loose in the envelope with your check, and send to the address above.