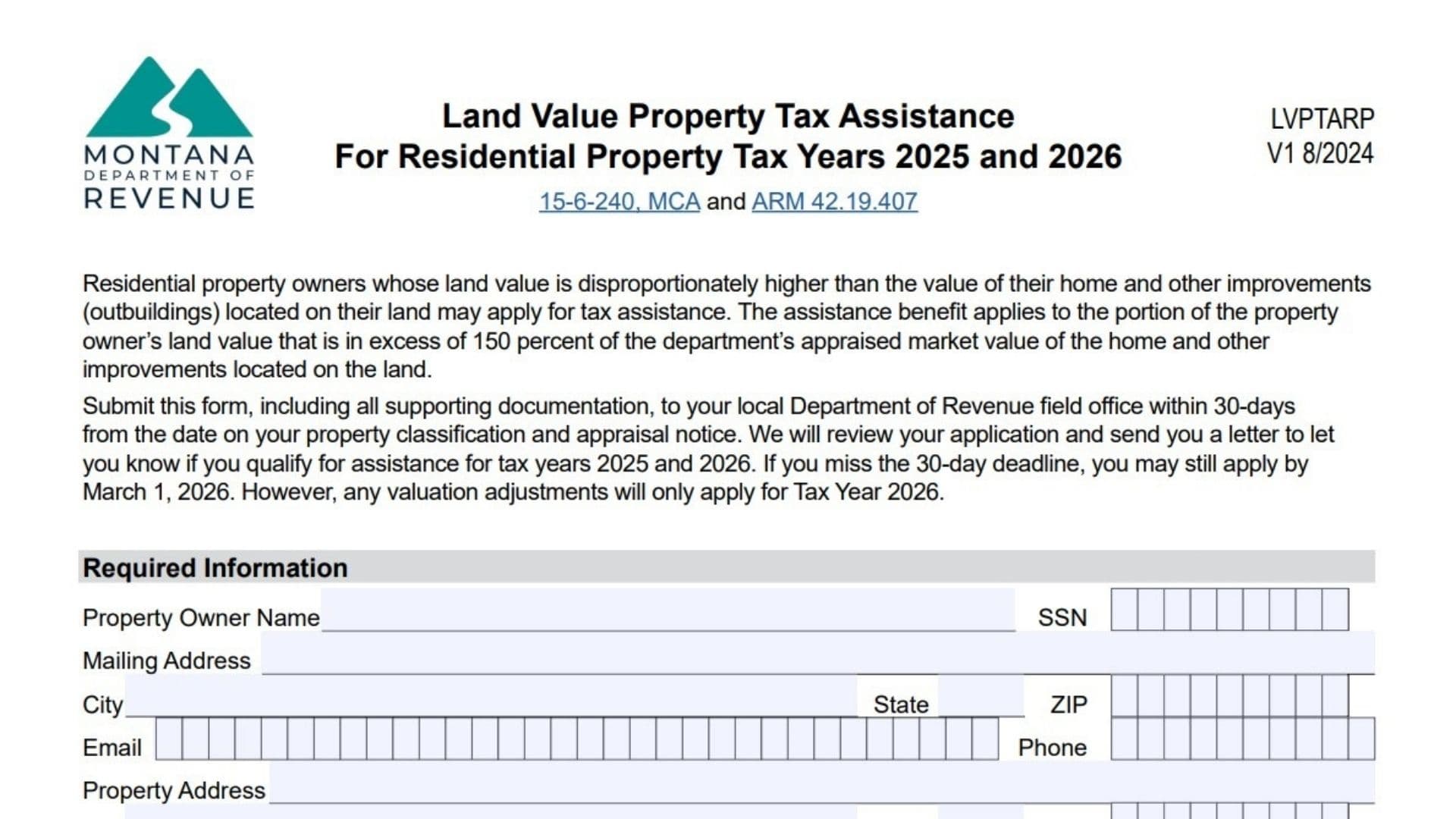

Form LVPTARP, “Land Value Property Tax Assistance for Residential Property,” is a tax relief application for residential property owners in Montana whose land value is significantly higher than the value of their home and other improvements. Specifically, this program assists when the appraised market value of the land exceeds 150% of the value of the home and outbuildings. The assistance essentially reduces the taxable value of the portion of the land that exceeds this 150% threshold. To qualify for the full two-year cycle (Tax Years 2025 and 2026), you must own the home, use it as your primary residence for at least seven months a year, and the land must have been owned by you or a close family member for at least 30 consecutive years.

How To File This Form

You must submit this completed form, along with all required supporting documentation, to your local Department of Revenue field office. The ideal deadline is within 30 days of the date on your property classification and appraisal notice to receive benefits for both 2025 and 2026 tax years. If you miss this window, you can still apply by March 1, 2026, but the tax assistance will only apply to the 2026 tax year.

How to Complete Montana Form LVPTARP

Required Information Section

Property Owner Name

Enter the full legal name of the property owner.

Social Security Number

Provide the property owner’s Social Security Number (SSN).

Mailing Address

Enter the address where you receive your mail, including city, state, and ZIP code.

Contact Details

List a valid email address and phone number where the department can reach you if they have questions.

Property Address

Enter the physical address of the property for which you are seeking tax assistance.

Property Identifiers

You must enter the Property Geocode and Assessment Code. These numbers can typically be found on your property tax bill or classification notice.

Qualifying Questions (Lines 1-5)

Question 1: Value Comparison

You must determine if your land value is more than 150% of your home’s value. Check “Yes” or “No.” You can verify this by checking your electronic property record card at property.mt.gov; eligible properties will have a specific note in the “Value History” section.

Question 2: Acreage Limit

Confirm if your home is located on five acres of land or less. Check “Yes” or “No.”

Question 3: Primary Residence

Indicate whether you own and occupy the home as your primary residence for at least seven months out of the year. The department may ask for proof of this residency. Check “Yes” or “No.”

Question 4: 30-Year Ownership Rule

This is a critical eligibility requirement. You must confirm if the land has been owned by you or a family member within the third degree of consanguinity (parents, children, siblings, grandparents, aunts/uncles, nieces/nephews) for at least 30 consecutive years. Check “Yes” or “No.” If “Yes,” you must attach supporting documents like deeds, tax records, or bills of sale to prove this continuous family ownership.

Question 5: Rental Status

Indicate if your home is rented out at any time during the year you are applying for. Check “Yes” or “No.”

Affirmation And Signature

Signature And Date

The property owner must sign and date the application. By doing so, you are affirming under penalty of false swearing that all information provided is true and complete.

Printed Name

Clearly print the name of the property owner who signed the form.