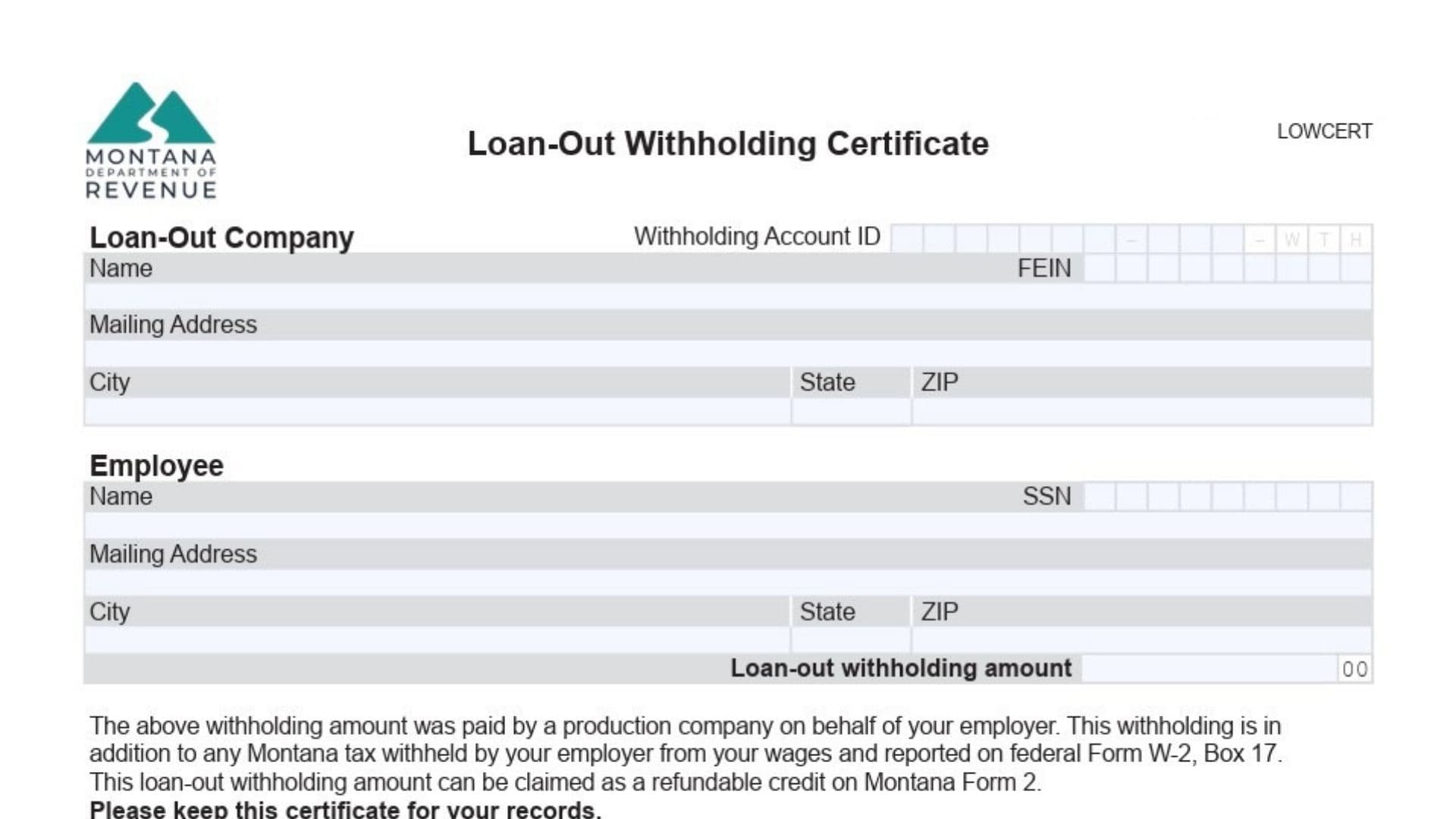

The Montana Loan-Out Withholding Certificate, often referred to as Form LOWCERT, is a critical tax document used in the film and production industry to verify specific tax payments made on behalf of a performing artist or crew member. When a production company hires a loan-out corporation (a personal service corporation set up by the talent), the production company is often required to withhold taxes from payments made to that loan-out entity. This certificate serves as the official proof that these “loan-out withholding” amounts were actually paid to the Montana Department of Revenue. Unlike standard wage withholding that appears on a W-2, this specific withholding is separate and is paid by the production company, not the direct employer. The primary purpose of this form is to give the employee a paper trail so they can claim this amount as a refundable credit on their personal Montana Form 2 income tax return. Essentially, it acts as a receipt ensuring the individual doesn’t pay tax twice on the same income—once when the production company withheld it, and again when they file their personal taxes.

How To File Form LOWCERT

Unlike a standard tax return, this form is not typically mailed directly to the Department of Revenue by itself. Instead, the loan-out company completes this certificate and issues it to the employee. The employee then keeps this certificate for their personal records to substantiate the credit claimed on their Montana Form 2 tax return. It essentially functions like a W-2 or 1099—it is a supporting document for the taxpayer’s annual filing.

How To Complete Form LOWCERT (Line-By-Line Instructions)

The form is divided into three main sections: the company details, the employee details, and the financial figures. Since the form often contains two copies separated by a cut line, you should ensure both sections are identical if you are providing multiple copies.

Loan-Out Company Information

Withholding Account ID

Enter the specific Montana Withholding Account ID assigned to the loan-out company. This ensures the payment is tracked to the correct business entity in the state’s system.

Name

Print the full legal name of the loan-out company (the employer of the individual).

FEIN

Enter the Federal Employer Identification Number (FEIN) of the loan-out company.

Mailing Address, City, State, ZIP

Provide the complete current mailing address for the loan-out company.

Employee Information

Name

Enter the full legal name of the employee (the actor, artist, or crew member) for whom the withholding was paid.

SSN

Enter the employee’s Social Security Number. This is crucial because the credit will be claimed on the employee’s personal tax return, which is identified by their SSN.

Mailing Address, City, State, ZIP

Fill in the employee’s current residential or mailing address.

Financial Information

Loan-Out Withholding Amount

Enter the exact dollar amount of Montana tax that was withheld by the production company on behalf of the loan-out company. This figure represents the cash value of the refundable credit the employee is entitled to claim on their tax return.

Important Note For The Employee

The text on the certificate clarifies that this amount is in addition to any standard Montana tax withheld from wages and reported in Box 17 of federal Form W-2. Do not combine these amounts on the W-2; this certificate handles the specific production company withholding separately.