Montana Form INH-4, officially titled the “Application for Determination of Estate Tax,” is used by personal representatives of a decedent’s estate to determine the amount of estate tax that may be due to the State of Montana. This form applies specifically to individuals who passed away between January 1, 2001 and December 31, 2004, and whose estates meet the federal filing requirements (i.e., they must file Federal Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return). The estate may consist of both probate and non-probate assets, and the form is intended to clarify Montana’s share of the federal state death tax credit. Filing is the responsibility of the personal representative—usually the executor or administrator of the estate—or any person in possession of the decedent’s property if no representative has been appointed. It must be filed within 18 months from the decedent’s date of death. This article provides line-by-line instructions to help you accurately complete Form INH-4 and submit it to the Montana Department of Revenue.

How To File Montana Form INH-4

To file Montana Form INH-4:

- Ensure the decedent’s death occurred between January 1, 2001, and December 31, 2004.

- Confirm that the estate must file Federal Form 706.

- Collect all necessary estate records, including asset valuations, probate documents, and a complete copy of Form 706.

- Complete all sections of Form INH-4 using the instructions below.

- Submit the completed form and the federal Form 706 to:

Montana Department of Revenue

PO Box 5805

Helena, MT 59604-5805

Note: Any taxes due must be paid within 18 months of the date of death to avoid penalties and interest.

How to Complete Montana Form INH-4

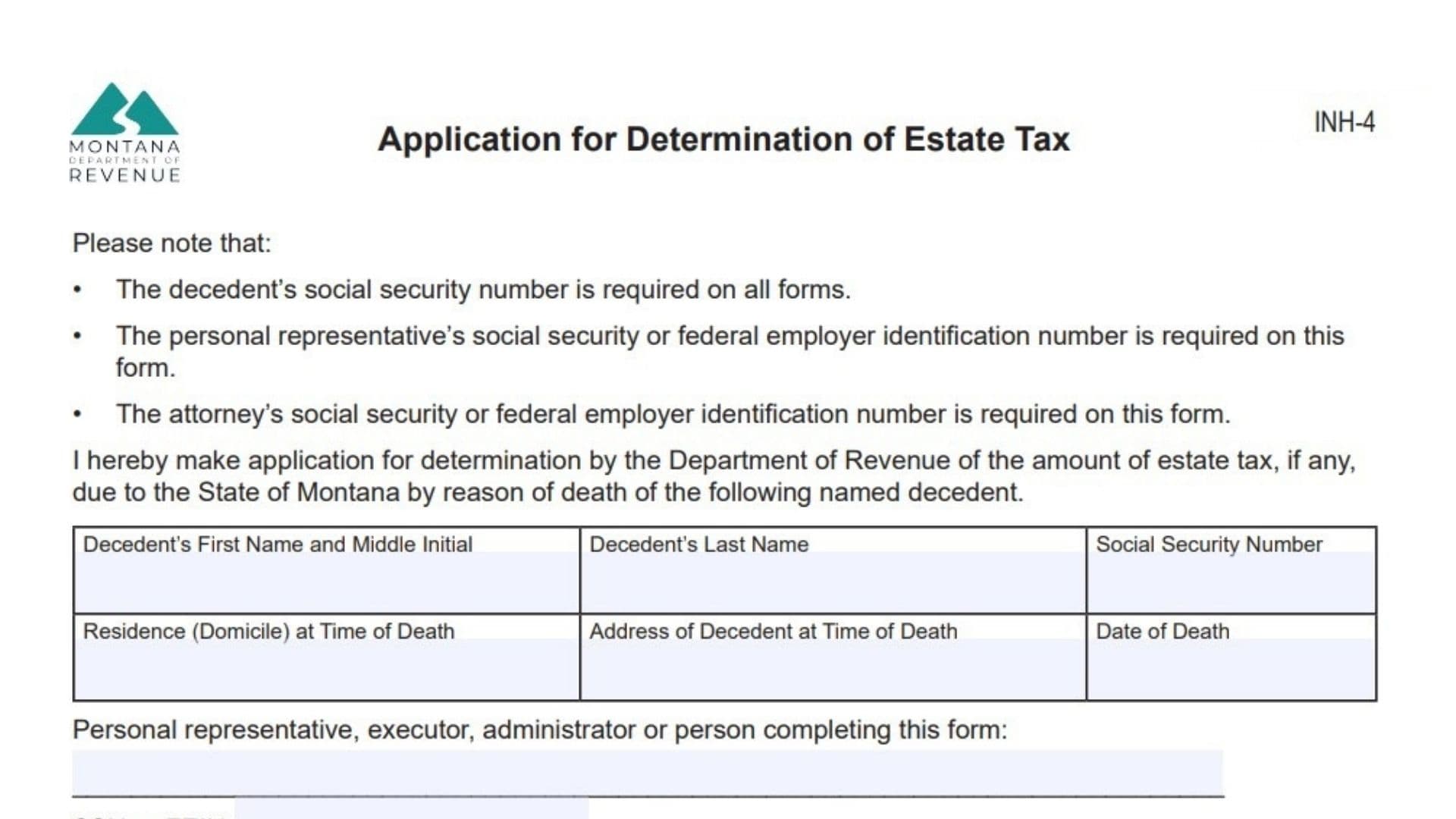

Part I – Decedent And Estate Information

Decedent’s First Name and Middle Initial:

Enter the decedent’s legal first name and middle initial.

Decedent’s Last Name:

Enter the decedent’s legal last name.

Social Security Number:

Enter the decedent’s full Social Security number. This is required.

Residence (Domicile) at Time of Death:

Specify the state and county where the decedent legally resided at the time of death.

Address of Decedent at Time of Death:

Provide the full street address, city, state, and ZIP code of the decedent’s residence when they passed away.

Date of Death:

Enter the exact date the decedent died (MM/DD/YYYY).

Part II – Personal Representative Information

Personal Representative, Executor, Administrator, or Person Completing This Form:

Enter the full name of the individual filing the form.

SSN or FEIN:

Include the Social Security Number (if an individual) or Federal Employer Identification Number (if an entity) of the person named above.

Mailing Address (Line 1 and Line 2):

Fill in the mailing address where correspondence should be sent.

Phone:

Provide a daytime phone number for contact purposes.

Part III – Attorney Information

Attorney Representing the Estate:

Enter the full name of the attorney assisting with the estate, if any.

SSN or FEIN:

Enter the Social Security Number or Federal EIN of the attorney.

Mailing Address (Line 1 and Line 2):

Provide the attorney’s full mailing address.

Phone:

Enter a phone number where the attorney can be reached.

Part IV – Probate Information

Judicial District and County Where the Will Was Probated or the Estate Was Administered:

Specify the judicial district and the county where probate proceedings were filed.

Probate Number:

Include the case number assigned by the probate court.

Part V – Declaration

Certification Statement:

This section is a sworn declaration by the filer affirming that the form and any attached schedules are true, correct, and complete to the best of their knowledge.

Dated This ___ Day of ___, Year ___:

Fill in the day, month, and year of signing.

Signature of Personal Representative or Person Completing This Form:

The responsible person must sign here.

Attorney or Person Preparing Return:

If someone other than the filer prepared the form (e.g., an attorney or CPA), they must sign here.

Part VI – Computation of Montana Estate Tax

Line 1 – Total State Death Tax Credit Allowed (Federal Form 706):

Enter the amount from Federal Form 706 representing the allowable state death tax credit.

Line 2 – Value of Property Located Outside Montana:

Input the value of real and tangible personal property that is situated outside Montana.

Line 3 – Value of Montana Property:

Include the value of all real and tangible personal property located in Montana that was part of the estate.

Line 4 – Value of All Property (Add Line 2 and Line 3):

Add the values from lines 2 and 3 to determine the estate’s total property value.

Line 5 – Ratio (Divide Line 3 by Line 4):

Divide the Montana property value (Line 3) by the total property value (Line 4) to calculate the percentage of the estate situated in Montana.

Line 6 – Montana Estate Tax (Multiply Line 5 by Line 1):

Multiply the ratio from Line 5 by the total allowable death tax credit from Line 1. This gives the Montana portion of estate tax owed.

Line 7 – Interest for Late Payment:

Calculate interest if the tax was not paid within 18 months of death. Interest accrues at 10% annually unless there was an unavoidable delay (in which case it’s 6%). Begin calculation from the date of death.

Line 8 – Total Due (Add Line 6 and Line 7):

Add the Montana estate tax and any interest owed to find the total amount payable.

Line 9 – Total Paid:

Enter any estate tax amounts already paid to Montana.

Line 10 – Balance Due or Refundable (Subtract Line 9 from Line 8):

If Line 9 is less than Line 8, the difference is the amount still owed. If Line 9 is more than Line 8, the estate may be due a refund.