Montana Form ETM—“Enrolled Tribal Member Exempt Income Certification/Return”—is the form enrolled members use to certify income that is exempt from Montana income tax because it was earned by an enrolled member of the reservation’s governing tribe, while residing on and working on that same reservation. If all of your income is exempt, Form ETM functions as your Montana income tax return (you don’t file Form 2) and you attach a copy of your federal Form 1040. If only some of your income is exempt—or you’re claiming a refund of Montana withholding—you file Form ETM with Montana Form 2. Married couples who both fully qualify should complete separate ETM forms; if you file a joint federal return and only part of the joint income is exempt, each spouse who has exempt income completes an ETM and includes it with Form 2. Income is not exempt if it was earned (1) on a reservation where you’re not an enrolled member of the governing tribe, (2) off your own reservation (including out-of-state), or (3) while not residing on your own reservation. If your nonexempt income exceeds the filing threshold, you must file Form 2; 2024 thresholds are roughly: Single $14,600 (under 65) / $16,550 (65+); Head of Household $20,800 / $22,750; Married Filing Jointly $29,200 (both <65), $30,750 (one 65+), $32,300 (both 65+); Married Filing Separately $5; Qualifying Surviving Spouse $29,200 / $30,750. Federal dependent filing rules (Publication 501) also apply, and if you have any Montana additions or subtractions you must file Form 2 even if Montana taxable income is zero.

How To File Montana Form ETM

- Decide Your Filing Path.

- File Online Or By Mail.

- Online (free): Use the Montana Department of Revenue’s TransAction Portal (TAP) and choose “File a Return.”

- Mail: Montana Department of Revenue, PO Box 6577, Helena, MT 59604-6577.

- Tip on the paper form: Use the original—don’t submit a photocopy.

- Need Help? See Administrative Rules of Montana 42.15.220 or contact the Department of Revenue at (406) 444-6900 (Montana Relay 711).

How To Complete Montana Form ETM

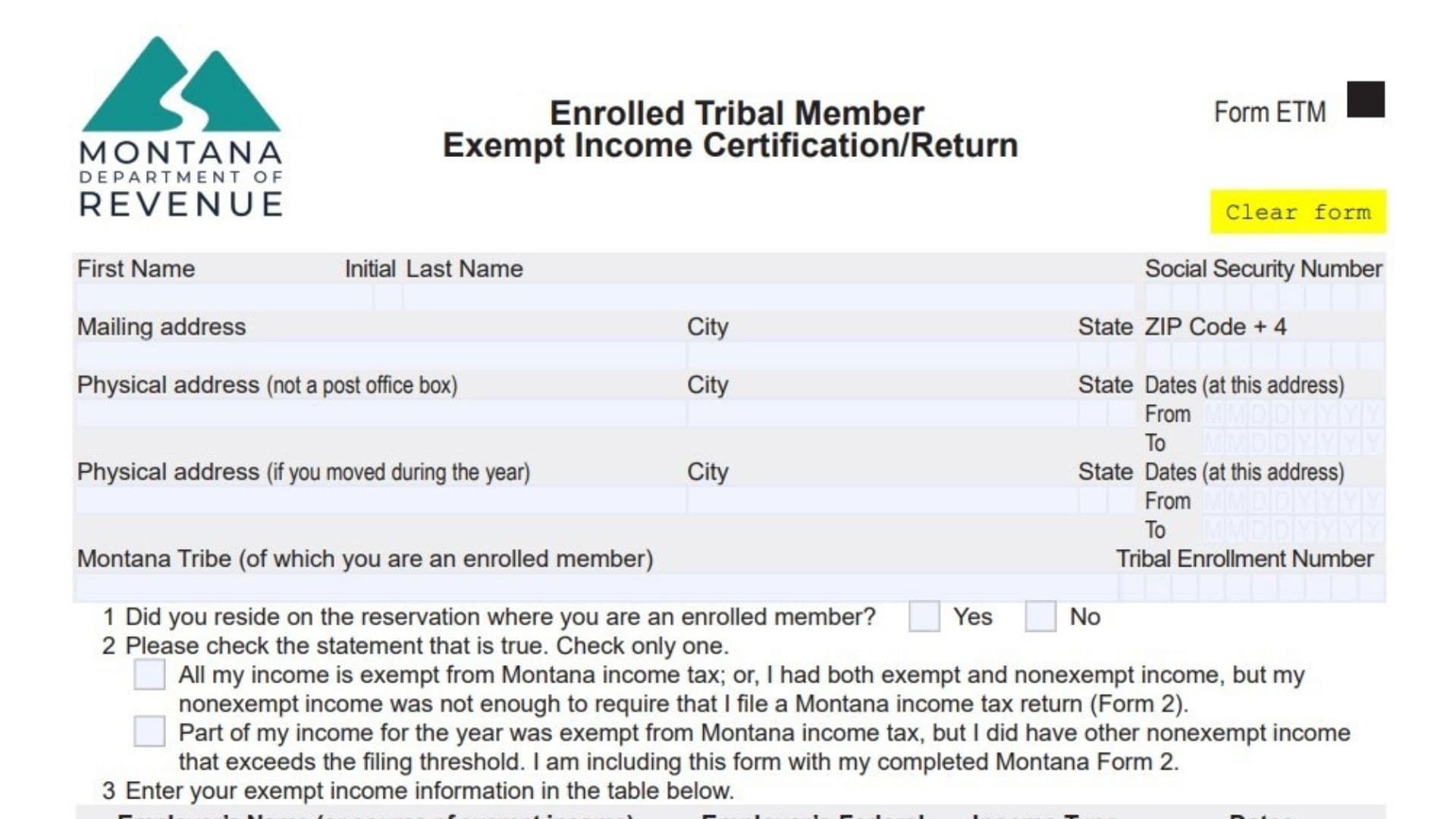

Follow the fields exactly as they appear on Page 1 of the form. If you lived at more than two addresses or had more exempt-income sources than the grid allows, attach a separate sheet with the extra entries. Do not enter dollar amounts in the exempt-income table.

Filer Information (Top Section)

- First Name | Initial | Last Name | Social Security Number

Enter your legal name and SSN exactly as on your federal return. - Mailing Address | City | State | ZIP Code + 4

Provide your current mailing address. Use ZIP+4 if known. - Physical Address (If You Moved During The Year) | City | State | Dates (From/To)

If you had a different residence during the year, list that physical (street) address and the exact dates you lived there. Use From and To to show the period. - Physical Address (Not A Post Office Box) | City | State | Dates (From/To)

List your current physical residence (street address, not a P.O. Box) and the From/To dates for the period you lived there this year. If you had more than two physical addresses, add a separate sheet with locations and dates. - Montana Tribe (Of Which You Are An Enrolled Member) | Tribal Enrollment Number

Enter your governing tribe’s name and your official enrollment number. You must possess the full rights of tribal membership to certify exempt income.

Line 1 — Residency On Your Own Reservation

- Question: “Did you reside on the reservation where you are an enrolled member?”

Check Yes only if you resided on your governing tribe’s reservation for the entire year. Check No if you lived off your own reservation at any time during the year. Your answer here determines whether income can be treated as exempt.

Line 2 — Choose Your Filing Situation (Check Only One)

- Option A: All my income is exempt; or I had both exempt and nonexempt income, but the nonexempt amount did not require filing Form 2.

Choose this if either all your income is exempt or your nonexempt income is below the filing threshold for your age/status. You may also use this box (with Form 2) to request a refund of any Montana tax withheld or payments you made. - Option B: Part of my income was exempt, but I had other nonexempt income above the filing threshold. I’m including this with Form 2.

Select this if you had both exempt and nonexempt income and your nonexempt portion exceeds the threshold—Form 2 is required to pay tax on the nonexempt income.

Reminder on Exempt vs. Nonexempt: Income is exempt only when all are true: you’re an enrolled member of the reservation’s governing tribe, you resided and worked on that reservation, and the income was earned on that reservation. Otherwise, it’s not exempt.

Line 3 — Exempt Income Information Table

Complete a row for each source of exempt income:

- Employer’s Name (Or Source Of Exempt Income)

Enter your employer’s full legal name. If you are self-employed, enter your business name. - Street Address, City, State, ZIP (Physical Location Only—No P.O. Boxes)

Provide the physical location where the wages were earned or services were provided. - Employer’s Federal Employer Identification Number (FEIN)

If you’re an employee, copy the FEIN from your Form W-2. (Self-employed filers leave employer FEIN blank.) - Income Type (e.g., wages, interest, etc.)

Identify the nature of the exempt income. Do not list dollar amounts on this form. - Dates — From / To

Enter the exact dates the work was performed or the income was earned on your reservation. If you have more sources than the grid allows, attach an additional sheet with the same columns.

Required — Signature, Paid Preparer, And Third-Party Designee

- Taxpayer Signature | Date | Phone

You must sign for the certification/return to be valid. Filing electronically counts as your declaration under penalty of false swearing that you’re the taxpayer and that the form is true, correct, and complete. Include a phone number. - Third-Party Designee (Two Checkboxes + Name/Phone)

- Check the box to allow the Department of Revenue (DOR) to discuss this return with your tax preparer; or

- Check the box to allow discussion with someone other than your preparer (enter the designee’s printed name and phone). If you don’t complete this section in full, the DOR cannot speak to a third party about your ETM.

- Paid Preparer Use Only — Signature | Print Name | Phone | Firm’s FEIN | PTIN

If you used a preparer, they complete and sign this block with their identification numbers.

Where To File And Helpful References (Quick Recap)

- File online (TAP) for free or mail to: Montana Department of Revenue, PO Box 6577, Helena, MT 59604-6577.

- Questions? Call (406) 444-6900 or use Montana Relay 711. See ARM 42.15.220 for rules.

- Paper tip: Don’t photocopy the form. Attach your federal Form 1040 when ETM serves as your return.