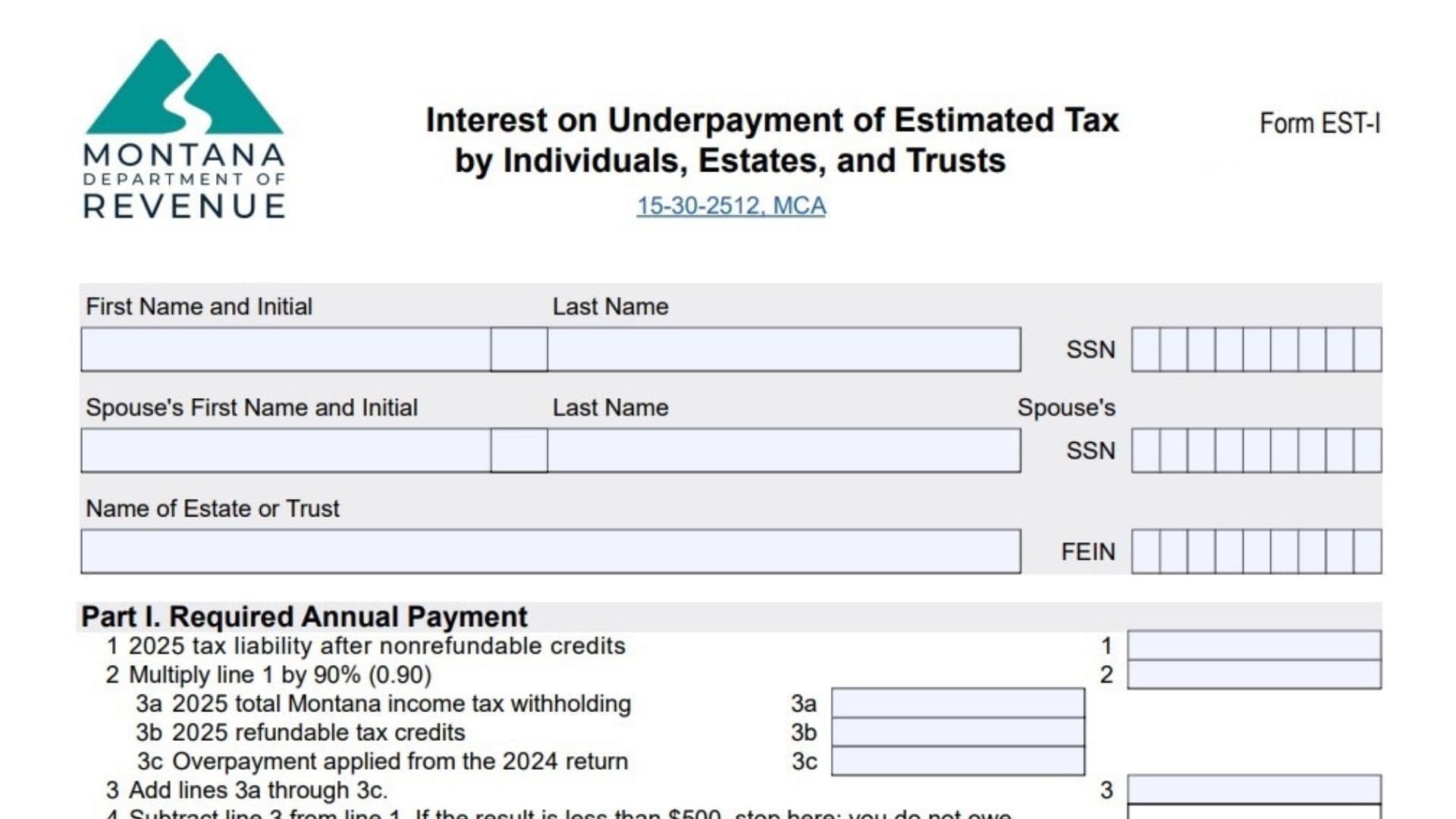

Montana Form EST-I, formally known as the Estate Tax Information Form, is an essential document required by the Montana Department of Revenue for estates of Montana residents and certain nonresidents. Its primary purpose is to provide the state with all relevant information about an estate following a decedent’s passing, ensuring state requirements are met for estate tax reporting—even if no Montana estate tax is ultimately owed. This form collects comprehensive details about the decedent, the estate’s representatives, the estate’s assets, and federal estate tax filings. Completing Montana Form EST-I is necessary for the lawful transfer of estate assets and for the accurate processing of tax clearances or lien releases. It is often a required step for probate court proceedings and the legal settlement of an estate in Montana.

How To File Montana Form EST-I

To file Montana Form EST-I, gather all required information about the decedent, the estate, and any federal estate tax filings. Complete every section of the form, ensuring all questions are answered and supporting documentation is included where instructed. Once the form is completed and signed by the personal representative or authorized individual, mail it to the Montana Department of Revenue, following the address provided in the form’s instructions. Retain a copy for your records and, if necessary, provide copies to attorneys or other estate representatives.

How To Complete Montana Form EST-I

Decedent Information

1. Decedent’s Name

Enter the full legal name of the deceased individual.

2. Social Security Number

Provide the decedent’s Social Security Number.

3. Date of Death

Enter the date the decedent passed away in the MM/DD/YYYY format.

4. County of Residence at Death

Write the name of the Montana county where the decedent resided at the time of death.

5. State of Domicile at Death

Indicate the state in which the decedent was legally domiciled when they died.

6. Decedent’s Address at Death

Provide the street address, city, state, and ZIP code where the decedent was living at the time of death.

Estate Representative Information

7. Name of Personal Representative

Enter the full name of the estate’s personal representative or executor.

8. Address of Personal Representative

Fill in the mailing address, including street, city, state, and ZIP code, for the personal representative.

9. Telephone Number

Provide a current telephone number where the representative can be reached.

10. Email Address

Enter the email address for the personal representative. If not available, write “N/A.”

11. Relationship to Decedent

Describe the relationship of the personal representative to the decedent (e.g., spouse, child, attorney).

Probate and Estate Information

12. Probate Case Number

If the estate is in probate, enter the probate case number assigned by the court. If not applicable, write “N/A.”

13. County Where Probate is Filed

Provide the name of the Montana county where the probate case is filed, or “N/A” if not applicable.

14. Date Probate Was Filed

Enter the date the probate was opened. Use “N/A” if there is no probate.

Federal Estate Tax Filing

15. Was a Federal Estate Tax Return (IRS Form 706) Filed?

Mark “Yes” or “No.” If “Yes,” submit a copy of the filed federal return.

16. If Yes, What Is the IRS Estate Tax Closing Letter Date?

If you answered “Yes” above, enter the date on the IRS estate tax closing letter.

17. If No, State Why the Federal Return Was Not Required

If you answered “No” to filing a federal estate tax return, briefly explain why (e.g., estate value below filing threshold).

Estate Asset and Value Information

18. Value of Gross Estate

Enter the total value of the decedent’s gross estate at the date of death.

19. Value of Montana Real Property

Provide the total value of real property located in Montana that was part of the estate.

20. Value of Montana Tangible Personal Property

List the total value of tangible personal property in Montana included in the estate.

21. Did the Decedent Own an Interest in a Business?

Mark “Yes” or “No.” If “Yes,” include details about the business interest.

22. Did the Decedent Make Taxable Gifts Within Three Years of Death?

Mark “Yes” or “No.” If “Yes,” provide a description of the gifts and their values.

Additional Documentation and Certification

23. Are Any Special Elections or Deductions Being Claimed?

Mark “Yes” or “No.” If “Yes,” specify the elections or deductions and attach supporting documents.

24. Are There Any Disputes or Litigation Affecting the Estate?

Mark “Yes” or “No.” If “Yes,” describe the nature of the disputes or legal actions.

25. Additional Comments or Explanations

Use this space for any information that clarifies previous answers or provides additional context about the estate.

26. Attachments Checklist

Check off each supporting document attached to the form (such as the death certificate, will, trust, property appraisals, or federal estate tax returns).

Declaration and Signature

27. Declaration Statement

Read the declaration, which affirms that the information provided is true, correct, and complete.

28. Signature of Personal Representative or Authorized Individual

Sign the form where indicated.

29. Printed Name of Signer

Print the name of the person signing the form.

30. Date Signed

Enter the date the form was signed.

31. Title or Relationship to Decedent

State the signer’s title or relationship to the decedent (e.g., executor, attorney, trustee).

Submission

After completing and signing Montana Form EST-I, ensure all required attachments are included. Mail the full packet to the Montana Department of Revenue at the address specified in the form’s instructions. Retain a copy for your records.