Montana Form DFR, officially the Disabled First Responder Property Tax Relief Application, is the form used to apply for a specialized property tax reduction available to first responders who were disabled in the line of duty, or their surviving unmarried spouses. This program offers a lower tax rate on the applicant’s primary residence (including mobile or manufactured homes) provided they have owned and occupied it for at least seven months of the year. The application process involves verifying both your disability status (via retirement benefit documentation or compensation records) and your income eligibility based on specific Federal Adjusted Gross Income (FAGI) thresholds for the prior tax year. Once approved, you typically do not need to reapply annually; the state will automatically verify your income eligibility each year as long as you continue to own and live in the home.

How To File Montana Form DFR

You must submit your completed and signed application, along with all required documentation, to your local Montana Department of Revenue field office. The standard deadline to postmark or hand-deliver the form is April 15 for the current tax year. If you miss this date, you should still apply as soon as possible to ensure you are processed for the next tax year. Depending on your tax filing history, you may need to attach a copy of your federal income tax return or other income statements if you did not file a Montana return for the qualifying year.

How To Complete Montana Form DFR

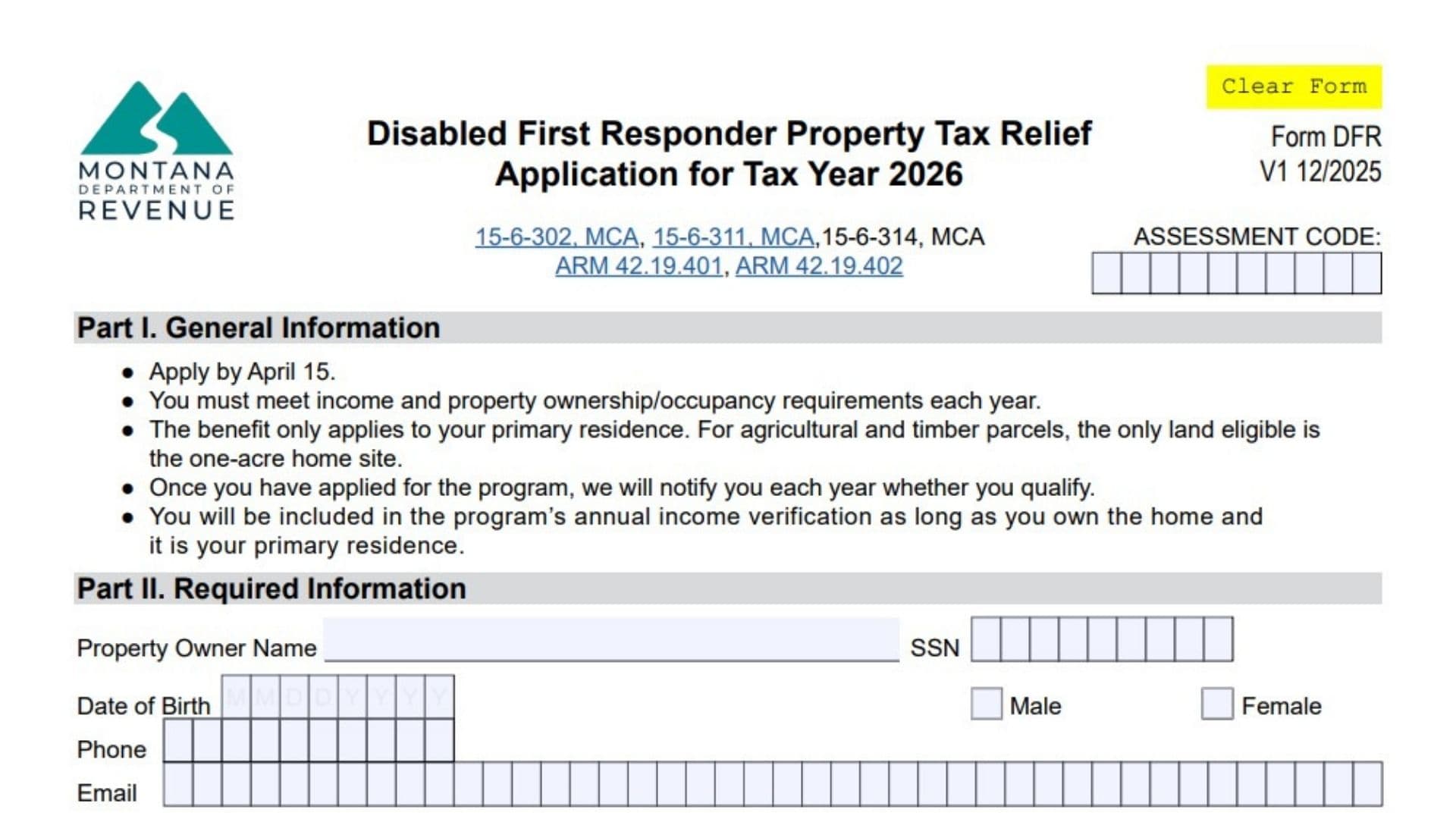

Part I. General Information

Property Owner Name

Enter the full legal name of the primary applicant (the disabled first responder or surviving spouse).

SSN / Date Of Birth / Gender

Provide the applicant’s Social Security Number, date of birth (MM/DD/YYYY), and check the box for Male or Female.

Contact Information

Enter a valid phone number and email address where the department can reach you.

Spouse’s Name

If applicable, enter the full legal name of the applicant’s spouse.

Spouse’s SSN / Date Of Birth / Gender / Phone

Provide the spouse’s Social Security Number, birth date, gender, and phone number.

County

Write the name of the county where the property is located.

Applicant’s Mailing Address

Enter the full mailing address (City, State, ZIP) where you receive mail.

Applicant’s Primary Residence Physical Address

Enter the physical address of the home for which you are claiming the tax relief. This must be the home you occupy for at least seven months of the year.

Part II. Required Information

Did You File A Montana Income Tax Return For Tax Year 2024?

Check “Yes” or “No.”

- If Yes: You do not need to attach income documentation; the department will verify it internally.

- If No: You must attach a copy of your 2024 federal tax return (if a new resident) or a Social Security statement/other proof of income if your income is from non-taxable sources.

Mobile Or Manufactured Home Question

Answer “Yes” or “No” to: “If this application is for a mobile or manufactured home, do you own the land upon which your home is located?”

- If Yes: Enter the geocode for the land in the space provided.

Part III. Qualifying Criteria

This section outlines the rules rather than asking for input, but you must read it to ensure you qualify. It confirms that single applicants must have a 2024 FAGI below $62,598, while head of household or married applicants must be below $72,229. Unmarried surviving spouses must have income below $54,573. It also lists the required verification documents you must attach (e.g., disability retirement benefit letter or employer letter for surviving spouses).

Part IV. Affirmation And Signature

Check The Appropriate Affirmation Box

- Check the first box if you are the disabled first responder injured in the line of duty.

- Check the second box if you are the surviving spouse of a first responder killed in the line of duty.

Property Owner Signature / Date

The primary applicant must sign and date the form here. This certifies under penalty of law that you own and occupy the home.

Property Owner’s Spouse Signature / Date

If there is a spouse, they must also sign and date the application.

Signature Of Person Completing This Form

If someone other than the applicant helped fill out the form, they must sign, date, and print their name, phone number, and relationship to the applicant here.