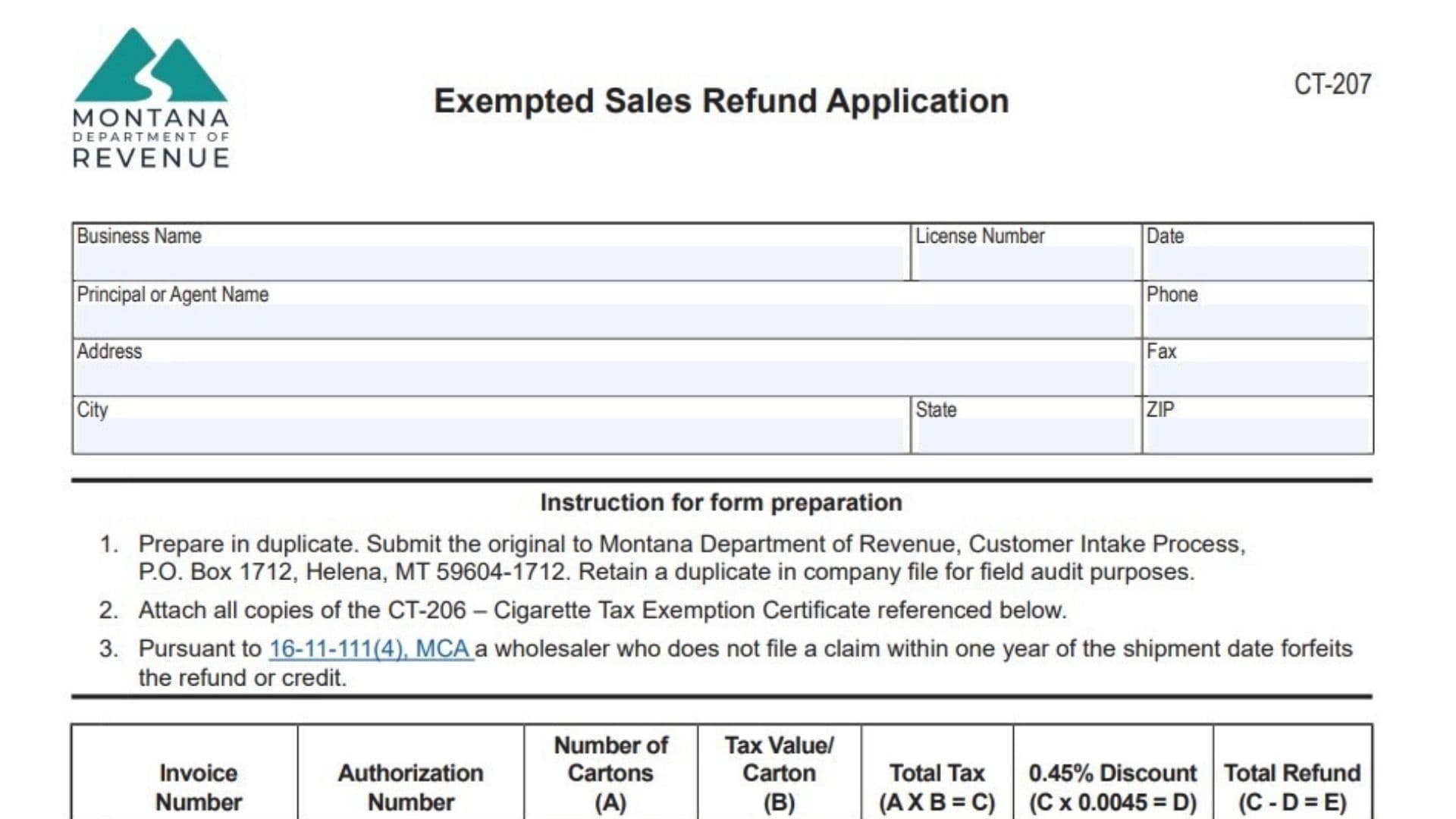

The Montana Exempted Sales Refund Application (CT-207) is used by wholesalers who want to claim a refund for taxes paid on exempted sales of cigarettes. This form is important for businesses to recover taxes on sales that qualify for exemption, such as sales to tax-exempt organizations. Follow the instructions below to ensure that your application is filled out correctly. This article provides detailed instructions for completing the Montana Exempted Sales Refund Application Form (CT-207). This form is used to claim a refund for cigarette tax exemptions based on exempted sales, and the article guides you through each section for a smooth and accurate submission.

How to Complete Montana Exempted Sales Refund Application Form CT-207

1. Business Information

- Business Name: Enter the legal name of your business as registered with the Montana Department of Revenue.

- License Number: Provide your business license number issued by the Montana Department of Revenue.

- Date: Enter the date when the application is being submitted.

- Principal or Agent Name: If the business has a representative filing on its behalf, include their name here.

- Phone: Enter the telephone number where your business can be reached.

- Fax: Provide the fax number for your business (if applicable).

- Address: Include your business address, including the street address, city, state, and ZIP code.

- Shipping Address: If different from the business address, enter the shipping address where goods are delivered.

2. Attach CT-206 – Cigarette Tax Exemption Certificate

- Attach all copies of the CT-206 – Cigarette Tax Exemption Certificate referenced in this application. These certificates are necessary to support your claim for exemption and refund.

3. Invoice and Refund Calculation

- Invoice Number: For each transaction, list the invoice number related to the exempted sales.

- Authorization Number: This is the unique authorization number assigned to the transaction, which will be found on your CT-206 certificate.

- Number of Cartons (A): Enter the number of cartons sold for each transaction. This will be recorded in two categories:

- 20/Pk Cartons

- 25/Pk Cartons

- Tax Value/Carton (B): Enter the tax value per carton. For example, the tax value may be $17.00 per 20 pack carton or $21.25 per 25 pack carton.

- Total Tax (A X B = C): Multiply the number of cartons (A) by the tax value per carton (B) to calculate the total tax for each transaction. Enter this value in column C.

- 0.45% Discount (C x 0.0045 = D): To apply the discount, multiply the total tax (C) by 0.0045. This will calculate the 0.45% discount (column D).

- Total Refund (C – D = E): Subtract the 0.45% discount (D) from the total tax (C) to determine the total refund amount for each transaction. Enter this value in column E.

4. Total Calculations

- Total 20/Pack Cartons: Sum the total refund amounts for all 20/pack cartons from column E.

- Total 25/Pack Cartons: Sum the total refund amounts for all 25/pack cartons from column E.

- Total Refund (Total column E): Add the total refunds from the 20/pack and 25/pack cartons to get the total refund amount for the application. This is the amount you are claiming as a refund for exempted sales.

5. Signature and Certification

- Signature: The application must be signed by the taxpayer or an authorized representative of the business.

- Date: Enter the date the form is signed.

- Print Name: Print the name of the person signing the application.

- Title: If the person signing is a corporate officer, partner, or another authorized individual, include their title here.

- Spouse’s Signature (if applicable): If the tax matters concern a joint return (e.g., for a business partnership), the spouse must also sign.

6. Filing Instructions

- Where to Submit: After completing the form, submit the original Exempted Sales Refund Application (CT-207) to:

- Montana Department of Revenue

- Customer Intake Process

- P.O. Box 1712

- Helena, MT 59604-1712

- Retain a Duplicate: Make a duplicate copy of the form for your records. This is important in case of a field audit.

- Deadline: Be aware of the one-year filing deadline for claims from the shipment date. Claims filed after one year will not be eligible for a refund.

FAQs

- What is the CT-207 form used for?

The CT-207 form is used to claim a refund for cigarette tax exemptions based on exempted sales. - Who should file the CT-207 form?

Wholesalers who have made exempted sales of cigarettes are required to file the form to receive a refund. - What documents should I attach with the CT-207 form?

You must attach all copies of the CT-206 – Cigarette Tax Exemption Certificate referenced in your claim. - What is the deadline for filing the CT-207 form?

Claims must be filed within one year from the shipment date; otherwise, the refund will be forfeited. - Where do I submit the completed CT-207 form?

Submit the form to the Montana Department of Revenue, Customer Intake Process, P.O. Box 1712, Helena, MT 59604-1712.