Montana Form AB-30T is the state’s application a tribe uses to request a temporary property tax exemption for the current year on qualifying fee land that the tribe is working to place into federal trust title. The key idea is timing and proof: the state requires the tribe to apply by the annual deadline and to include specific documents showing the trust process is underway (for example, confirmation that the tribe’s trust request package is complete, a tribal resolution identifying the land by legal description, and ownership/transfer documentation). This application starts a formal review by the Montana Department of Revenue, which then issues a written decision (approved or denied) and notifies local offices. If approved, it does not “run forever” without action—there is an annual certification requirement, and there are recapture rules if the trust request is denied or the property does not enter trust within the temporary exemption timeframe. In short, AB-30T is the paperwork pathway for tribes seeking a temporary Montana property tax exemption while a Bureau of Indian Affairs trust application is still being considered.

How To File Montana Form AB-30T

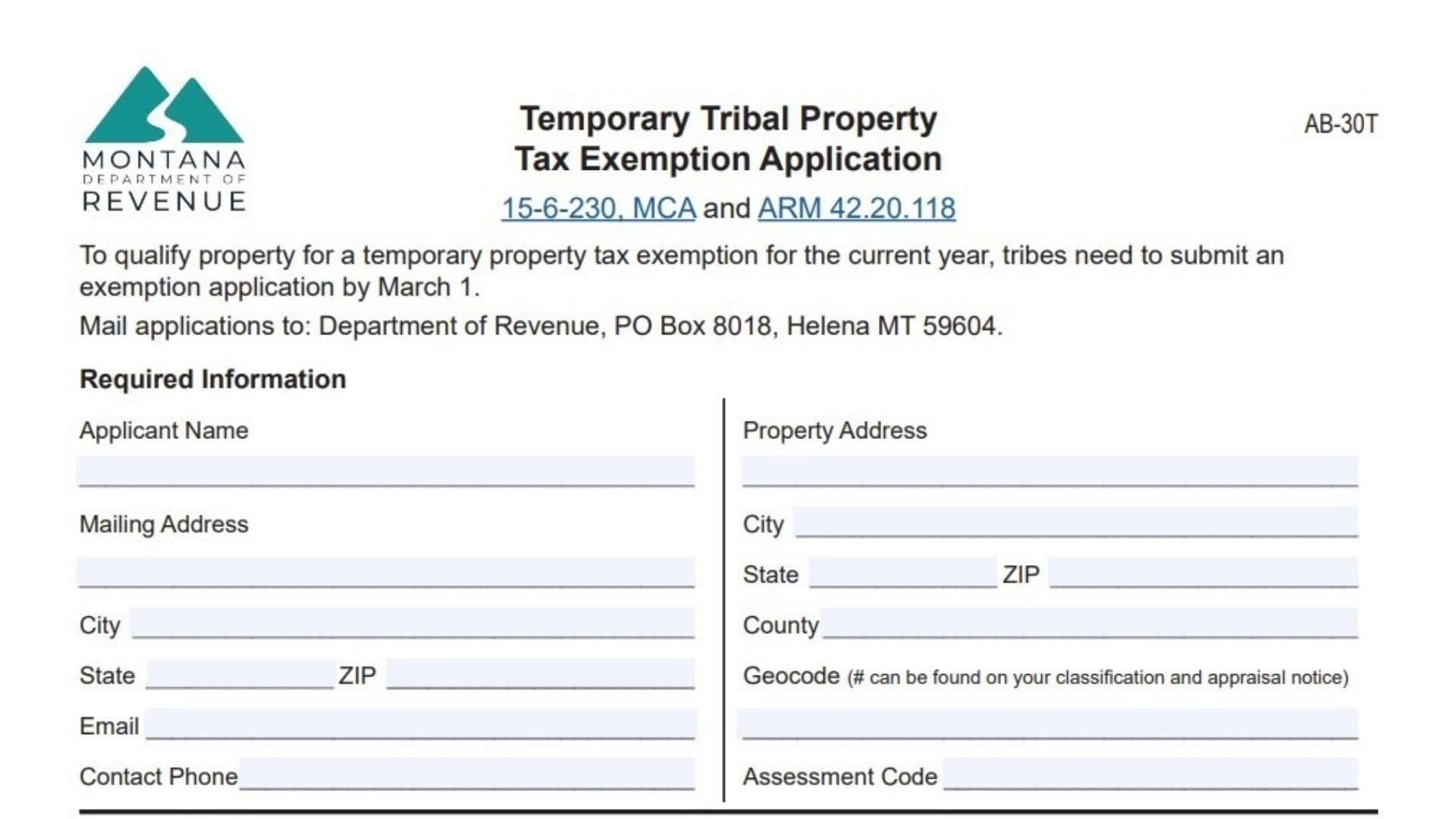

- Meet The Deadline: To qualify for the current year’s temporary property tax exemption, submit the application by March 1.

- Complete All Required Information Fields: Fill in the applicant and property details completely (don’t leave contact or location lines blank).

- Attach All Required Documentation: Include photocopies of every required document listed in the documentation section. Do not send originals.

- Sign And Date The Affirmation: The application must be signed and dated by the applicant.

- Mail The Application To The State: Send the application packet to:

Department of Revenue

PO Box 8018

Helena, MT 59604 - Keep Copies For Your Records: Retain a full copy of the completed form and all attachments, plus proof of mailing.

How To Complete Montana Form AB-30T

Eligibility And Timing Statement

- “To qualify property for a temporary property tax exemption for the current year, tribes need to submit an exemption application by March 1.”

Treat this as a strict filing deadline: if you want the exemption for the current year, plan to mail your packet early enough to arrive by March 1.

Mailing Instruction

- “Mail applications to: Department of Revenue, PO Box 8018, Helena MT 59604.”

Use this exact mailing address for your submission. If you use a courier or need tracking, confirm your delivery method will reach a P.O. Box.

Required Information

Applicant Details

- “Applicant Name”

Enter the tribe’s name (or the applicant name requested for the filing), written clearly and consistently with your attached documents. - Blank Line Under Applicant Name

Write the full name on the provided line. - “Mailing Address”

Enter the mailing address where you want all correspondence sent (street address or P.O. Box, as applicable). - Blank Line Under Mailing Address

Write the complete mailing address on the line. - “City”

Enter the city for the mailing address. - Blank/City Line

Write the city name on the provided line. - “State ____ ZIP ____”

Fill in the state abbreviation and ZIP code for the mailing address. - “Email”

Provide an email address for follow-up questions and the decision notice if the department uses email for communication. - “Contact Phone”

Provide a phone number where the department can reach the right person quickly (include area code and extension if needed).

Property Location Details

- “Property Address”

Enter the physical location address of the property (not just a mailing address). - Blank Line Under Property Address

Write the full property street address on the line. - “City” (Property City Line)

Enter the city where the property is located. - “State ____ ZIP ____” (Property State/ZIP Line)

Fill in the property’s state abbreviation and ZIP code. - “County”

Enter the Montana county where the property sits (this matters for local notifications and tax administration).

Identification Numbers Used For Tax/Assessment

- “Geocode (# can be found on your classification and appraisal notice)”

Enter the property’s geocode number. If you don’t know it, locate it on the property’s classification and appraisal notice before submitting. - Blank Line Under Geocode

Write the geocode clearly, without missing digits. - “Assessment Code”

Enter the assessment code associated with the property. - Blank Line Under Assessment Code

Write the assessment code exactly as shown on your records/notices.

Required Documentation

Documentation Instruction And Copy Rule

- “The following documentation must be submitted with your application. Do not send original documents. Photocopies are acceptable.”

Include every required document. Send copies only—keep originals in your records.

Documentation Items (Include All That Apply As Listed)

- Department of the Interior / Bureau of Indian Affairs Confirmation Of Completeness

Include documentation from the U.S. Department of the Interior, Bureau of Indian Affairs stating that the tribe’s initial written request or trust application submission is complete. - Tribal Resolution Identifying The Fee Land By Legal Description

Include a tribal resolution that specifically identifies the fee land (by legal description) for which the tribe has applied for federal trust title. - Offer To Convey Lands Into Trust

Include the offer to convey the land to the United States of America in trust for the tribe. - Ownership Verification Document

Include a deed, contract for deed, or notice of purchaser’s interest that confirms the tribe’s ownership interest.

Form Title And Reference Lines

- “Temporary Tribal Property Tax Exemption Application”

This is the form’s name/subject. No entry is required here, but it confirms you’re using the correct application. - “AB-30T”

This is the form number. No entry required. - “V2 8/2021”

This is the version/date label. No entry required. - “15-6-230, MCA and ARM 42.20.118”

These are the legal references for the program. No entry required, but they explain the authority behind the application and the temporary exemption rules.

Affirmation And Signature

- Affirmation Statement (Penalty Of Law Reference)

Read the statement carefully. By signing, you are certifying that the application details are true and accurate, and you are acknowledging legal penalties for false statements. - “X Applicant Signature ______ Date ______”

The applicant (or authorized signer) must sign on the signature line and enter the date of signature. - “Printed Name ______”

Print the signer’s name clearly so it matches the signature and identifies who signed.

Important After-Filing Notes (Do Not Skip)

- Decision Letter Statement

After the department reviews the application, the applicant will receive a letter stating whether the exemption was approved or denied. Expect written confirmation either way. - Notification To Local Offices

The county treasurer and the local Department of Revenue field office will also be notified of the department’s decision. - Annual Certification Requirement If Approved (By March 1)

If approved, the tribe must certify each year—by March 1—that the trust application is still being considered by the Bureau of Indian Affairs. Plan to calendar this as an annual compliance task. - Tax Recapture Warning

The county treasurer may recapture property taxes if the Bureau of Indian Affairs denies the trust request, or if the property is not accepted into trust within the five-year temporary exemption timeframe. Treat this as a serious risk item when planning and budgeting.

Questions And Contact Information

- Helena Exemption Specialists Phone Numbers

If you have questions, you can call in Helena at (406) 444-5698 or (406) 444-4616 to speak with an exemption specialist. - Call Center Number

You can also contact the call center at (406) 444-6900. - Montana Relay (Hearing Impaired)

For hearing impaired assistance, use 711.

For Department Use Only (Leave Blank)

- “For Department Use Only”

Do not write in this section. - “Date Received”

Leave blank; the department records when they receive your application. - “Application Number Assigned”

Leave blank; the department assigns this tracking number. - “Signature / Date” (Department Signature Lines)

Leave blank; this is for department staff. - “Printed Name / Title” (Department Staff Identification)

Leave blank; department staff complete these fields. - “Date Local County Treasurer Notified”

Leave blank; the department records when the county treasurer is notified.