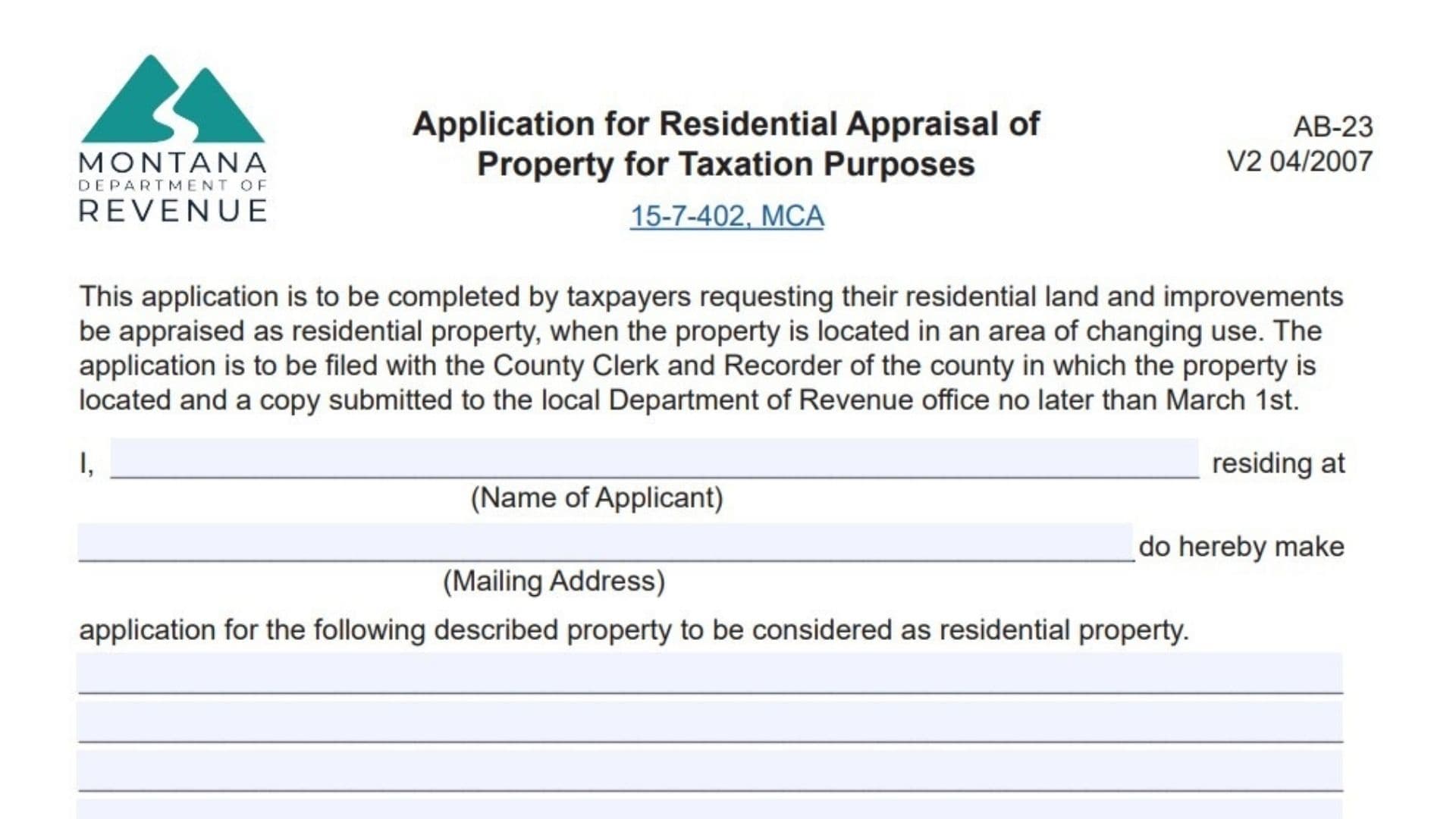

Montana Form AB-23 is a specialized property tax application used by homeowners whose residential property is located in an area where land use is changing—typically meaning an area that is becoming commercial or industrial. Under Montana Code Annotated (MCA) 15-7-402, if your property is used exclusively for residential purposes but is surrounded by commercial development that drives up the value, you can request that it be appraised strictly as residential property rather than at its potentially higher “highest and best use” commercial value. By filing this application, you are certifying that the property is your principal residence and is not used for commercial purposes. However, you are also acknowledging that if you later convert the property to commercial or industrial use, you may be subject to a “roll-back tax” for up to five years, meaning you would have to pay back the tax savings you received.

How To File Montana Form AB-23

Filing this form is a two-step process with a strict deadline.

- File Original: You must file the original completed application with the County Clerk and Recorder of the county where the property is located.

- Submit Copy: You must submit a copy of that filed application to your local Department of Revenue office.

Deadline: Both steps must be completed no later than March 1st of the tax year for which you are applying. Late applications may not be considered for the current tax year.

How to Complete Montana Form AB-23

Applicant Information

Name of Applicant

On the first blank line after “I,”, print your full legal name as the property owner and applicant.

Mailing Address

On the line following “residing at,” enter your complete mailing address. This is where the Department will send correspondence regarding your application.

Property Description

Legal Description

The form provides several blank lines under the phrase “application for the following described property to be considered as residential property.”

In this space, you must provide the legal description of your property. You can find this on your property tax bill, deed, or assessment notice. It typically includes the Section, Township, Range, and Lot/Block numbers, or a geocode. Do not just write the street address; provide the formal legal description to ensure the correct parcel is identified.

Declarations And Acknowledgments

By signing the form, you are making three specific legal declarations:

- Residential Use: You affirm that the property is used only for human habitation, is the principal residence of the owner, and is not used for commercial purposes.

- Filing Confirmation: You must fill in the blanks in item #2 to verify you filed the original with the County Clerk.

- Enter the name of the County.

- Enter the Day, Month, and Year you filed the original application with the Clerk and Recorder.

- Roll-Back Tax: You acknowledge that if the property use changes to industrial or commercial in the future, it will be subject to a roll-back tax not to exceed 5 years.

Signature

Applicant’s Signature

Sign your name on the “Applicant’s Signature” line. By signing, you are affirming under penalty of law that the information is true and correct and that the property will continue to be used as residential property.

Date

Enter the date you signed the application.

Department Use Only

Do not write below the “Applicant’s Signature” line. The section starting with “Received by Local Department of Revenue Office” is for official use by the appraiser to grant or deny your application and record their reasons.