The Montana Department of Revenue uses Form AB-13, officially titled the Nonproductive Patented Mining Claim Classification (Rev 12 18), to allow property owners to apply for a specific tax classification under Montana law (15-6-133(1)(b), MCA). This form is designed for owners of “patented mining claims”—land originally purchased from the federal government specifically for mining—who are currently not using the land for productive mining, agriculture, or other commercial purposes. By filing this application, owners seek to verify that their land meets the statutory criteria to be classified as nonproductive, which can impact property tax assessments. The form requires a series of “Yes” or “No” declarations regarding the land’s current use, improvements, and restrictions to prove it qualifies for this specific status.

How To File Montana Form AB-13

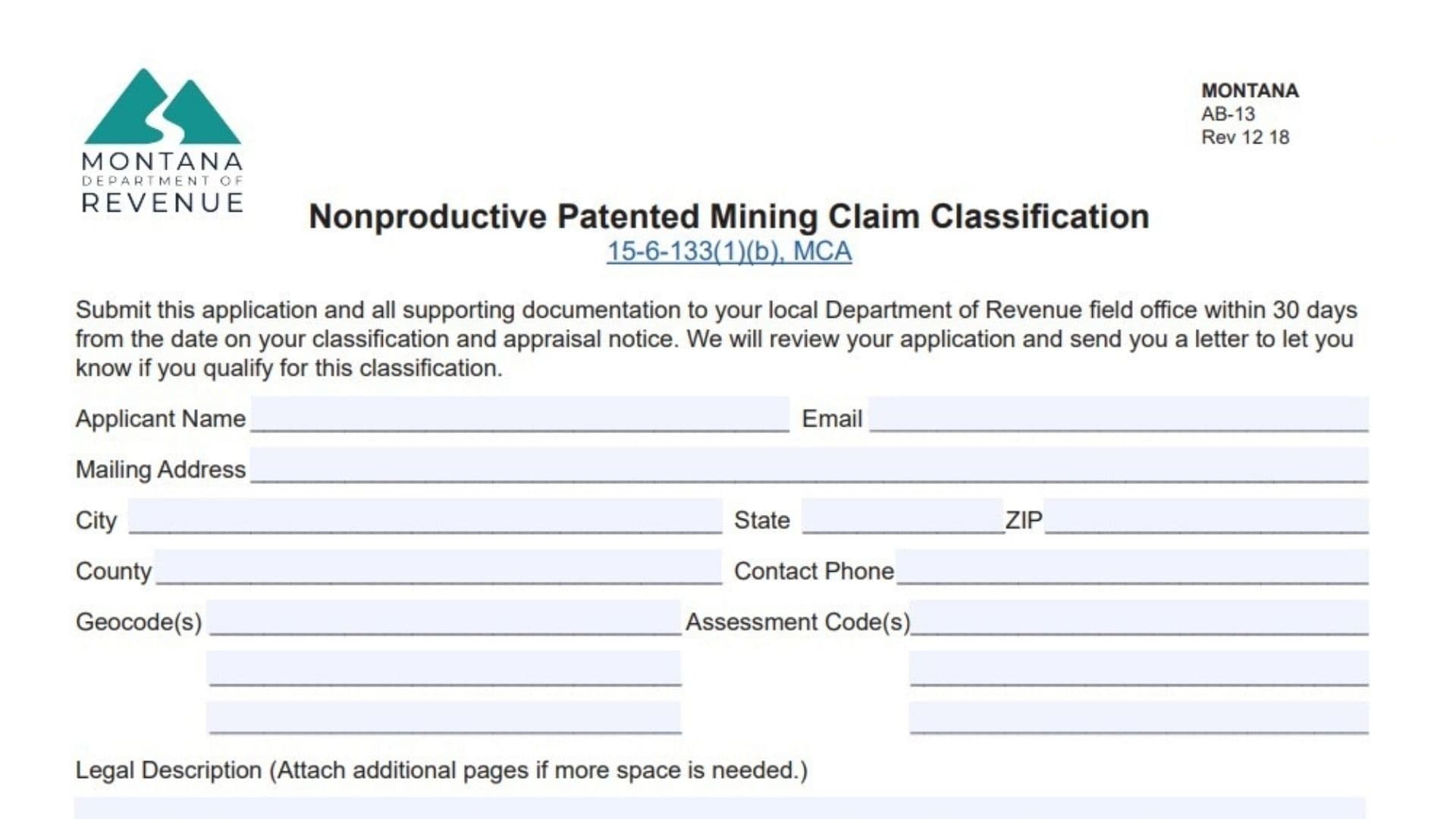

You must submit the completed application along with all required supporting documentation to your local Department of Revenue field office. The deadline for submission is strict: it must be filed within 30 days from the date listed on your classification and appraisal notice. You can find the specific mailing address for your local field office on the Department’s website at MTRevenue.gov or by calling the number provided on the form.

How To Complete Montana Form AB-13

Applicant Information

- Details: Enter your full Name, Mailing Address, City, State, ZIP code, Email, and Contact Phone Number.

- Property Identification: Fill in the County where the property is located, the Geocode(s), and the Assessment Code(s).

- Legal Description: Provide the full legal description of the property. If the description is too long for the space provided, attach additional pages.

Questionnaire

Answer each question by checking the “Yes” or “No” box. Supporting documents must be attached where indicated.

- Patented Status: Confirm if the land is a patented mining claim (purchased from the federal government solely for mining).

- Agriculture/Timber: Indicate if any agricultural commodities (grains, livestock, etc.) or commercial timber (producing 100+ board feet/acre annually) are grown on the property.

- Improvements: State if there are buildings or structures on the land. If yes, indicate if they are used for mining. If yes to both, specify the total acres associated with these improvements.

- Mining Activity: Confirm if there is currently any mining activity taking place.

- Restrictions: Indicate if there are covenants or ordinances restricting mining. (Attach a copy if yes).

- Topography: State if the terrain is so severe that it prevents any development other than mining.

- Leases: Indicate if any land is leased for recreational, commercial, residential, industrial, or agricultural use. (Attach a copy of the lease if yes).

- Survey: State if a survey has been filed since the original patent.

- Location: Confirm if the land is outside the limits of an incorporated city or town.

- Consolidation: If applicable (in county-municipal consolidations), indicate if the land was outside city limits prior to consolidation.

- Ownership: Confirm if you are the owner of record on the county tax roll. If No, you must attach proof of ownership (e.g., US patent certificate, realty transfer certificate, or deed).

Affirmation and Signature

- Sign and Date: The applicant must sign and date the form, affirming under penalty of false swearing that the information is true and complete.

- Print Name: Clearly print the name of the signer below the signature line.