Montana Form 2, officially titled the 2026 Montana Individual Income Tax Return, is the primary state tax form used by Montana residents, part-year residents, and nonresidents who earn income in Montana. It’s issued by the Montana Department of Revenue and corresponds directly with your federal Form 1040. Essentially, it helps determine your state taxable income, tax credits, and total payments, and whether you owe additional tax or qualify for a refund.

Montana Form 2 mirrors your federal filing, beginning with your federal adjusted gross income (AGI) and making state-specific additions and subtractions. It also applies various Montana-only deductions, tax credits, and adjustments like the Elderly Homeowner/Renter Credit and Earned Income Credit. Form 2’s layout ensures accuracy and consistency with your federal return while accounting for Montana’s tax rules.

How To File Montana Form 2

You can file Montana Form 2 either electronically or by mail.

- Electronic filing (recommended): Submit via approved software or a tax preparer to ensure faster processing and refund.

- Mail filing: Send your completed Form 2 to the Montana Department of Revenue. The address depends on whether you owe tax or expect a refund (listed in the official instructions).

Before filing, ensure that all W-2s, 1099s, and related statements are attached. If you claim credits or deductions requiring additional forms (like Form 2EC for the Elderly Credit), include those as well.

How to Complete Montana Form 2

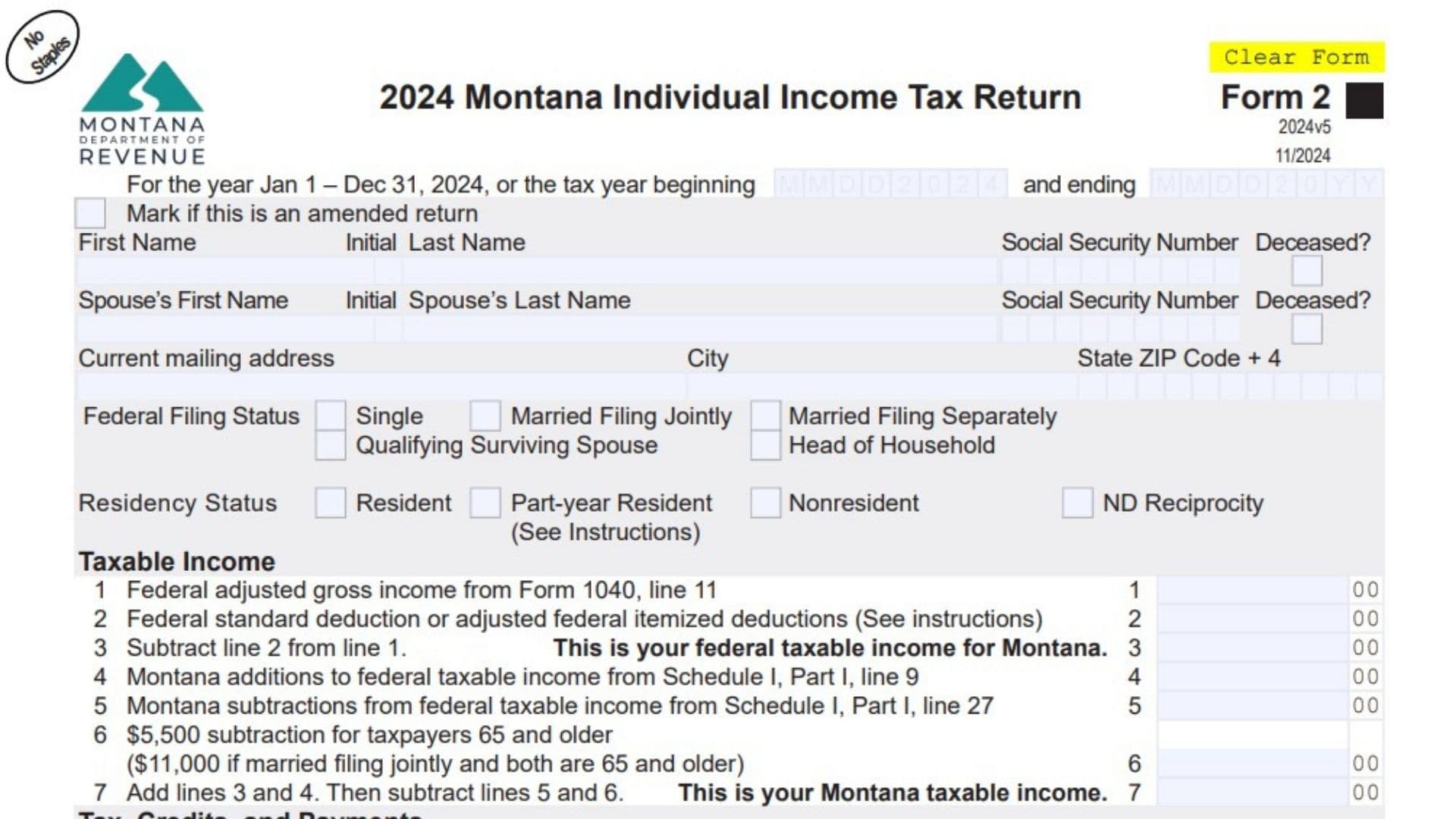

Top Section – Identification and Filing Status

- Year & Tax Period: The form applies to January 1–December 31, 2024, or any fiscal year starting in 2024.

- Amended Return: Check the box if you’re correcting a previously filed return.

- Name & SSN: Enter your legal name(s) and Social Security Number(s). Mark “Deceased?” if applicable.

- Mailing Address: Include your current mailing address, city, state, and ZIP + 4.

- Federal Filing Status: Choose your federal filing status (Single, Married Filing Jointly, Married Filing Separately, Head of Household, or Qualifying Surviving Spouse).

- Residency Status: Check one—Resident, Part-year Resident, Nonresident, or ND Reciprocity (for North Dakota reciprocal agreements).

Taxable Income Section

Line 1. Enter your federal adjusted gross income from Form 1040, line 11.

Line 2. Enter your federal standard deduction or adjusted itemized deductions (whichever applies).

Line 3. Subtract line 2 from line 1 → your federal taxable income for Montana.

Line 4. Add Montana additions from Schedule I, Part I, line 9.

Line 5. Subtract Montana subtractions from Schedule I, Part I, line 27.

Line 6. If you or your spouse are 65 or older, subtract $5,500 per eligible taxpayer (up to $11,000 for joint filers 65 +).

Line 7. Add lines 3 and 4, then subtract lines 5 and 6 → your Montana taxable income.

Tax, Credits, And Payments

Line 8. Enter tax liability before credits using the Montana tax tables or computation on page 2.

Line 9. Input nonrefundable tax credits from Schedule III, Part I, line 14.

Line 10. Subtract line 9 from line 8 → your tax after nonrefundable credits.

Withholding & Payments

Line 11a. Montana income tax withheld on Form W-2.

Line 11b. Withholding reported on Form 1099 (e.g., independent contractor or pension).

Line 11c. Pass-through entity tax credit from Montana Schedule K-1.

Line 11d. Withholding from Montana Schedule K-1.

Line 11e. Loan-out withholding from Form LOWCERT.

→ Add 11a–11e to get total withholding.

Line 12. 2024 estimated tax payments.

Line 13. Overpayment applied from 2023 return.

Line 14. Extension payment (if you filed for an extension).

Line 15. Earned Income Credit = Federal EIC × 10%.

Line 16. Elderly Homeowner/Renter Credit (from Schedule 2EC, line 30).

Line 17. Refundable tax credits from Schedule III, Part I, line 17.

Line 18. Payments made with the original return (for amended filings).

Line 19. Contributions, penalties, interest, and other taxes from Schedule IV, line 8.

Line 20. Previous overpayment (for amended returns).

Line 21. Add lines 11–18, then subtract lines 19 and 20 → your total payments.

Tax Due Or Overpayment

Line 22. If line 21 < line 10, subtract line 21 from line 10 → tax due.

Line 23. If line 21 > line 10, subtract line 10 from line 21 → tax overpaid.

Line 24. Amount from line 23 you’d like applied to 2025 estimated tax.

Line 25. Amount you want deposited into a 529 or 529A savings account.

Line 26. Add lines 24 + 25 then subtract from line 23 → your refund amount.

Page 2 — Direct Deposit & Montana Individual Income Tax Computation

Direct Deposit Your Refund

- Routing Number: Enter your 9-digit bank routing number.

- Account Number: Enter your checking or savings account number.

- Foreign Account Box: Check if the account is outside the U.S. or its territories.

- Account Type (529/529A): Mark if depositing refund into a 529 education or 529A ABLE account.

- Deposit Amount: Enter the portion of refund to contribute to these accounts.

Montana Individual Income Tax Computation

For residents, part-year residents, and nonresidents:

- Line 1. Bring forward your Montana taxable income (page 1, line 7).

- Line 2. Net long-term capital gains from federal Schedule D, line 15.

- Line 3. Enter lesser of line 1 or line 2.

- Line 4. Subtract line 3 from line 1.

- Line 5. Enter amount based on federal filing status:

• $20,500 Single/Married Separate

• $41,000 Married Joint/Qualifying Spouse

• $30,750 Head of Household - Line 6. Subtract line 4 from line 5 (enter zero if negative).

- Line 7. Lesser of line 3 or line 6.

- Line 8. Multiply line 7 × 3% (0.03).

- Line 9. Subtract line 6 from line 3 (enter zero if negative).

- Line 10. Multiply line 9 × 4.1% (0.041).

- Line 11. Add lines 8 + 10 → your Montana net long-term capital gains tax.

- Line 12. If no long-term capital gain, compute tax on line 1 or line 4 using the Montana Ordinary Income Tax Table → Montana ordinary income tax.

- Line 13. Residents add lines 11 + 12 → enter on page 1, line 8 = Montana resident tax.

Signatures & Preparer Information

- Signatures Required: Both spouses must sign if filing jointly.

- Dates & Birthdates: Provide for verification.

- Phone Numbers: Enter current contact numbers.

- Preparer Info: If applicable, include preparer’s printed name, date signed, PTIN, and phone number.

- Third-Party Designee: Mark if you permit DOR to discuss your return with your preparer or another person.