The Montana Department of Revenue, Alcoholic Beverage Control Division, utilizes Form DWL, the Domestic Winery License Application, to license entities wishing to manufacture and sell table wine within the state. This application is the primary document for establishing a new winery, transferring ownership of an existing one, or changing a winery’s location. The process involves a thorough vetting by the Department of Justice, which investigates both the applicant and the proposed location. Approval typically takes 60 to 90 days. Concurrently, applicants must apply for a Basic Permit from the federal Alcohol and Tobacco Tax and Trade Bureau (TTB) and secure label approvals for their products. The license covers “table wine,” defined as wine containing not more than 16% alcohol by volume, including cider. Any wine exceeding this limit is classified as liquor and must be distributed through the state liquor warehouse system.

How To File

You are encouraged to apply online via MTRevenue.gov for faster processing. Alternatively, you can mail the completed application, along with the appropriate fees and all required supporting documentation (such as floor plans, financial statements, and entity formation documents), to the Montana Department of Revenue, Liquor Control Division at the address provided on the form (PO Box 1712, Helena, MT 59624-1712).

How To Complete Montana Form DWL

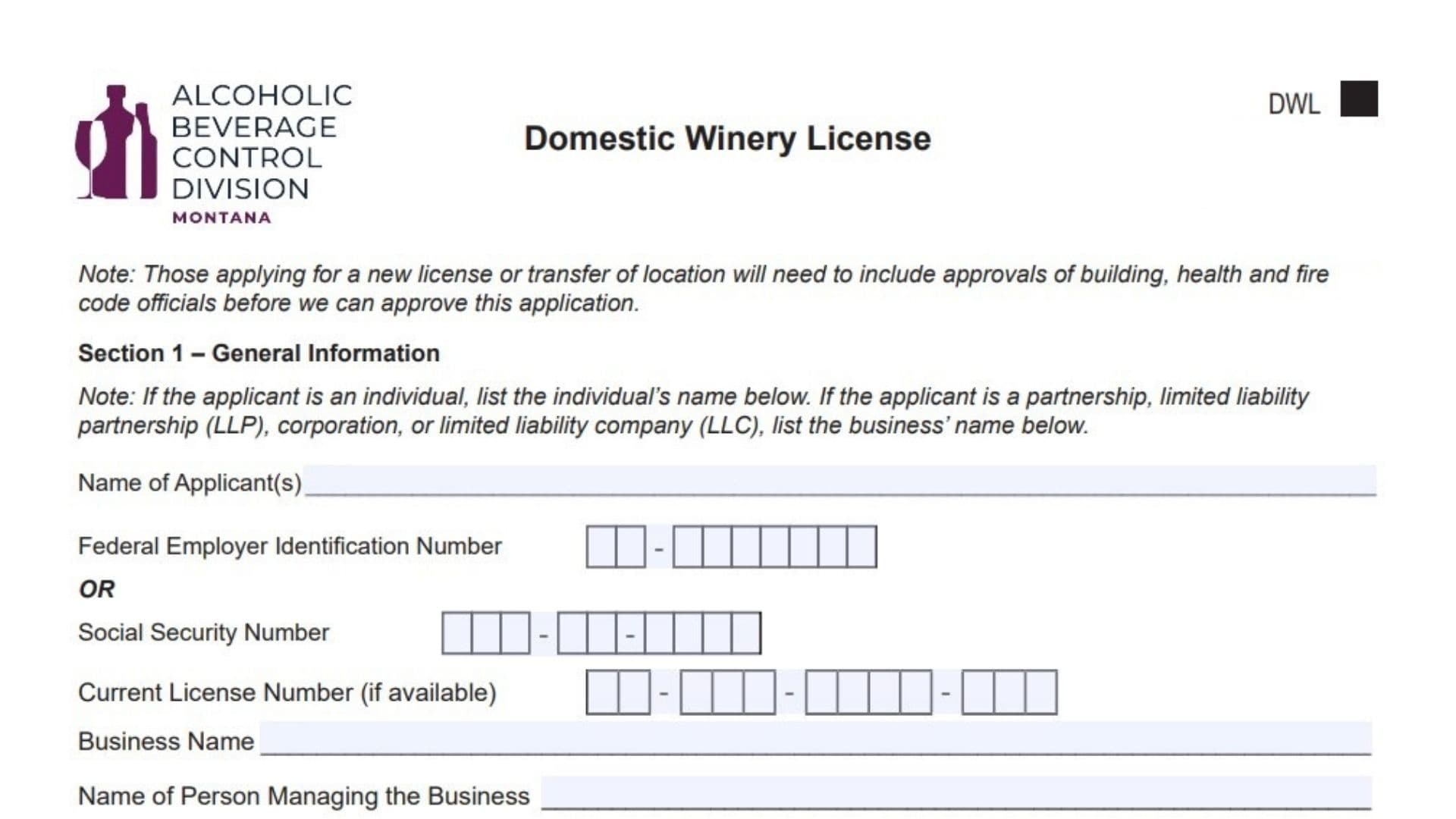

Section 1: General Information

- Applicant Name: Enter the full name of the individual applicant, or the business name if applying as a partnership, LLP, corporation, or LLC.

- ID Numbers: Provide your Federal Employer Identification Number (FEIN). If you are applying as an individual, you may provide your Social Security Number instead.

- Current License: If you already hold a license, enter the number here.

- Business Details: Fill in the business name (Doing Business As), the name of the manager, telephone number, fax, and email address.

- Location: Enter the physical address of the winery (Street, City, State, Zip) and the mailing address if different.

- Preferences: Check the boxes to opt-in for electronic renewal reminders or to authorize an attorney to receive correspondence on your behalf.

Section 2: Type of Transaction and Fees

- Select Transaction: Check the box that corresponds to your application type: New License ($400), Transfer of Ownership, Transfer of Location, or Corporate Structure Change.

- Processing Fee: A mandatory $200 processing fee applies to all transactions.

- Direct Shipment: If you intend to ship wine directly to consumers, check this box and include the $50 fee.

- Fingerprint Fee: Include $30 for each individual required to be fingerprinted.

- Total: Calculate and enter the total amount enclosed. Make checks payable to “Department of Revenue.”

Section 3: Corporate Statement

- Ownership Details: List all shareholders, members, or partners. For each person, provide their name, SSN, address, date of birth, actual number of shares, and percentage of ownership. Attach additional pages if necessary.

- Officers/Directors: List all officers and directors, including their name, address, date of birth (optional), SSN (optional), and title.

Section 4: Questions

- Retail Interest: Answer “Yes” or “No” regarding whether any applicant holds an interest in a retail alcoholic beverage license, agency liquor store, or distributor license. (Note: Manufacturers generally cannot hold retail interests).

- Family Interest: Disclose if any owner’s spouse or dependent has a pending or current retail license interest.

- Financial Interest: Indicate if anyone other than the applicant has a financial interest in the business.

- Zoning: Confirm if the location allows for the sale of alcohol under local ordinances.

- Property Ownership: State whether you own or are purchasing the building. If yes, submit a purchase agreement or tax bill. If no, submit a lease.

- FF&E: Indicate ownership of furniture, fixtures, and equipment.

- Readiness: Confirm if the building is ready for use. If not, provide an expected completion date and indicate if it is new construction or a remodel.

Section 5: Temporary Operating Authority

- Request: Check “Yes” if you are requesting authority to operate while the license transfer is pending (only applicable for transfers of ownership at the same location).

- Current Licensee: The recorded owner must sign to authorize this temporary transfer.

- Applicant: You must sign to accept responsibility for operations during this interim period.

Section 6: Declaration and Affidavit

- Signature: The applicant or authorized representative must sign and date the application, certifying under penalty of false swearing that all information provided is true and complete.

- Details: Print the name and title of the signer.

Required Documentation Checklist (Reference Only)

Ensure you attach all necessary documents listed in the instructions, such as:

- TTB Basic Permit and label approvals.

- Entity documents (Articles of Organization/Incorporation, Partnership Agreements).

- Fingerprint cards and Personal/Criminal History Statements for all owners/managers.

- Financial documents (Loan agreements, Source of funding proofs, Financial statements).

- Premises documents (Floor plan, Zoning documents).